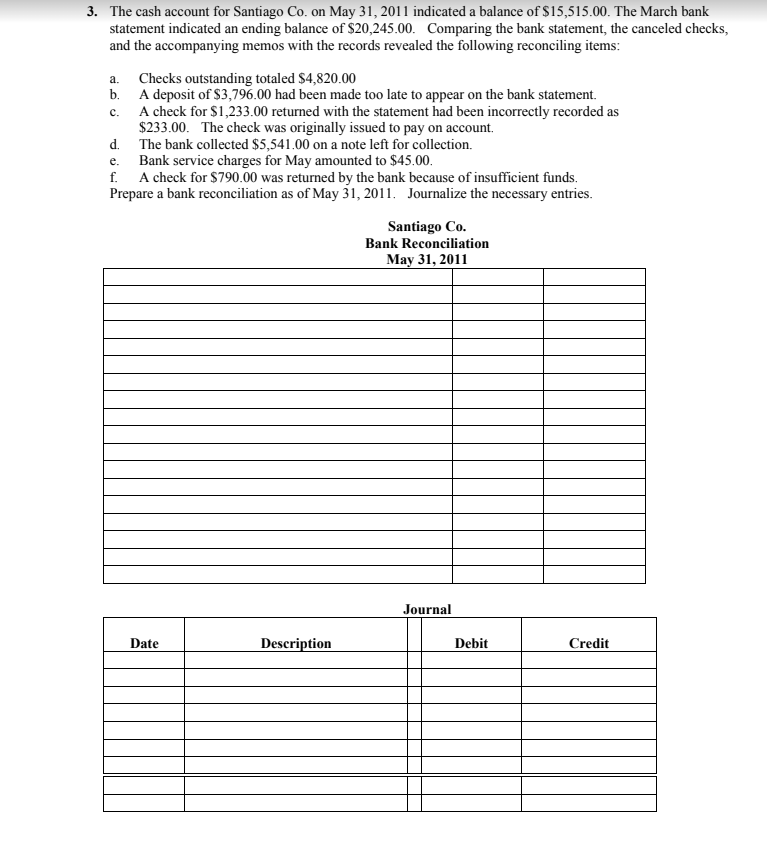

The cash account for Santiago Co. on May 31, 2011 indicated a balance of $15,515.00. The March bank statement indicated an ending balance of $20,245.00. Comparing the bank statement, the canceled checks, and the accompanying memos with the records revealed the following reconciling items: a. Checks outstanding totaled $4,820.00 b. A deposit of $3,796.00 had been made too late to appear on the bank statement. c. A check for $1,233.00 returned with the statement had been incorrectly recorded as $233.00. The check was originally issued to pay on account. d. The bank collected $5,541.00 on a note left for collection. e. Bank service charges for May amounted to $45.00. f. A check for $790.00 was returned by the bank because of insufficient funds. Prepare a bank reconciliation as of May 31, 2011. Journalize the necessary entries.

The cash account for Santiago Co. on May 31, 2011 indicated a balance of $15,515.00. The March bank statement indicated an ending balance of $20,245.00. Comparing the bank statement, the canceled checks, and the accompanying memos with the records revealed the following reconciling items: a. Checks outstanding totaled $4,820.00 b. A deposit of $3,796.00 had been made too late to appear on the bank statement. c. A check for $1,233.00 returned with the statement had been incorrectly recorded as $233.00. The check was originally issued to pay on account. d. The bank collected $5,541.00 on a note left for collection. e. Bank service charges for May amounted to $45.00. f. A check for $790.00 was returned by the bank because of insufficient funds. Prepare a bank reconciliation as of May 31, 2011. Journalize the necessary entries.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 1PB

Related questions

Question

Transcribed Image Text:3. The cash account for Santiago Co. on May 31, 2011 indicated a balance of $15,515.00. The March bank

statement indicated an ending balance of $20,245.00. Comparing the bank statement, the canceled checks,

and the accompanying memos with the records revealed the following reconciling items:

Checks outstanding totaled $4,820.00

b. A deposit of S3,796.00 had been made too late to appear on the bank statement.

A check for $1,233.00 returned with the statement had been incorrectly recorded as

$233.00. The check was originally issued to pay on account.

d. The bank collected $5,541.00 on a note left for collection.

e. Bank service charges for May amounted to $45.00.

f. A check for $790.00 was returned by the bank because of insufficient funds.

Prepare a bank reconciliation as of May 31, 2011. Journalize the necessary entries.

a.

с.

Santiago Co.

Bank Reconciliation

Мaу 31, 2011

Journal

Date

Description

Debit

Credit

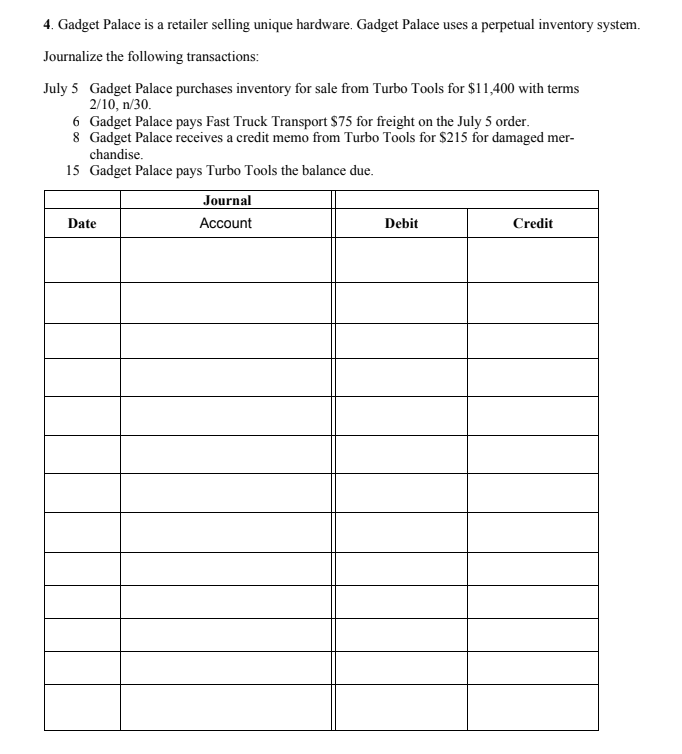

Transcribed Image Text:4. Gadget Palace is a retailer selling unique hardware. Gadget Palace uses a perpetual inventory system.

Journalize the following transactions:

July 5 Gadget Palace purchases inventory for sale from Turbo Tools for $11,400 with terms

2/10, n/30.

6 Gadget Palace pays Fast Truck Transport $75 for freight on the July 5 order.

8 Gadget Palace receives a credit memo from Turbo Tools for $215 for damaged mer-

chandise.

15 Gadget Palace pays Turbo Tools the balance due.

Journal

Date

Account

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning