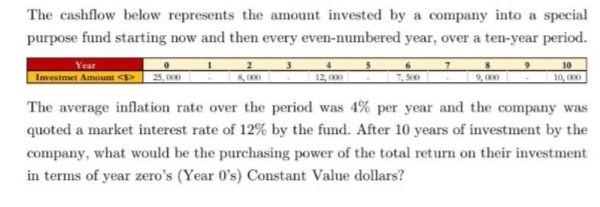

The cashflow below represents the amount invested by a company into a special purpose fund starting now and then every even-numbered year, over a ten-year period. Year Imestmet Amount <$E 10 10, 000 The average inflation rate over the period was 4% per year and the company was quoted a market interest rate of 12% by the fund. After 10 years of investment by the company, what would be the purchasing power of the total return on their investment in terms of year zero's (Year 0's) Constant Value dollars?

The cashflow below represents the amount invested by a company into a special purpose fund starting now and then every even-numbered year, over a ten-year period. Year Imestmet Amount <$E 10 10, 000 The average inflation rate over the period was 4% per year and the company was quoted a market interest rate of 12% by the fund. After 10 years of investment by the company, what would be the purchasing power of the total return on their investment in terms of year zero's (Year 0's) Constant Value dollars?

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter3: Data Visualization

Section: Chapter Questions

Problem 6P: The file MutualFunds contains a data set with information for 45 mutual funds that are part of the...

Related questions

Question

Transcribed Image Text:The cashflow below represents the amount invested by a company into a special

purpose fund starting now and then every even-numbered year, over a ten-year period.

Year

Investmet Amount <>

7. S00

10

10, 000

25, 000

12, 00

9, 000

The average inflation rate over the period was 4% per year and the company was

quoted a market interest rate of 12% by the fund. After 10 years of investment by the

company, what would be the purchasing power of the total return on their investment

in terms of year zero's (Year 0's) Constant Value dollars?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning