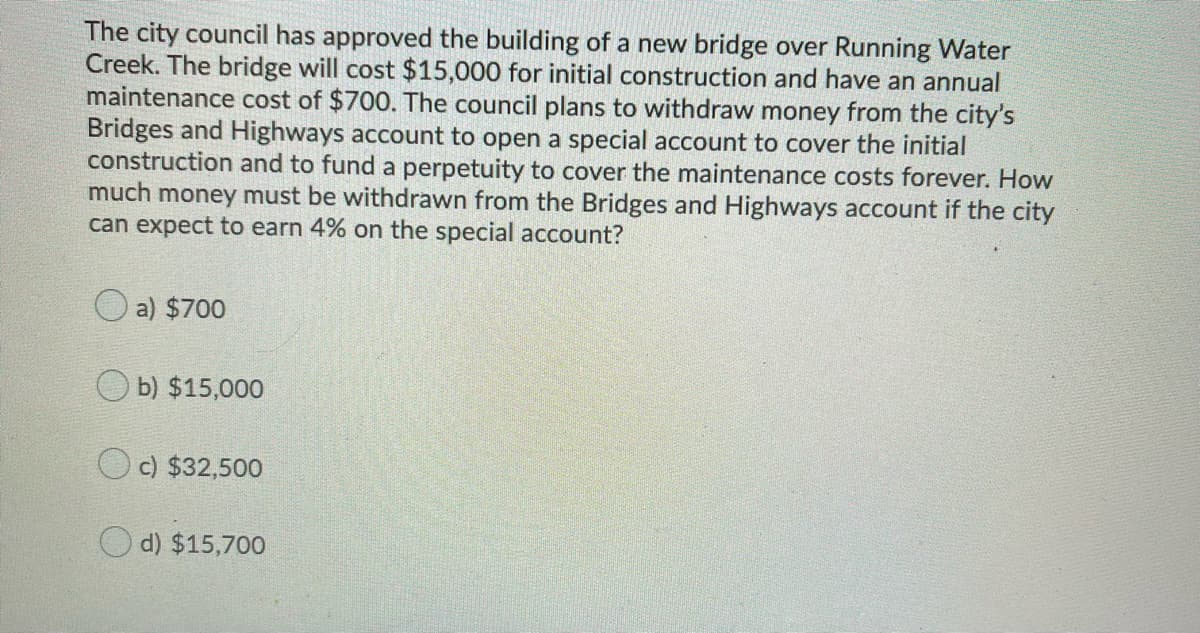

The city council has approved the building of a new bridge over Running Water Creek. The bridge will cost $15,000 for initial construction and have an annual maintenance cost of $700. The council plans to withdraw money from the city's Bridges and Highways account to open a special account to cover the initial construction and to fund a perpetuity to cover the maintenance costs forever. How much money must be withdrawn from the Bridges and Highways account if the city can expect to earn 4% on the special account? O a) $700 O b) $15,000 O c) $32,500 d) $15,700

Q: The present value of Alternative 1 is S (Round the final answer to the nearest dollar as needed.…

A: Present value of cash flows is based on the concept of time value of money. Time value of money is…

Q: Income tax is levied on all of the following taxable items except: O Wages O Interest and dividends…

A: Income tax is levied on Wages, Interest and dividends from moeny invested and Capital gains from…

Q: b) You can invest in taxable bonds that are paying a yield of 9.50% or a municipal bond paying a…

A: A security bond is a legally enforceable promise to pay the government if you or your employee…

Q: Brans Co. is considering a $270,000 investment, which will provide net returns of $110,000,…

A: Year Cashflow Cumulative 1 -270000 -270000 2 110000 -160000 3 140000 -20000 4 220000 200000…

Q: As an electric utility company, Arbot Industries is expected to maintain a constant dividend payout…

A: Last year EPS = $4.50 Payout ratio = 65% Last dividend (D0) = EPS*Payout ratio…

Q: (rounded to nearest dollar) A ten year bond issue with a face amount of $100,000 bears interest 16.…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Suppose that you want to create a "college fund" for your newborn child and place $300 in a bank…

A: Answer - Future Value Formula - = P [ (1+i)n - 1] / I Given, P = 300 i = 0.07 n = 20 years…

Q: Approximately how many years would it take for an investment to grow fivefold if it were invested…

A: Investment amount (P) = $1 Future value (FV) = $5 Interest rate (r) = 9% Number of compounding per…

Q: Hank made payments of $106 per month at the end of each month for 30 years to purchase a piece of…

A: Here, Monthly payment = $106 per month Total number of years = 30 years Selling price of property =…

Q: withholding taxes). Calculate the net present valu of this project assuming the company hedged 50 of…

A: International financial management, often refers to international finance, is the administration of…

Q: Appa deposits $2500 in an account earning 4.9% interest compounded monthly. How much will Ap in the…

A: As the compounding increases the more is effective interest rate and more is the accumulation of…

Q: Consider the Black-Scholes model. In class, we derived the formula for the price of the European…

A: A call option entitles the holder to purchase a stock, whereas a put option entitles the holder to…

Q: An Airline has been buying jet fuel. The company wishes to enter into futures market to buy jet…

A: Here, Correlation Coefficient between Kenya Shillings and USA Dollar is -0.32 Standard Deviation of…

Q: 5. MM Proposition 2: McLaren Corp is financed entirely by common stock and has a beta of 1.0. The…

A: Given: Particulars Amount Beta 1 Price earning ratio 8 WACC 12.50% Stock price $50 debt…

Q: Suppose you found a CD that pays 2.9% interest compounded monthly for 5 years. If you deposit…

A: 1) FV = PV * (1 + r / m)m*n FV = future value PV = present value = $12,000 r = rate of interest =…

Q: Wisdom Tree U.S. Total Earnings Fund (EXT) returns for the past 5 years have been: 2015 -2.30 % 2017…

A: Question 8 - Solved using excel Correct option - A ; 13.60%

Q: TR issues 6.0%, 10-year bonds with a total face amount of $1,500,000. The market interest rate for…

A: Here, To Find: Part 4. Issue price of the bond =? Part 5. Interest expense at first payment =? Part…

Q: 8. How much do you need to save at the end of each year to receive 100 million in 10 years? The…

A: Future value required (FV) = 100,000,000 Number of annual savings (n) = 10 Interest rate (r) = 10%

Q: that will pay CNY 150 in one Perpetuities nd it will continue to make payments at annual intervals…

A: Present value is the equivalent amount of payment that we would receive in the future considering…

Q: The Rivoli Company has no debt outstanding, and its financial position is given by the following…

A: Intrinsic value of an unleverd firm is the sum of the expected value of the future cash flows of the…

Q: The demand for Clean-Well company's product charges P30 per liter, how much revenue the company will…

A: Answer- Consumer surplus is the maximum price that a consumer of the good is willing to pay for a…

Q: 5. You bought a convertible bond issued by Spark Corp which has a conversion ratio of 25 common…

A: a) Stock price per share to make profit = Bond price at par value/Number of shares = 1000/25 = 40…

Q: Faisal deposits $1,139 in a fund paying 4% annual compound interest; after 5 years the fund…

A: The future value of the account at the end of 11 years can be calculated with the help of future…

Q: A nine-year maturity, AAA-rated corporate bond has a 6 percent coupon rate. The bond's promised…

A: Coupon rate is 6% Annual duration is 7.1023 YTM is 5.75% Time to maturity is 9 years To Find:…

Q: Determine which of the following two alternatives is the most efficient and which is the most…

A: Generally the project with higher IRR is better. Since Alternative A has higher IRR than Alternative…

Q: a. calculate the payback period for each project. b. calculate the net present value for each…

A: Payback period is the time required to recover the cost of investment. Payback period = ((Year of…

Q: Janae pays $10,500 for shares in a new company. She sells the shares 10 years later for $21,500.…

A: Annual return = [( Ending value/ Initial valu)(1/n)] -1

Q: 3. Suppose a bond with face value of $5,000 pays a semi-annual coupon of $60 and is currently priced…

A: The coupon rate of the bond is calculated as annual coupon divided by the face value of the bond…

Q: A company is looking at five different potential projects, but it can only do one of them. Which…

A: IRR of all projects is greater than the MARR (10%), hence we need to analyse the incremental IRRs.…

Q: On January 1, 2009 Tonks Hair Products Inc. issues $500,000 of 10 year, 7.5% bonds. The bonds pay…

A: Date Amount Particulars 1.1.2009 $500,000 10 years,7.5% bonds (5000 Bonds @ $100)…

Q: The Sample Company discounts a $100,000 note receivable on 15 Máy 20x2. The following facts are…

A: Maturity value can be calculated as sum of principal and interest. Further, the discount amount can…

Q: How much must Riley have in the account for Scott to receive the $220 payments for 5 years? If Riley…

A: A stream of equal cash flows paid or received periodically is termed as annuity. Annuity is either…

Q: What can be done by a business to mitigate: Execution risk Technology risk Reputation risk…

A: Risk management Risk management is the identification, evaluation, and prioritization of risks…

Q: Anna is buying a house selling for $265,000. To obtain the mortgage, Anna is required to make a 10%…

A: Data given:: Selling price of house = $265,000 Down payment = 10% N= 30 years Interest rate =5%…

Q: after a lengthy meeting with the marketing team about a new product being introduced, your boss asks…

A:

Q: Assume that your hotel decided to add new menu items to the restaurant's menu. This project will…

A: Year Cash flow 0 -15000 1 10000 2 3000 3 3000 4 300 5 300

Q: How long (in years) will it take to quadruple it earns 0.03 compounded semiannually?

A: compound interest formula, which is A = P(1 + r/n)^(nt).

Q: No money is added or removed from the savings account for 3 years. What is the total amount of money…

A: Simple Interest: It is the interest computed by the product of the daily rate of interest,…

Q: Your Answer:

A: On an financial position statement, a capitalised cost is an item that is contributed to the cost…

Q: (a) State whether the problem relates to an ordinary annuity or an annuity due. ordinary annuity…

A: Time value of money (TVM) is used to measure the value of money at different point of time in the…

Q: Replacing old equipment at an immediate cost of $50,000 and an additional outlay of $15,000 six…

A: Initial cost = $50,000 Additional cost in six years = $15,000 Annual savings for 7 years = $11,000…

Q: Stargate Corporation is considering two projects of machinery that perform the same task. The…

A: Net present value is the difference between Present Value of cash Inflows and Initial Investment. A…

Q: Stargate Corporation is considering two projects of machinery that perform the same task. The…

A: Net present value is the difference between Present Value of cash Inflows and Initial Investment.…

Q: I ONLY NEED #2 Solved. Questions 1 and 2 are connected, I only need #2 The rights to Michael…

A: 2. Year 1 2 3 4 5 Annual Casl Flow $ 3,50,000.00 $ 3,80,000 $…

Q: Use the following to answer questions 25 – 27 On January 1, year 1, ST borrows $24,000 to purchase a…

A:

Q: To raise $5,000,000 to expand into new markets, a very successful laptop manufacturing company…

A: Given: Face Value FV: $5000000 Annual coupon rate = 7% Periodic/Semi-annual coupon = 5000000*7%/2 =…

Q: Which of the given interest rates and compounding periods would provide the best investment? (a) 10…

A: Given: Interest rate 10 1/2 percent per year, Interest rate 10 1/4 percent per year, Interest rate…

Q: Table below is information about three USD10000 par value bonds, each of which pays coupon…

A: Given: Particulars 1 2 3 Par value $10,000 $10,000 $10,000 Coupon rate 8% 14% 16% Years 5…

Q: INTERMEDIATE (Questions 18–33) 18. Bond Price Movements Bond X is a premium bond making semiannual…

A: A bond is a sort of financial asset in which the issuer owes the holder a debt and is required to…

Q: Typically, you will receive a very low-interest rate on money you deposit in a bank. Interest rates…

A: A business loans are loans that is intended primarily for business reasons. As with all loans, it…

Step by step

Solved in 2 steps

- This year, Port City was sued for injuries sustained when a citizen slipped and broke her hip on the icy City Hall steps. The City attorney estimates the City will be held liable by the courts and a judgment of $200,000 will result. Because of the nature of the case it will likely be four years before the City makes any payment related to the accident. The present value of the likely future payment is $167,000. In the General Fund, at the end of the current fiscal year, Port City should recognize a liability of $200,000.00 $167,000.00 $0.00 $50,000.00In response to a petition signed by the property owners of Riverdale Subdivision, the city of Pewaukee will oversee the installation of sidewalks, curbs, and gutters in the subdivision, to be accounted for in the city’s capital projects fund. Pewaukee reports on a calendar-year basis. Construction is estimated to cost $900,000 and will be financed by a $100,000 county grant, a $50,000 transfer from the city’s general fund, and special assessments of $750,000 to be levied against subdivision property owners. One-third of the levy is to be due on February 1 of each year, starting with 2018. The first $250,000 installment will be received by the capital projects fund directly. The remaining installments will be collected by the debt service fund and will be used to service the related bond debt. The project is to begin on January 15, 2018, and is to take 18 months to complete. It is estimated that 70% of the work will be completed during 2018.To cover construction costs, a 6%, $500,000…A village recently completed the construction of a new water tower. The entire cost of the water tower was $948,000, and the government paid $360,000 of the total cost through the awarding of a grant. In addition, the village can delay paying the balance of the cost for 40 years (without paying any interest during the 40 years). To finance the balance, the village board will at this time assess its 511 homeowners a one-time flat fee surcharge and then invest this money in a 40-year CD paying 7.1% interest compounded monthly. Complete parts (a) through (c) below. a) What is the balance due on the water tower? $ b) How much will the village need to invest at this time to raise the balance due in 40 years? (Round to the nearest cent as needed.) $ c) What amount should each homeowner pay as a surcharge? $

- Neighboring parishes in Louisiana have agreed to pool road tax resources already designated for bridge refurbishment. At a recent meeting, the engineers estimated that a total of $500,000 will be deposited at the end of next year into an account for the repair of old and safety-questionable bridges throughout the area. Further, they estimate that the deposits will increase by $100,000 per year for only 9 years thereafter, then cease. Determine the equivalent (a) present worth and (b) annual series amounts, if public funds earn at a rate of 5% per year. Draw also the cash flow diagramA city starts a solid waste landfill that it expects to fill to capacity gradually over a 10-year period. At the end of the first year, it is 8 percent filled. At the end of the second year, it is 19 percent filled. Currently, the cost of closure and postclosure is estimated at $1 million. None of this amount will be paid until the landfill has reached its capacity.If this landfill is judged to be a proprietary fund, what liability will be reported at the end of the second year on fund financial statements? Choose the correct.a. $–0–b. $110,000c. $190,000d. $200,000A city starts a solid waste landfill that it expects to fill to capacity gradually over a 12-year period. At the end of the first year, it is 7 percent filled. At the end of the second year, it is 17 percent filled. Currently, the cost of closure and postclosure is estimated at $1 million. None of this amount will be paid until the landfill has reached its capacity. If this landfill is judged to be a proprietary fund, what liability will be reported at the end of the second year on fund financial statements? a. $100,000. b. $180,000. c. $170,000. d. $0.

- A city starts a solid waste landfill that it expects to fill to capacity gradually over a 10-year period. At the end of the first year, it is 8 percent filled. At the end of the second year, it is 19 percent filled. Currently, the cost of closure and postclosure is estimated at $1 million. None of this amount will be paid until the landfill has reached its capacity. If this landfill is judged to be a governmental fund, what liability will be reported at the end of the second year on fund financial statements? Choose the correct.a. $–0–b. $110,000c. $190,000d. $200,000A city starts a solid waste landfill that it expects to fill to capacity gradually over a 12-year period. At the end of the first year, it is 7 percent filled. At the end of the second year, it is 17 percent filled. Currently, the cost of closure and postclosure is estimated at $1 million. None of this amount will be paid until the landfill has reached its capacity. If this landfill is judged to be a governmental fund, what liability will be reported at the end of the second year on fund financial statements? a. $170,000. b. $0. c. $100,000. d. $180,000.The City of Pfeiffer starts the year of 2017 with the general fund and an enterprise fund. The general fund has two activities: education and parks/recreation. For convenience, assume that the general fund holds $123,000 cash and a new school building costing $1 million. The city utilizes straight-line depreciation. The building has a 20-year life and no salvage value. The enterprise fund has $62,000 cash and a new $600,000 civic auditorium with a 30-year life and no salvage value. The enterprise fund monitors just one activity, the rental of the civic auditorium for entertainment and other cultural affairs.The following transactions for the city take place during 2017. Assume that the city’s fiscal year ends on December 31.a. Decides to build a municipal park and transfers $70,000 into a capital projects fund and immediately expends $20,000 for a piece of land. The creation of this fund and this transfer were made by the highest level of government authority.b. Borrows $110,000 cash…

- The City of Pfeiffer starts the year of 2017 with the general fund and an enterprise fund. The general fund has two activities: education and parks/recreation. For convenience, assume that the general fund holds $123,000 cash and a new school building costing $1 million. The city utilizes straight-line depreciation. The building has a 20-year life and no salvage value. The enterprise fund has $62,000 cash and a new $600,000 civic auditorium with a 30-year life and no salvage value. The enterprise fund monitors just one activity, the rental of the civic auditorium for entertainment and other cultural affairs. The following transactions for the city take place during 2017. Assume that the city’s fiscal year ends on December 31. Decides to build a municipal park and transfers $70,000 into a capital projects fund and immediately expends $20,000 for a piece of land. The creation of this fund and this transfer were made by the highest level of government authority. Borrows $110,000 cash…The City of Lawrence opens a solid waste landfill in 2017 that is at 54 percent of capacity on December 31, 2017. The city had initially anticipated closure costs of $2 million but later that year decided that closure costs would actually be $2.4 million. None of these costs will be incurred until 2021 when the landfill is scheduled to be closed. What will appear on the government-wide financial statements for this landfill for the year ended December 31, 2017? Assuming that the landfill is recorded within the general fund, what will appear on the fund financial statements for this landfill for the year ended December 31, 2017?The City of Waterman established a capital projects fund for the construction of an access ramp from the parking garage to the city’s office building to be used by individuals with disabilities. The estimated cost of the ramp is $200,000. On January 1, 20X2, a 10 percent, $150,000 bond issue was sold at 104.0 with the premium transferred to the debt service fund. At that date, the county board provided a $50,000 grant. After a period of negotiation, the city council awarded a construction contract for $182,000 on April 5, 20X2. The ramp was completed on August 8, 20X2; its actual cost was $189,000. The city council approved payment of the total actual cost of $189,000. In addition to the $189,000, the ramp was carpeted with all-weather material at a cost of $5,500. On November 3, 20X2, the city council gave the final approval to pay for the ramp and the carpeting. After all bills were paid, the remaining fund balance was transferred to the debt service fund. 1. Prepare entries for the…