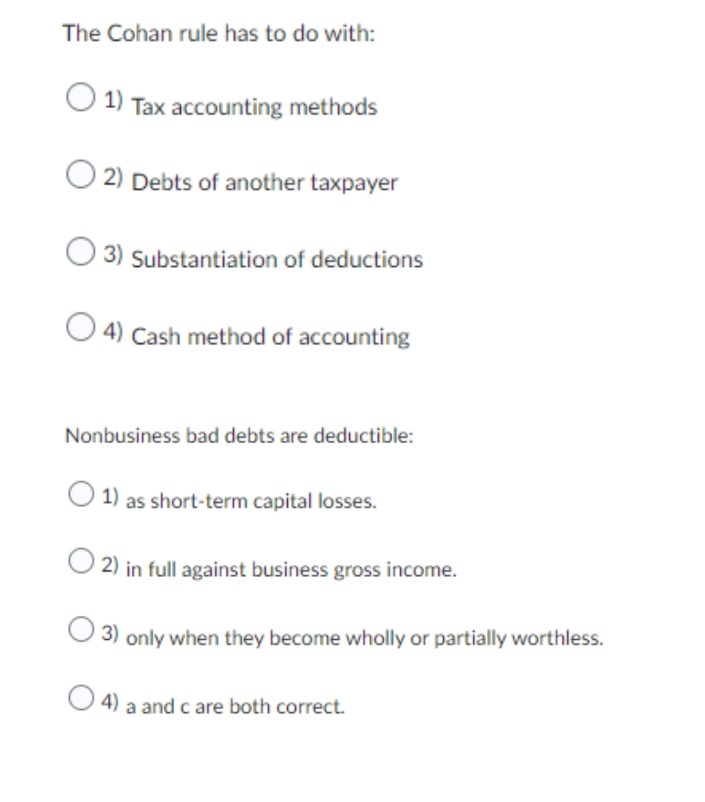

The Cohan rule has to do with: 1) Tax accounting methods 2) Debts of another taxpayer 3) Substantiation of deductions O4) Cash method of accounting

Q: On January 1, 20x1, the partners of ABC Co. decided to liquidate their partnership. Cash 80,000…

A: Partnership firm will be formed when two or more individuals join together to start business, where…

Q: O years. Determine the benefit cost ratio if money is worth 10% per annum.

A: Benefit-Cost is a ratio which represent the relationship between the costs and the benefits of a…

Q: Chicken Wings Company purchased a copier for P447,150 on January 1, 2021. The estimated useful life…

A: Since the change in useful life is a change in accounting estimate the effect will be given…

Q: An independent contractor or self-employed person's employer is not required to deduct taxes, CPP,…

A: Benefits provided by employers when an employee works for a company, then every employer has to…

Q: Meiji Isetan Corp. of Japan has two regional divisions with headquarters in Osaka and Yokohama.…

A: Return on Investment (ROI) refers to the return that the investors receive if invested in a certain…

Q: What is the total amount of liabilities in his business? a.R1 397 600 b.R1 122 300 c.R1 147…

A: Lets understand the basics. Liability is portion in financial statement which show how much amount…

Q: Waste Disposal, Inc. provided the following information concerning its accounting records: Sales…

A: >Account receivables are the balances of customers or borrowers who owe the business certain…

Q: Information from the financial statements of Henderson-Niles Industries included the following at…

A: Earnings Per Share- EPS is the portion of net profits available to equity stockholders after…

Q: For the following scenario, determine the dollar amount of book-tax difference (if any) written as a…

A: Lets understand the basics. Temporary different is a temporary difference between book profit and…

Q: Identify the major payroll tax forms and describe the purpose of each.

A: Payroll tax refers to the percentage which is withheld from the pay or salaries of the employee…

Q: ook value at the end of 14 years is P2,197.22. Using Sum of the Years Depreciation, determine the…

A: Depreciation: It is the reduction in the value of assets due to its continuous use and wear and…

Q: An audit of business's financial reports, preformed by a third party to validate that it is an…

A: Auditing is a process in which the audits of all financial statements of the company are done. The…

Q: Trovato Corporation is considering a project that would require an investment of $68,000. No other…

A: Profitability index=Present value of the cash inflowsInitial investment

Q: hour. Your anticipated costs include: Advertising $25 per month Gas $1.50 per hour Depreciation…

A: Answer:- Particular First Month ($) Second Month ($) @60% Cost @30% Cost…

Q: Required information [The following information applies to the questions displayed below.] Below are…

A: A separate book named Ledger will be opened and kept up to date with all the Accounts recognized…

Q: The following is monthly budgeted cost and activity information for two activities in the purchasing…

A: A budget is an estimate of income and expenditures for a given future period of time, and it is…

Q: 37. When an entity reduces its interest in an investment in equity securities accounted for by the…

A: Introduction: If an investor company invests and acquires between 20 to 50% stake in the investee…

Q: At the beginning of 2021, JOJO acquired a mine for P970,000. Of this amount, P100,000 was ascribed…

A: Depletion refers to the technique of the accrual accounting which is used for allocating the…

Q: Use the following information for questions 7 to 8: Sarah Company started construction of its…

A: Lets undestand the basics. As per IAS23 "Borrowing cost", borrowing cost incurred for construction…

Q: Write him a brief memo explaining the form and content of the statement of cash flows.

A: A cash flow statement is such type of statement in which it is shown from which sources and from…

Q: 18. Which one of the following items is classified as an investing activity? O A. Receipts of cash…

A: Investing activities refers to the purchase and sale of long-term assets and other business…

Q: Calculate Jamie's net pay

A: Vacation pay means the amount that is paid for the employee's vacation. In this, the employee gets…

Q: Ascenda Corp. distributes the "Smart brand of electronic controller systems. The company currently…

A: Variable Cost Ratio - The variable cost ratio measures how many times net revenues exceed variable…

Q: Murphy's Paw produces and sells 1,000 units of a single product per year (with excess capacity of…

A: Murphy Law's is producing and selling 1000 units and has excess capacity of 400 units , hence while…

Q: Hindenburger, Inc., began operations on January 1. It made 5,000 burgers and sold 4,000 of them.…

A: Total product cost includes a total direct cost. It includes direct material, direct wages, and…

Q: How about perpetual inventory system

A: The difference between the recording of the inventory under periodic and perpetual inventory system…

Q: Milano Co. manufactures and sells three products: product 1, product 2, and product 3. Their unit…

A: The breakeven point is the amount of production at which a product's expenses equal its revenues.…

Q: Harris Fabrics computes its plantwide predetermined overhead rate annually on the basis of direct…

A: Introduction: Overhead is computed by dividing overall indirect expenses (also known as overhead)…

Q: axable year 2X18: Tuition Fees Miscellaneous Fees Interest on Bank Deposits Rent Income Salaries and…

A: Not for Profit Organisations : These are the organisation whose motive is not to earn the profit but…

Q: Government contracts account for the majority of Alice's business, which she owns as a contracting…

A: Bribe is a type of crime committed in terms of gaining illegal income through various ways. For eg.…

Q: Chain Reaction, Inc. allocates overhead using machine hours as the allocation activity. The…

A: Given allocation base is machine hours Overhead cost per machine hour = $400000/10000 =$40

Q: Prepare a statement of cash flows in good form assuming that Avatar Company uses the indirect…

A: Operating activities in statement of cash flow under indirect method is prepared by making…

Q: The ABC Company’s profit for the year ended December 31 was P 2,883,400. During the year, ABC…

A: Earnings per share on common stock: It is a financial ratio. It is calculating by divides net…

Q: 13 Complete the statement: The effect of recording a 100% share dividend would be to ______.…

A: Share dividend is one of the form of dividend being paid to shareholders. Under this, additional…

Q: Quality Chairs Incorporated (QC) manufactures chairs for industrial use. Laura Winters, the Vice…

A: Current profit can be calculated by deducting the cost per unit from the total sales price.

Q: KPT Enterprises COMPARITIVE INCOME STATEMENT for years ended 31 December 2020 Revenues and gains…

A: The comparative income statement is described as that statement in which the operating results for a…

Q: Mr B aged 63 years, has earned rupees 75,00,000 out of his business . His ex- wife gifted him cash…

A: The tax slab rate for the tax payable of 60 years or above is mentioned below: Tax Slab Rates…

Q: The carry forward periods for losses varies with the type of loss . Briefly describe the carry…

A:

Q: Business On October 1st, a borrowed $25,000 from a bank. The loan has a period of 120 days and an…

A: Interest expense is the monetary obligation of the borrower to pay regularly towards the sum…

Q: Marcos Company, which had 35,000 shares of common stock outstanding, declared a 4-for-1 stock split.…

A: A stock split refers splitting or dividing a single stock into multiple stocks. The face value and…

Q: [S1] Prices of existing bonds move upward as market interest rates move downward. [S2] Assuming the…

A: Comment- We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: 2. Advanced Learning Institute, an educational institution, provided the following data for the…

A: Introduction: Income tax payable is a type of account in the current liabilities section of a…

Q: accounting is used by internal decision makers and accounting is used for external

A: Management accounting & Financial accounting are both branches of accounting, while the former…

Q: Open the ledger accounts in T-account form with their unadjusted balances then post the adjusting…

A: Based on the balances from the unadjusted trial balance and the adjustments the T accounts are as…

Q: Norte De University, a proprietary educational institution, has the following selected information…

A: The income tax payable in any accounting year is equal to the income tax for the year (calculated by…

Q: Beginning the year 2020, the ABC Company began marketing its phone. Each phone sells for P50,000. To…

A: As per IFRS 15 -Revenue from contracts with customers the unearned revenue to be recognized by the…

Q: [S1] Analysts and investors may differ on the value they give to an asset or business depending on…

A: S1: Estimate of Value of an asset or investment is based on many assumptions, other factors and risk…

Q: Question 7. PINAUTANG started constructing a building for its own use in March 1, 2020. PINAUTANG…

A: INTRODUCTION: Total cost is the total cost of manufacturing that includes both fixed and variable…

Q: On January 1, 2020, PS ind issued P600,000 of 7% bonds, due in 10 years. The bonds were issued for…

A: Amount of bond issue=P600,000 Issue price=P559,231 Interest rate=7% Interest payment to be made=…

Q: Every tax year, regardless of whether there is any tax owing, all resident corporations (apart from…

A: The Hutterite colonies were initially set up in Moravia pulled through the Reformation and are…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- The definition of gross income in the tax law is: All items specifically listed as income in the tax law All cash payments received for goods provided and services performed All income from whatever source derived All income from whatever source derived unless the income is earned illegallyWhich of the following is an acceptable method of accounting under the tax law? The accrual method The hybrid method The cash method All of the above are acceptable None of the aboveWhich of the following statements accurately describes the impact of accounting for bad debts on taxes? A) Accounting for bad debts increases taxable income in the period they are recognized. B) Accounting for bad debts decreases taxable income in the period they are recognized. C Accounting for bad debts has no impact on taxable income. D) Accounting for bad debts defers taxable income to future periods.

- Which of the following statements is false? In order to claim a bad debt deduction: a. There must be an existing debt. b. The debt must be written-off. c. The taxpayer must be in the business of money-lending. d. The debt must be bad.Which of the following statements is false? Group of answer choices A.Prepaid expenses are fully deductible when paid for a cash basis taxpayer. B.Reasonableness is most often considered in the context of compensation. C.Inventory can not be deducted when paid. D.You are considered to have paid at the date you pay with a credit card, even though you still owe the bank.f a business owner paid for the business expenses with their personal account, and those expenses would otherwise be deductible, they: A. CANNOT be deducted on the tax return because they weren't paid for from a business account. B. CAN be included on the tax return as long as proof of the expenses is sent with the return. C. CAN be deducted on the tax return. D. CANNOT be deducted because the IRS requires separate business and personal bank accounts.

- Some items are treated as a deduction for tax purposes when they are paid but are recognised as expenses when they are accrued for accounting purposes. Which of the following items are of that type? a. Warranty costs b. Goodwill impairment c. Fines d. Entertainment expenses e. Prepaid insuranceA company has only one deductible temporary difference due to the use of the current expected credit loss method (CECL) of recognizing credit losses (ie, bad debts) for financial reporting purposes. The company is trying to determine how the resulting deferred tax asset will be reported on the balance sheet. Which section of the authoritative literature describes whether deferred tax assets and liabilities are classified as current or noncurrent? Enter your response in the answer fields below. Unless specifically requested, your response should not cite implementation guidance. Guidance on correctly structuring your response appears above and below the answer fields. Type the topic here. Correctly formatted FASB ASC topics are 3 digits. FASB ASCWhich of the following statements is true regarding the calculation of a C corporation's taxable income and tax liability? A. Business bad debts are allowed as an ordinary business deduction if the direct write-off method is used. B. Charitable contributions are considered a special deduction rather than part of ordinary business deductions. C. The foreign tax credit is applied to taxable income before multiplying by the tax rate to determine gross tax liability. D. The dividends received deduction is used to determine income before NOL and special deductions. 2. As the result of an IRS audit of a C corporation and its sole shareholder, the IRS agent proposes that a portion of the shareholder's salary is unreasonable. Because the corporation has significant earnings and profits, the agent has determined that the unreasonable portion of the salary is a dividend. Which of the following is correct regarding the impact of the proposed adjustment to both the…

- 8. The amounts charged to income for bad debts on accounts receivable will generally be the same for both tax and accounting purposes True or False? 9 A self employed individual cannot deduct CCA on a home office in his principal residence unless it is used exclavely for income producing purposes. True or False?1. When a business ceases to operate and its inventories are disposed of a gain on the inventories will be treated as a capital gain unless an election is made by the selling taxpayer True or False 2. When a business ceases to operate and its accounts receivable are disposed of with the other business assets any loss on the receivables will be treated as a capital loss unless a joint election is made by the purchaser and seller. True or FalsePLEASE ANSWER ALL QUESTIONS IN BOTH 1 AND 2 PLEASE. 1. Some accountants believe that deferred taxes should not be recognized for certain temporary differences. What is the conceptual basis for this argument? 2.What events create permanent differences between accounting income and taxable income? What effect do these events have on the determination of income taxes payable and deferred income taxes? Identify three examples of permanent differences between accounting income and taxable income.