The company has received a large order and anticipates the need to go to the bank to increase its borrowings. As a result, it has to forecast its cash requirement to January, February and March. Typically, the company collects 20 percent of its sales in the month of sale, 70 percent in the subsequent month, and 10 percent in the second month after the sale. All sales are credit sales. Accounts Payable (0008) Cash 360 50 Notes Payable 530 Accrued Expenses 545 Current Liabilities 1125 400 Accounts Receivable 212 Inventories 972 Long term Liabilities Total Liabilities Current Assets 450 1422 Non-current Assets 1836 Common Stocks 100 Retained Earnings Total Liabilities & Shareholder's Equity 1439 2961 Total Assets 2961 Purchase of raw materials are made in the month prior to the sale and amount to 60 percent of sales in the subsequent month. Payments for these purchases occur in the month after the purchase. Labor costs, including overtime, are expected to be P150,000 in January, P200,000 in February, and P160,000 in March. Selling, administrative, taxes and other cash expenses are expected to be P100,000 per month for January to March. Actual Sales in November and December and projected sales for January through April are as follows: (000s) November P500 February March P1,000 December P600 P650 January P600 April P750 Required Taking into consideration that the firm wants to maintain a cash balance of P50,000 at all times, prepare the following: 1. Cash Budget for the months of January, February and March 2. Pro-forma Income Statements for the three-month period 3. Pro-forma Statement of Financial Position as of March 31 4. Pro-forma Statement of Cash Flows dated March 31

The company has received a large order and anticipates the need to go to the bank to increase its borrowings. As a result, it has to forecast its cash requirement to January, February and March. Typically, the company collects 20 percent of its sales in the month of sale, 70 percent in the subsequent month, and 10 percent in the second month after the sale. All sales are credit sales. Accounts Payable (0008) Cash 360 50 Notes Payable 530 Accrued Expenses 545 Current Liabilities 1125 400 Accounts Receivable 212 Inventories 972 Long term Liabilities Total Liabilities Current Assets 450 1422 Non-current Assets 1836 Common Stocks 100 Retained Earnings Total Liabilities & Shareholder's Equity 1439 2961 Total Assets 2961 Purchase of raw materials are made in the month prior to the sale and amount to 60 percent of sales in the subsequent month. Payments for these purchases occur in the month after the purchase. Labor costs, including overtime, are expected to be P150,000 in January, P200,000 in February, and P160,000 in March. Selling, administrative, taxes and other cash expenses are expected to be P100,000 per month for January to March. Actual Sales in November and December and projected sales for January through April are as follows: (000s) November P500 February March P1,000 December P600 P650 January P600 April P750 Required Taking into consideration that the firm wants to maintain a cash balance of P50,000 at all times, prepare the following: 1. Cash Budget for the months of January, February and March 2. Pro-forma Income Statements for the three-month period 3. Pro-forma Statement of Financial Position as of March 31 4. Pro-forma Statement of Cash Flows dated March 31

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter8: Budgeting

Section: Chapter Questions

Problem 17E

Related questions

Question

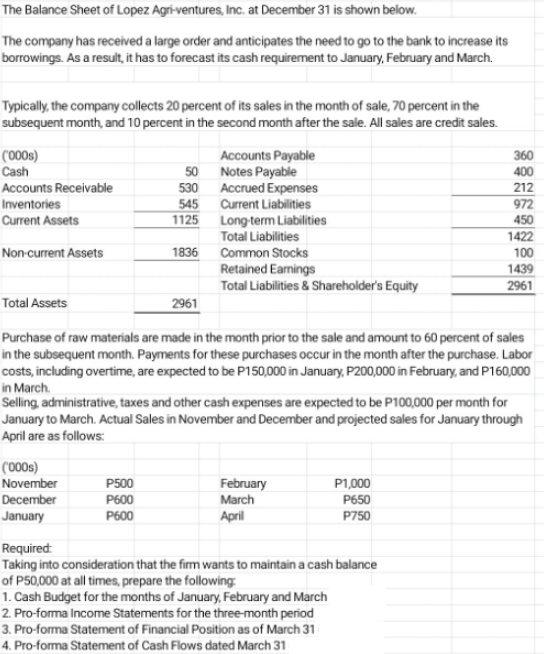

Transcribed Image Text:The Balance Sheet of Lopez Agri-ventures, Inc. at December 31 is shown below.

The company has received a large order and anticipates the need to go to the bank to increase its

borrowings. As a result, it has to forecast its cash requirement to January, February and March.

Typically, the company collects 20 percent of its sales in the month of sale, 70 percent in the

subsequent month, and 10 percent in the second month after the sale. All sales are credit sales.

(000s)

Cash

Accounts Payable

50 Notes Payable

530 Accrued Expenses

545

360

400

Accounts Receivable

212

Inventories

Current Liabilities

972

Current Assets

1125

Long-term Liabilities

Total Liabilities

450

1422

Non-current Assets

1836

Common Stocks

100

Retained Earnings

Total Liabilities & Shareholder's Equity

1439

2961

Total Assets

2961

Purchase of raw materials are made in the month prior to the sale and amount to 60 percent of sales

in the subsequent month. Payments for these purchases occur in the month after the purchase. Labor

costs, including overtime, are expected to be P150,000 in January, P200,000 in February, and P160,000

in March.

Selling, administrative, taxes and other cash expenses are expected to be P100,000 per month for

January to March. Actual Sales in November and December and projected sales for January through

April are as follows:

('000s)

November

P500

February

P1,000

December

P600

March

P650

January

P600

April

P750

Required:

Taking into consideration that the firm wants to maintain a cash balance

of P50,000 at all times, prepare the following

1. Cash Budget for the months of January, February and March

2. Pro-forma Income Statements for the three-month period

3. Pro-forma Statement of Financial Position as of March 31

4. Pro-forma Statement of Cash Flows dated March 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College