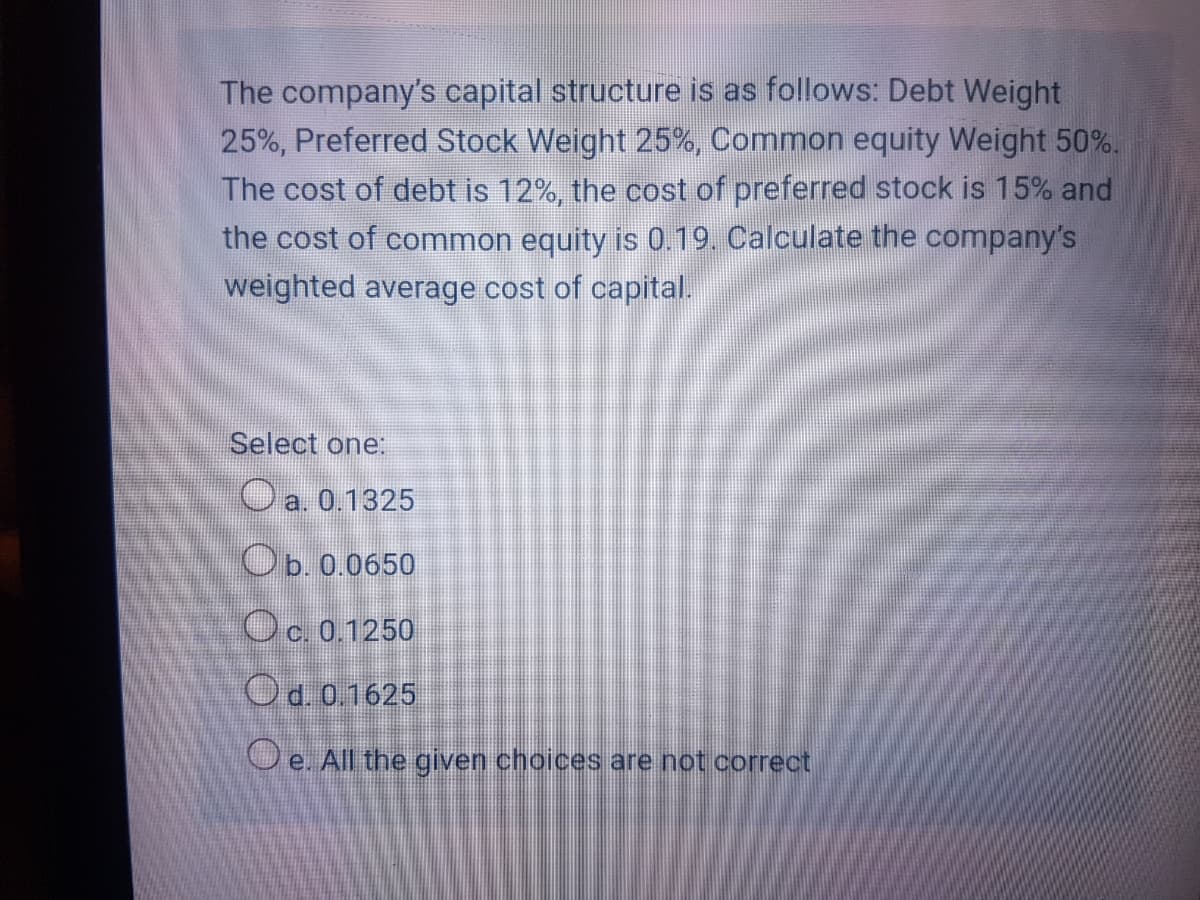

The company's capital structure is as follows: Debt Weight 25%, Preferred Stock Weight 25%, Common equity Weight 50%. The cost of debt is 12%, the cost of preferred stock is 15% and the cost of common equity is 0.19. Calculate the company's weighted average cost of capital. Select one: O a. 0.1325 Ob. 0.0650 Oc. 0.1250 Od. 0.1625 Oe. All the given choices are not correct

The company's capital structure is as follows: Debt Weight 25%, Preferred Stock Weight 25%, Common equity Weight 50%. The cost of debt is 12%, the cost of preferred stock is 15% and the cost of common equity is 0.19. Calculate the company's weighted average cost of capital. Select one: O a. 0.1325 Ob. 0.0650 Oc. 0.1250 Od. 0.1625 Oe. All the given choices are not correct

Chapter12: Balanced Scorecard And Other Performance Measures

Section: Chapter Questions

Problem 14MC: The capital structure of Ridley Enterprises Is: Debt 40%, Equity 60%. The cost of debt is 13%, and...

Related questions

Question

Transcribed Image Text:The company's capital structure is as follows: Debt Weight

25%, Preferred Stock Weight 25%, Common equity Weight 50%.

The cost of debt is 12%, the cost of preferred stock is 15% and

the cost of common equity is 0.19. Calculate the company's

weighted average cost of capital.

Select one:

O a. 0.1325

Ob. 0.0650

Oc. 0.1250

Od. 0.1625

O e. All the given choices are not correct

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning