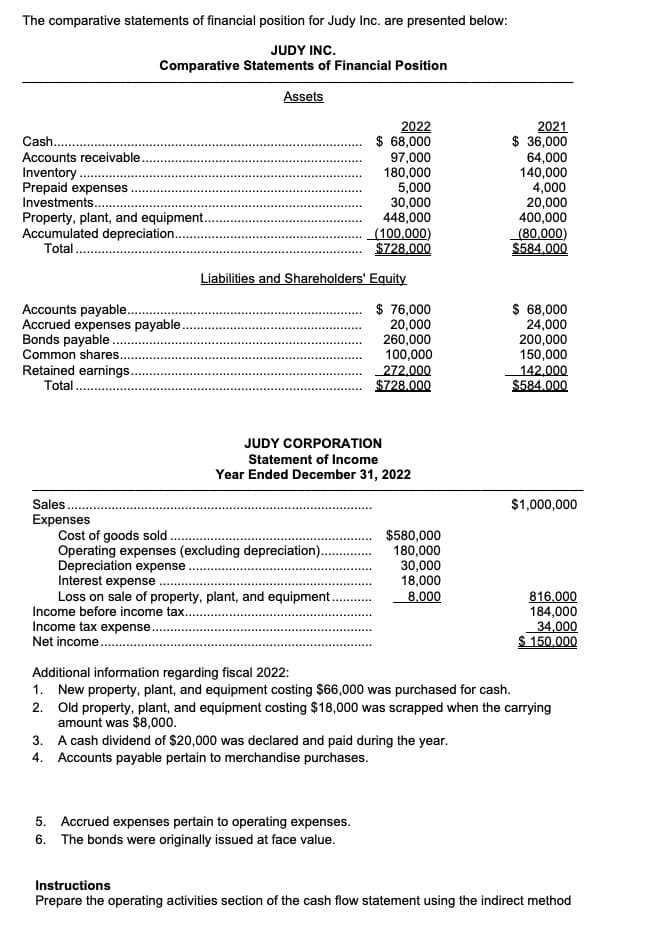

The comparative statements of financial position for Judy Inc. are presented below: JUDY INC. Comparative Statements of Financial Position Assets Cash. Accounts receivable. Inventory. Prepaid expenses. Investments.. Property, plant, and equipment.. Accumulated depreciation..... Total..... Accounts payable. Accrued expenses payable Bonds payable... Common shares. Retained earnings. Total..... Sales Expenses Cost of goods sold. Operating expenses (excluding depreciation).. Depreciation expense Income tax expense. Net income..... Liabilities and Shareholders' Equity Interest expense Loss on sale of property, plant, and equipment.. Income before income tax.. 2022 $ 68,000 97,000 180,000 5,000 30,000 448,000 (100,000) $728.000 JUDY CORPORATION Statement of Income Year Ended December 31, 2022 $ 76,000 20,000 260,000 100,000 272,000 $728.000 5. Accrued expenses pertain to operating expenses. 6. The bonds were originally issued at face value. $580,000 180,000 30,000 18,000 8,000 2021 $ 36,000 64,000 140,000 4,000 20,000 400,000 (80,000) $584.000 3. A cash dividend of $20,000 was declared and paid during the year. 4. Accounts payable pertain to merchandise purchases. $ 68,000 24,000 200,000 150,000 142,000 $584.000 Additional information regarding fiscal 2022: 1. New property, plant, and equipment costing $66,000 was purchased for cash. $1,000,000 2. Old property, plant, and equipment costing $18,000 was scrapped when the carrying amount was $8,000. 816,000 184,000 34,000 $ 150,000 Instructions Prepare the operating activities section of the cash flow statement using the indirect method

The comparative statements of financial position for Judy Inc. are presented below: JUDY INC. Comparative Statements of Financial Position Assets Cash. Accounts receivable. Inventory. Prepaid expenses. Investments.. Property, plant, and equipment.. Accumulated depreciation..... Total..... Accounts payable. Accrued expenses payable Bonds payable... Common shares. Retained earnings. Total..... Sales Expenses Cost of goods sold. Operating expenses (excluding depreciation).. Depreciation expense Income tax expense. Net income..... Liabilities and Shareholders' Equity Interest expense Loss on sale of property, plant, and equipment.. Income before income tax.. 2022 $ 68,000 97,000 180,000 5,000 30,000 448,000 (100,000) $728.000 JUDY CORPORATION Statement of Income Year Ended December 31, 2022 $ 76,000 20,000 260,000 100,000 272,000 $728.000 5. Accrued expenses pertain to operating expenses. 6. The bonds were originally issued at face value. $580,000 180,000 30,000 18,000 8,000 2021 $ 36,000 64,000 140,000 4,000 20,000 400,000 (80,000) $584.000 3. A cash dividend of $20,000 was declared and paid during the year. 4. Accounts payable pertain to merchandise purchases. $ 68,000 24,000 200,000 150,000 142,000 $584.000 Additional information regarding fiscal 2022: 1. New property, plant, and equipment costing $66,000 was purchased for cash. $1,000,000 2. Old property, plant, and equipment costing $18,000 was scrapped when the carrying amount was $8,000. 816,000 184,000 34,000 $ 150,000 Instructions Prepare the operating activities section of the cash flow statement using the indirect method

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter1: The Role Of Accounting In Business

Section: Chapter Questions

Problem 1.17E: Financial statements Each of the following items is shown in the financial statements of ExxonMobil...

Related questions

Question

Transcribed Image Text:The comparative statements of financial position for Judy Inc. are presented below:

JUDY INC.

Comparative Statements of Financial Position

Assets

Cash.

Accounts receivable.

Inventory.

Prepaid expenses.

Investments..

Property, plant, and equipment..

Accumulated depreciation.....

Total.....

Accounts payable.

Accrued expenses payable

Bonds payable..

Common shares.

Retained earnings.

Total.....

Sales

Expenses

Cost of goods sold.

Operating expenses (excluding depreciation)..

Depreciation expense

Income tax expense.

Net income.....

Liabilities and Shareholders' Equity

Interest expense

Loss on sale of property, plant, and equipment..

Income before income tax..

2022

$ 68,000

97,000

180,000

5,000

30,000

448,000

(100,000)

$728.000

JUDY CORPORATION

Statement of Income

Year Ended December 31, 2022

$ 76,000

20,000

260,000

100,000

272,000

$728.000

5.

Accrued expenses pertain to operating expenses.

6. The bonds were originally issued at face value.

$580,000

180,000

30,000

18,000

8,000

2021

$ 36,000

64,000

3.

A cash dividend of $20,000 was declared and paid during the year.

4. Accounts payable pertain to merchandise purchases.

140,000

4,000

20,000

400,000

(80,000)

$584.000

$ 68,000

24,000

200,000

150,000

142,000

$584.000

Additional information regarding fiscal 2022:

1. New property, plant, and equipment costing $66,000 was purchased for cash.

$1,000,000

2. Old property, plant, and equipment costing $18,000 was scrapped when the carrying

amount was $8,000.

816,000

184,000

34,000

$ 150,000

Instructions

Prepare the operating activities section of the cash flow statement using the indirect method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning