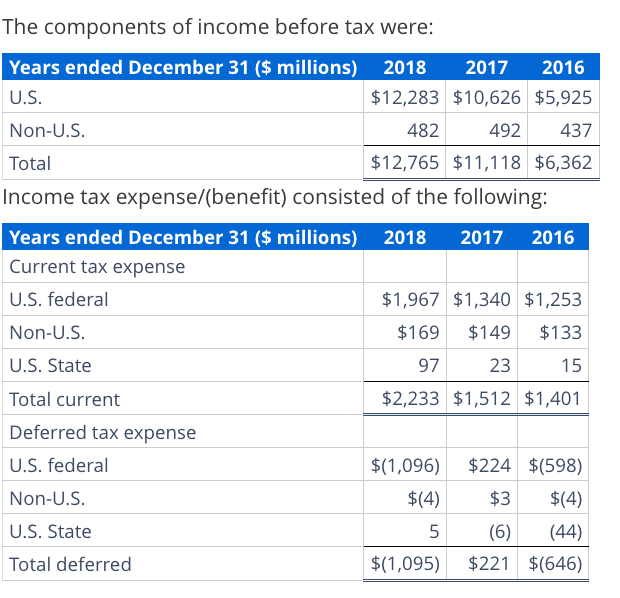

The components of income before tax were: Years ended December 31 ($ millions) 2018 U.S. Non-U.S. Total 2017 2016 $12,283 $10,626 $5,925 482 492 437 $12,765 $11,118 $6,362 Income tax expense/(benefit) consisted of the following:

The components of income before tax were: Years ended December 31 ($ millions) 2018 U.S. Non-U.S. Total 2017 2016 $12,283 $10,626 $5,925 482 492 437 $12,765 $11,118 $6,362 Income tax expense/(benefit) consisted of the following:

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter3: Taxes On The Financial Statements

Section: Chapter Questions

Problem 12P

Related questions

Question

Transcribed Image Text:The components of income before tax were:

Years ended December 31 ($ millions) 2018

U.S.

Non-U.S.

Total

2017

2016

$12,283 $10,626 $5,925

482

492 437

$12,765 $11,118 $6,362

Income tax expense/(benefit) consisted of the following:

Years ended December 31 ($ millions)

Current tax expense

U.S. federal

2017 2016

Non-U.S.

U.S. State

Total current

$1,967 $1,340 $1,253

$169 $149 $133

97

23

15

Deferred tax expense

U.S. federal

$2,233 $1,512 $1,401

$224 $(598)

$(1,096)

Non-U.S.

$(4)

$3 $(4)

U.S. State

5

(6)

(44)

Total deferred

$(1,095)

$221

$(646)

Transcribed Image Text:a. What is the amount of income tax expense reported by Boeing each year?

Year ($ millions)

2018 $

0

2017 $

0

2016 $

0

b. What percentage of total tax expense is currently payable for each year?

Round percentage to one decimal place (example: 0.7345 = 73.5%).

Year

2018

0%

2017

0%

2016

0%

c. What is Boeing's effective (average) tax rate for each year?

Round percentage to one decimal place (example: 0.7345 = 73.5%).

Year

2018

0%

2017

2016

0%

0%

d. Use the pretax information to determine the effective tax rate for U.S. federal and Non-U.S. operations for each year.

Round percentage to one decimal place (example: 0.7345 = 73.5%).

Year U.S. federal

Non-U.S.

2018

0%

0%

2017

0%

0%

2016

0%

0%

e. Determine the cash tax rate for U.S. operations for each year. Hint: Current tax expense is paid in cash.

Round percentage to one decimal place (example: 0.7345 = 73.5%).

Year

2018

0%

2017

0%

2016

0%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Step 1: Introduction:

VIEWStep 2: (a) Determine the amount of income tax expense reported by Boeing each year:

VIEWStep 3: (b) Determine the percentage of total tax expense is currently payable for each year:

VIEWStep 4: (c) Determine the Boeing’s effective (average) tax rate for each year:

VIEWSolution

VIEWTrending now

This is a popular solution!

Step by step

Solved in 5 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT