The condensed, adjusted trial balance of the Gary and James Partnership as at December 31, 2024, appears below: Current assets Equipment Accounts payable Long-term debt GARY AND JAMES PARTNERSHIP Adjusted Trial Balance December 31, 2024 Gary, capital Gary, drawings James, capital James, drawings Service revenue Operating expenses 1 2 Debit $50,000 117,500 295,000 270,000 93,000 $825,500 Credit $32,000 69,000 51,000 43,000 630,500 The partnership agreement stipulates that a division of partnership profit or loss is to be made as follows: Asalary allowance of $347,500 to Gary and $287,500 to James. The remainder is to be divided equally. $825,500

The condensed, adjusted trial balance of the Gary and James Partnership as at December 31, 2024, appears below: Current assets Equipment Accounts payable Long-term debt GARY AND JAMES PARTNERSHIP Adjusted Trial Balance December 31, 2024 Gary, capital Gary, drawings James, capital James, drawings Service revenue Operating expenses 1 2 Debit $50,000 117,500 295,000 270,000 93,000 $825,500 Credit $32,000 69,000 51,000 43,000 630,500 The partnership agreement stipulates that a division of partnership profit or loss is to be made as follows: Asalary allowance of $347,500 to Gary and $287,500 to James. The remainder is to be divided equally. $825,500

Chapter21: Partnerships

Section: Chapter Questions

Problem 57P

Related questions

Question

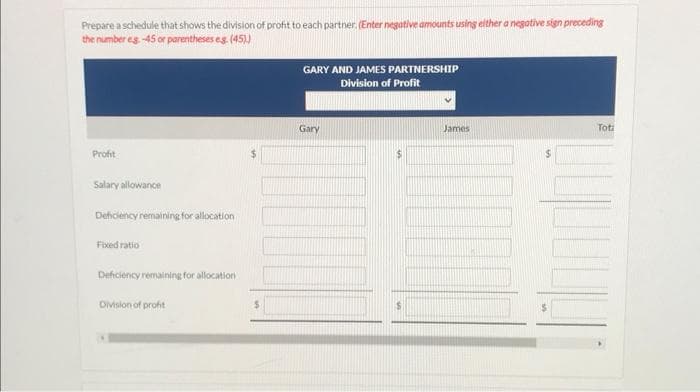

Transcribed Image Text:Prepare a schedule that shows the division of profit to each partner. (Enter negative amounts using either a negative sign preceding

the number eg.-45 or parentheses e.g. (45))

Profit

Salary allowance

Deficiency remaining for allocation

Fixed ratio

Deficiency remaining for allocation

Division of profit

$

GARY AND JAMES PARTNERSHIP

Division of Profit

Gary

$

$

James

Toti

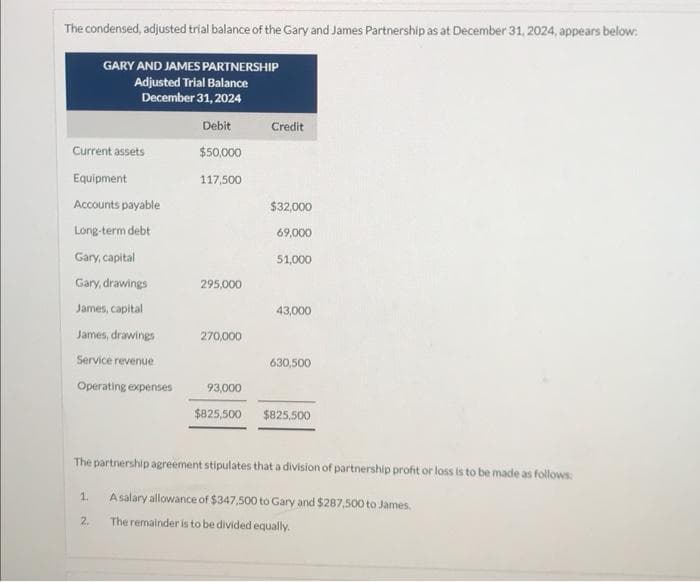

Transcribed Image Text:The condensed, adjusted trial balance of the Gary and James Partnership as at December 31, 2024, appears below:

Current assets

Equipment

Accounts payable

Long-term debt

GARY AND JAMES PARTNERSHIP

Adjusted Trial Balance

December 31, 2024

Gary, capital

Gary, drawings

James, capital

James, drawings

Service revenue

Operating expenses

1.

2.

Debit

$50,000

117,500

295,000

270,000

93,000

$825,500

Credit

$32,000

69,000

51,000

43,000

630,500

The partnership agreement stipulates that a division of partnership profit or loss is to be made as follows:

A salary allowance of $347,500 to Gary and $287,500 to James.

The remainder is to be divided equally.

$825,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College