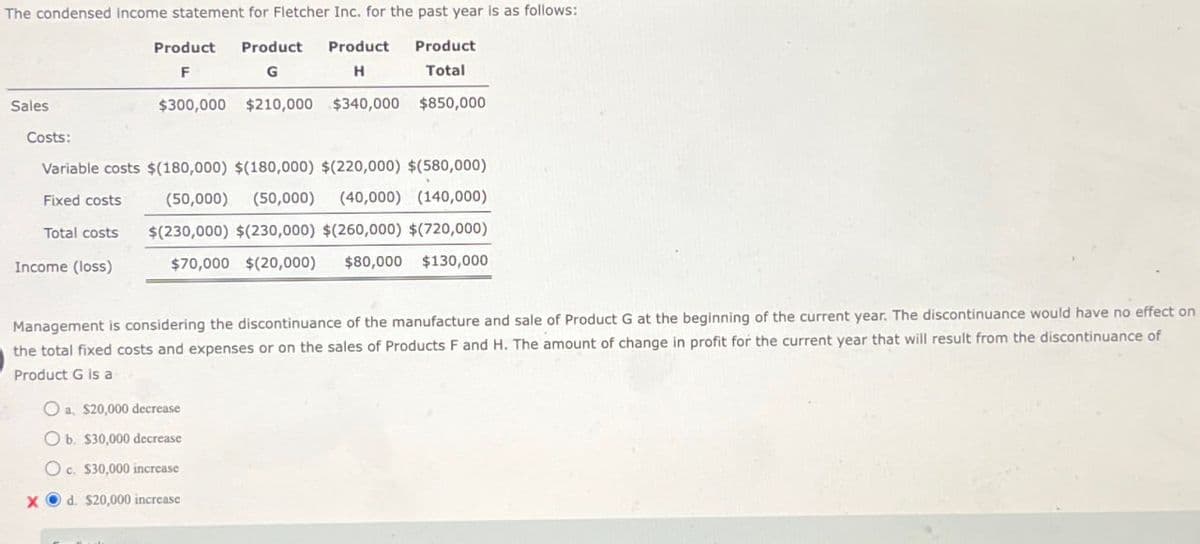

The condensed income statement for Fletcher Inc. for the past year is as follows: Sales Product F Product G Product Product H Total $300,000 $210,000 $340,000 $850,000 Costs: Variable costs $(180,000) $(180,000) $(220,000) $(580,000) Fixed costs Total costs Income (loss) (50,000) (50,000) (40,000) (140,000) $(230,000) $(230,000) $(260,000) $(720,000) $70,000 $(20,000) $80,000 $130,000 Management is considering the discontinuance of the manufacture and sale of Product G at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Products F and H. The amount of change in profit for the current year that will result from the discontinuance of Product G is a Oa. $20,000 decrease Ob. $30,000 decrease Oc. $30,000 increase X d. $20,000 increase

The condensed income statement for Fletcher Inc. for the past year is as follows: Sales Product F Product G Product Product H Total $300,000 $210,000 $340,000 $850,000 Costs: Variable costs $(180,000) $(180,000) $(220,000) $(580,000) Fixed costs Total costs Income (loss) (50,000) (50,000) (40,000) (140,000) $(230,000) $(230,000) $(260,000) $(720,000) $70,000 $(20,000) $80,000 $130,000 Management is considering the discontinuance of the manufacture and sale of Product G at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Products F and H. The amount of change in profit for the current year that will result from the discontinuance of Product G is a Oa. $20,000 decrease Ob. $30,000 decrease Oc. $30,000 increase X d. $20,000 increase

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 12MC: Youngstown Construction plans to discontinue its rooting segment. Last year, this segment generated...

Related questions

Question

GIVE PROPER EXPLANATION AND PROPER FORMATTING AND DO NOT GIVE SOLUTION IN IMAGE

Transcribed Image Text:The condensed income statement for Fletcher Inc. for the past year is as follows:

Sales

Product

F

Product

G

Product

Product

H

Total

$300,000 $210,000 $340,000 $850,000

Costs:

Variable costs $(180,000) $(180,000) $(220,000) $(580,000)

Fixed costs

Total costs

Income (loss)

(50,000) (50,000) (40,000) (140,000)

$(230,000) $(230,000) $(260,000) $(720,000)

$70,000 $(20,000) $80,000 $130,000

Management is considering the discontinuance of the manufacture and sale of Product G at the beginning of the current year. The discontinuance would have no effect on

the total fixed costs and expenses or on the sales of Products F and H. The amount of change in profit for the current year that will result from the discontinuance of

Product G is a

Oa. $20,000 decrease

Ob. $30,000 decrease

Oc. $30,000 increase

X

d. $20,000 increase

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning