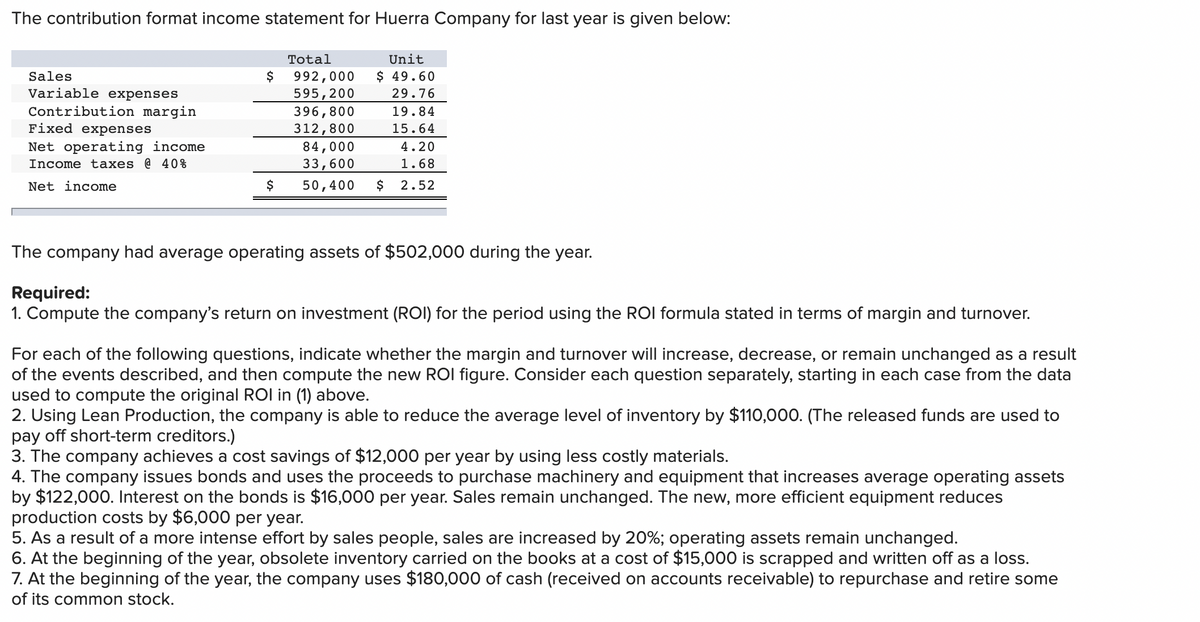

The contribution format income statement for Huerra Company for last year is given below: Total Unit $ 49.60 992,000 595,200 396,800 312,800 84,000 33,600 $ Sales Variable expenses Contribution margin Fixed expenses 29.76 19.84 15.64 Net operating income Income taxes @ 40% 4.20 1.68 Net income 50,400 $ 2.52 The company had average operating assets of $502,000 during the year. Required: 1. Compute the company's return on investment (ROI) for the period using the ROI formula stated in terms of margin and turnover. For each of the following questions, indicate whether the margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI figure. Consider each question separately, starting in each case from the data used to compute the original ROI in (1) above. 2. Using Lean Production, the company is able to reduce the average level of inventory by $110,000. (The released funds are used to pay off short-term creditors.) 3. The company achieves a cost savings of $12,000 per year by using less costly materials. 4. The company issues bonds and uses the proceeds to purchase machinery and equipment that increases average operating assets by $122,000. Interest on the bonds is $16,000 per year. Sales remain unchanged. The new, more efficient equipment reduces production costs by $6,000 per year. 5. As a result of a more intense effort by sales people, sales are increased by 20%; operating assets remain unchanged. 6. At the beginning of the year, obsolete inventory carried on the books at a cost of $15,000 is scrapped and written off as a loss. 7. At the beginning of the year, the company uses $180,000 of cash (received on accounts receivable) to repurchase and retire some of its common stock.

The contribution format income statement for Huerra Company for last year is given below: Total Unit $ 49.60 992,000 595,200 396,800 312,800 84,000 33,600 $ Sales Variable expenses Contribution margin Fixed expenses 29.76 19.84 15.64 Net operating income Income taxes @ 40% 4.20 1.68 Net income 50,400 $ 2.52 The company had average operating assets of $502,000 during the year. Required: 1. Compute the company's return on investment (ROI) for the period using the ROI formula stated in terms of margin and turnover. For each of the following questions, indicate whether the margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI figure. Consider each question separately, starting in each case from the data used to compute the original ROI in (1) above. 2. Using Lean Production, the company is able to reduce the average level of inventory by $110,000. (The released funds are used to pay off short-term creditors.) 3. The company achieves a cost savings of $12,000 per year by using less costly materials. 4. The company issues bonds and uses the proceeds to purchase machinery and equipment that increases average operating assets by $122,000. Interest on the bonds is $16,000 per year. Sales remain unchanged. The new, more efficient equipment reduces production costs by $6,000 per year. 5. As a result of a more intense effort by sales people, sales are increased by 20%; operating assets remain unchanged. 6. At the beginning of the year, obsolete inventory carried on the books at a cost of $15,000 is scrapped and written off as a loss. 7. At the beginning of the year, the company uses $180,000 of cash (received on accounts receivable) to repurchase and retire some of its common stock.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.2.1P

Related questions

Question

only need 4-7

Transcribed Image Text:The contribution format income statement for Huerra Company for last year is given below:

Total

Unit

Sales

$ 49.60

992,000

595,200

Variable expenses

29.76

Contribution margin

Fixed expenses

396,800

19.84

312,800

84,000

15.64

Net operating income

Income taxes @ 40%

4.20

33,600

1.68

Net income

50,400

$

2.52

The company had average operating assets of $502,000 during the year.

Required:

1. Compute the company's return on investment (ROI) for the period using the ROI formula stated in terms of margin and turnover.

For each of the following questions, indicate whether the margin and turnover will increase, decrease, or remain unchanged as a result

of the events described, and then compute the new ROI figure. Consider each question separately, starting in each case from the data

used to compute the original ROI in (1) above.

2. Using Lean Production, the company is able to reduce the average level of inventory by $110,000. (The released funds are used to

pay off short-term creditors.)

3. The company achieves a cost savings of $12,000 per year by using less costly materials.

4. The company issues bonds and uses the proceeds to purchase machinery and equipment that increases average operating assets

by $122,000. Interest on the bonds is $16,000 per year. Sales remain unchanged. The new, more efficient equipment reduces

production costs by $6,000 per year.

5. As a result of a more intense effort by sales people, sales are increased by 20%; operating assets remain unchanged.

6. At the beginning of the year, obsolete inventory carried on the books at a cost of $15,000 is scrapped and written off as a loss.

7. At the beginning of the year, the company uses $180,000 of cash (received on accounts receivable) to repurchase and retire some

of its common stock.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College