The credit card with the transactions described in the popup below uses the average daily balance method to calculate interest. The monthly interest rate is 1.4% of the average daily balance. Calculate parts a-d using the statement in the popup. E Click the icon to view the credit card statement. ... a. Find the average daily balance for the billing period. Round to the nearest cent. The average daily balance for the billing period is $ (Round to the nearest cent as needed.) - X Credit card statement Transaction Description Previous balance, $2647.59 June 1 June 6 June 8 June 9 June 17 Transaction Amount Billing date Payment Charge: Gas Charge: Groceries Charge: Gas $1200.00 credit $34.38 $136.53 $41.64 $127.54 $215.18 Charge: Groceries June 27 Charge: Clothing End of billing period Payment Due Date: July 9 June 30 Print Done

The credit card with the transactions described in the popup below uses the average daily balance method to calculate interest. The monthly interest rate is 1.4% of the average daily balance. Calculate parts a-d using the statement in the popup. E Click the icon to view the credit card statement. ... a. Find the average daily balance for the billing period. Round to the nearest cent. The average daily balance for the billing period is $ (Round to the nearest cent as needed.) - X Credit card statement Transaction Description Previous balance, $2647.59 June 1 June 6 June 8 June 9 June 17 Transaction Amount Billing date Payment Charge: Gas Charge: Groceries Charge: Gas $1200.00 credit $34.38 $136.53 $41.64 $127.54 $215.18 Charge: Groceries June 27 Charge: Clothing End of billing period Payment Due Date: July 9 June 30 Print Done

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 22MC: A company collects an honored note with a maturity date of 24 months from establishment, a 10%...

Related questions

Question

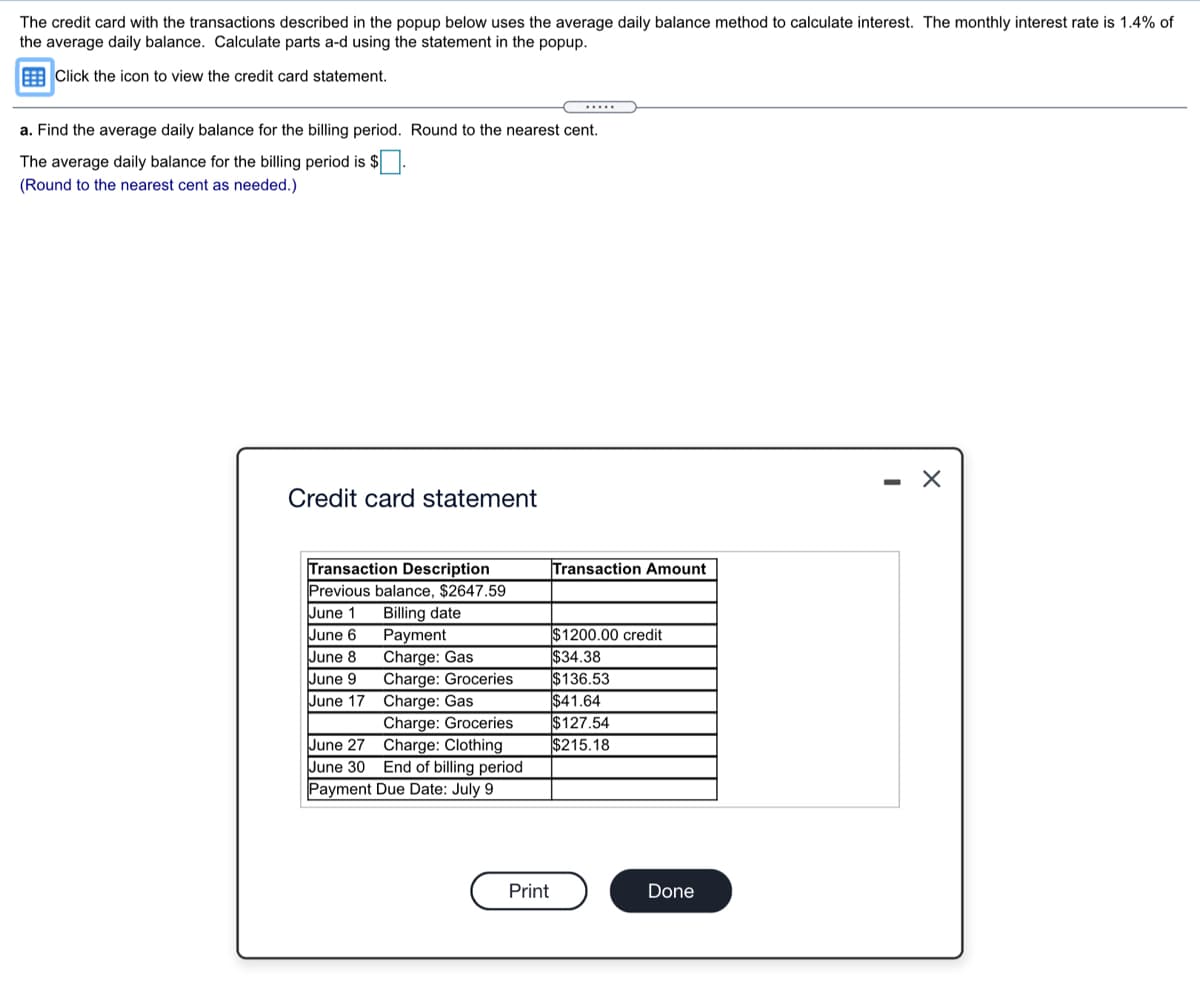

Transcribed Image Text:The credit card with the transactions described in the popup below uses the average daily balance method to calculate interest. The monthly interest rate is 1.4% of

the average daily balance. Calculate parts a-d using the statement in the popup.

EClick the icon to view the credit card statement.

.....

a. Find the average daily balance for the billing period. Round to the nearest cent.

The average daily balance for the billing period is $

(Round to the nearest cent as needed.)

Credit card statement

Transaction Description

Previous balance, $2647.59

Billing date

Payment

Charge: Gas

Charge: Groceries

Charge: Gas

Charge: Groceries

Charge: Clothing

June 30 End of billing period

Payment Due Date: July 9

Transaction Amount

June 1

$1200.00 credit

$34.38

$136.53

$41.64

$127.54

$215.18

June 6

June 8

June 9

June 17

June 27

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,