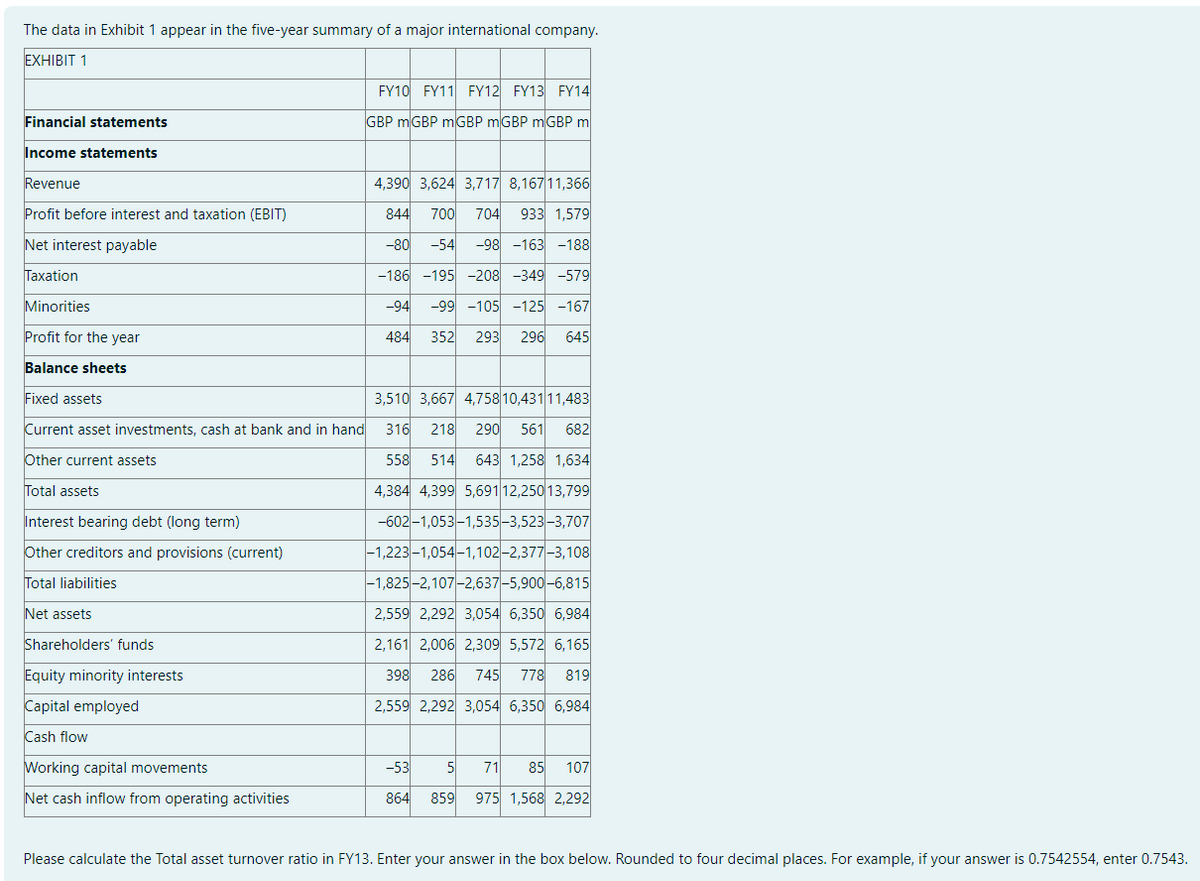

The data in Exhibit 1 appear in the five-year summary of a major international company. EXHIBIT 1 Financial statements FY10 FY11 FY12 FY13 FY14 GBP mGBP mGBP MGBP mGBP m Income statements Revenue 4,390 3,624 3,717 8,167 11,366 Profit before interest and taxation (EBIT) 844 700 704 933 1,579 Net interest payable Taxation Minorities -80 -54 -98 -163-188 -186 -195-208 -349-579 -94 -99-105-125-167 484 352 293 296 645 Profit for the year Balance sheets Fixed assets Current asset investments, cash at bank and in hand Other current assets Total assets Interest bearing debt (long term) Other creditors and provisions (current) Total liabilities Net assets Shareholders' funds Equity minority interests Capital employed Cash flow 3,510 3,667 4,758 10,431 11,483 316 218 290 561 682 558 514 643 1,258 1,634 4,384 4,399 5,691 12,250 13,799 -602-1,053-1,535-3,523-3,707 -1,223-1,054-1,102-2,377-3,108 -1,825-2,107-2,637-5,900-6,815 2,559 2,292 3,054 6,350 6,984 2,161 2,006 2,309 5,572 6,165 398 286 745 778 819 2,559 2,292 3,054 6,350 6,984 Working capital movements Net cash inflow from operating activities -53 864 5 71 85 107 859 975 1,568 2,292 Please calculate the Total asset turnover ratio in FY13. Enter your answer in the box below. Rounded to four decimal places. For example, if your answer is 0.7542554, enter 0.7543.

The data in Exhibit 1 appear in the five-year summary of a major international company. EXHIBIT 1 Financial statements FY10 FY11 FY12 FY13 FY14 GBP mGBP mGBP MGBP mGBP m Income statements Revenue 4,390 3,624 3,717 8,167 11,366 Profit before interest and taxation (EBIT) 844 700 704 933 1,579 Net interest payable Taxation Minorities -80 -54 -98 -163-188 -186 -195-208 -349-579 -94 -99-105-125-167 484 352 293 296 645 Profit for the year Balance sheets Fixed assets Current asset investments, cash at bank and in hand Other current assets Total assets Interest bearing debt (long term) Other creditors and provisions (current) Total liabilities Net assets Shareholders' funds Equity minority interests Capital employed Cash flow 3,510 3,667 4,758 10,431 11,483 316 218 290 561 682 558 514 643 1,258 1,634 4,384 4,399 5,691 12,250 13,799 -602-1,053-1,535-3,523-3,707 -1,223-1,054-1,102-2,377-3,108 -1,825-2,107-2,637-5,900-6,815 2,559 2,292 3,054 6,350 6,984 2,161 2,006 2,309 5,572 6,165 398 286 745 778 819 2,559 2,292 3,054 6,350 6,984 Working capital movements Net cash inflow from operating activities -53 864 5 71 85 107 859 975 1,568 2,292 Please calculate the Total asset turnover ratio in FY13. Enter your answer in the box below. Rounded to four decimal places. For example, if your answer is 0.7542554, enter 0.7543.

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Transcribed Image Text:The data in Exhibit 1 appear in the five-year summary of a major international company.

EXHIBIT 1

Financial statements

FY10 FY11 FY12 FY13 FY14

GBP mGBP mGBP MGBP mGBP m

Income statements

Revenue

4,390 3,624 3,717 8,167 11,366

Profit before interest and taxation (EBIT)

844 700 704 933 1,579

Net interest payable

Taxation

Minorities

-80 -54 -98 -163-188

-186 -195-208 -349-579

-94

-99-105-125-167

484 352 293 296 645

Profit for the year

Balance sheets

Fixed assets

Current asset investments, cash at bank and in hand

Other current assets

Total assets

Interest bearing debt (long term)

Other creditors and provisions (current)

Total liabilities

Net assets

Shareholders' funds

Equity minority interests

Capital employed

Cash flow

3,510 3,667 4,758 10,431 11,483

316 218 290 561 682

558

514 643 1,258 1,634

4,384 4,399 5,691 12,250 13,799

-602-1,053-1,535-3,523-3,707

-1,223-1,054-1,102-2,377-3,108

-1,825-2,107-2,637-5,900-6,815

2,559 2,292 3,054 6,350 6,984

2,161 2,006 2,309 5,572 6,165

398 286 745 778 819

2,559 2,292 3,054 6,350 6,984

Working capital movements

Net cash inflow from operating activities

-53

864

5 71 85 107

859

975 1,568 2,292

Please calculate the Total asset turnover ratio in FY13. Enter your answer in the box below. Rounded to four decimal places. For example, if your answer is 0.7542554, enter 0.7543.

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education