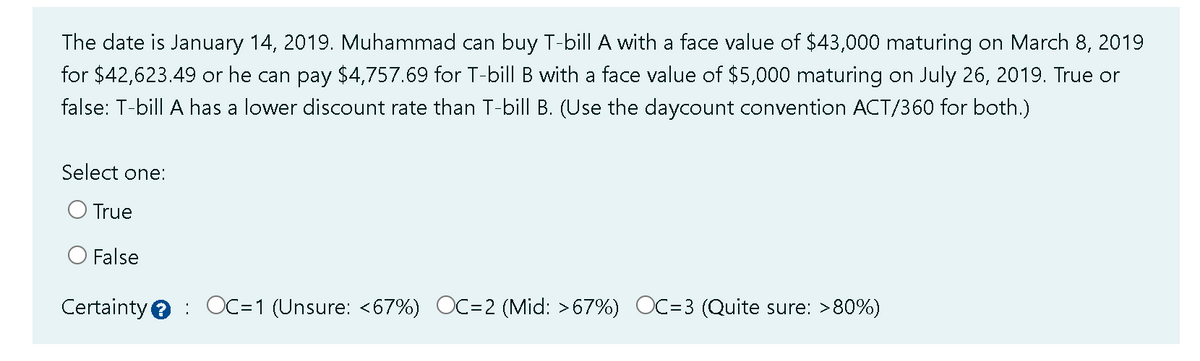

The date is January 14, 2019. Muhammad can buy T-bill A with a face value of $43,000 maturing on March 8, 2019 for $42,623.49 or he can pay $4,757.69 for T-bill B with a face value of $5,000 maturing on July 26, 2019. True or false: T-bill A has a lower discount rate than T-bill B. (Use the daycount convention ACT/360 for both.) Select one: O True O False Certainty OC=1 (Unsure: <67%) OC=2 (Mid: > 67%) OC-3 ( Quite sure: >80%)

The date is January 14, 2019. Muhammad can buy T-bill A with a face value of $43,000 maturing on March 8, 2019 for $42,623.49 or he can pay $4,757.69 for T-bill B with a face value of $5,000 maturing on July 26, 2019. True or false: T-bill A has a lower discount rate than T-bill B. (Use the daycount convention ACT/360 for both.) Select one: O True O False Certainty OC=1 (Unsure: <67%) OC=2 (Mid: > 67%) OC-3 ( Quite sure: >80%)

Chapter7: Tax Credits

Section: Chapter Questions

Problem 8MCQ

Related questions

Question

4. the math of interest. please indicate if you are unsure or totally sure about the answer

Transcribed Image Text:The date is January 14, 2019. Muhammad can buy T-bill A with a face value of $43,000 maturing on March 8, 2019

for $42,623.49 or he can pay $4,757.69 for T-bill B with a face value of $5,000 maturing on July 26, 2019. True or

false: T-bill A has a lower discount rate than T-bill B. (Use the daycount convention ACT/360 for both.)

Select one:

True

False

Certainty OC=1 (Unsure: <67%) OC=2 (Mid: >67%) OC=3 (Quite sure: >80%)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you