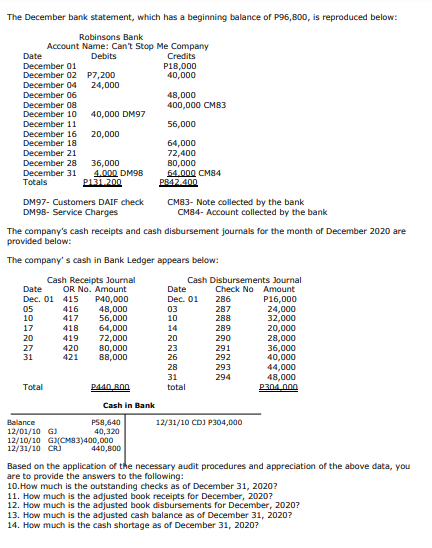

The December bank statement, which has a beginning balance of P96,800, is reproduced below: Robinsons Bank Account Name: Can't Stop Me Company Credits P18,000 40,000 Date Debits December 01 December 02 P7,200 December 04 24,000 December 06 December 08 December 10 48,000 400,000 См8з 40,000 DM97 December 11 56,000 December 16 December 18 20,000 64,000 72,400 80,000 64.000 CM84 PR42.400 December 21 December 28 36,000 December 31 Totals 4.000 DM98 PI31.200 DM97- Customers DAIF check CM83- Note collected by the bank CM84- Account collected by the bank DM98- Service Charges The company's cash receipts and cash disbursement journals for the month of December 2020 are provided below: The company s cash in Bank Ledger appears below: Cash Receipts Journal OR No. Amount Cash Disbursements Journal Check No Amount Date Date Dec. 01 P16,000 24,000 32,000 Dec. 01 415 P40,000 48,000 56,000 64,000 72,000 80,000 B৪,000 286 05 10 416 03 10 287 288 417 17 418 14 289 20,000 28,000 36,000 40,000 44,000 48,000 P304 000 20 419 20 290 27 31 420 421 23 26 291 292 28 293 31 294 Total total Cash in Bank Balance 12/01/10 G) 12/10/10 G(CM83)400,000 12/31/10 CRI PS8,640 40,320 12/31/10 CDJ P304,000 440,800 Based on the application of the necessary audit procedures and appreciation of the above data, you are to provide the answers to the following: 10.How much is the outstanding checks as of December 31, 2020? 11. How much is the adjusted book receipts for December, 2020? 12. How much is the adjusted book disbursements for December, 2020? 13. How much is the adjusted cash balance as of December 31, 2020?

The December bank statement, which has a beginning balance of P96,800, is reproduced below: Robinsons Bank Account Name: Can't Stop Me Company Credits P18,000 40,000 Date Debits December 01 December 02 P7,200 December 04 24,000 December 06 December 08 December 10 48,000 400,000 См8з 40,000 DM97 December 11 56,000 December 16 December 18 20,000 64,000 72,400 80,000 64.000 CM84 PR42.400 December 21 December 28 36,000 December 31 Totals 4.000 DM98 PI31.200 DM97- Customers DAIF check CM83- Note collected by the bank CM84- Account collected by the bank DM98- Service Charges The company's cash receipts and cash disbursement journals for the month of December 2020 are provided below: The company s cash in Bank Ledger appears below: Cash Receipts Journal OR No. Amount Cash Disbursements Journal Check No Amount Date Date Dec. 01 P16,000 24,000 32,000 Dec. 01 415 P40,000 48,000 56,000 64,000 72,000 80,000 B৪,000 286 05 10 416 03 10 287 288 417 17 418 14 289 20,000 28,000 36,000 40,000 44,000 48,000 P304 000 20 419 20 290 27 31 420 421 23 26 291 292 28 293 31 294 Total total Cash in Bank Balance 12/01/10 G) 12/10/10 G(CM83)400,000 12/31/10 CRI PS8,640 40,320 12/31/10 CDJ P304,000 440,800 Based on the application of the necessary audit procedures and appreciation of the above data, you are to provide the answers to the following: 10.How much is the outstanding checks as of December 31, 2020? 11. How much is the adjusted book receipts for December, 2020? 12. How much is the adjusted book disbursements for December, 2020? 13. How much is the adjusted cash balance as of December 31, 2020?

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 3E

Related questions

Question

4

Transcribed Image Text:The December bank statement, which has a beginning balance of P96,800, is reproduced below:

Robinsons Bank

Account Name: Can't Stop Me Company

Credits

Date

December 01

December 02 P7,200

December 04

December 06

Debits

P18,000

40,000

24,000

48,000

400,000 CM83

December 08

December 10

40,000 DM97

December 11

56,000

December 16

December 18

20,000

64,000

72,400

80,000

64.000 CM84

PR42.400

December 21

December 28

December 31

Totals

36,000

4.000 DM98

P131.200

DM97- Customers DAIF check

CM83- Note collected by the bank

CM84- Account collected by the bank

DM98- Service Charges

The company's cash receipts and cash disbursement journals for the month of December 2020 are

provided below:

The company' s cash in Bank Ledger appears below:

Cash Receipts Journal

OR No. Amount

Cash Disbursements Journal

Check No Amount

Date

Date

Dec. 01

Dec. 01 415

P40,000

48,000

56,000

64,000

286

P16,000

05

10

416

417

03

10

287

288

24,000

32,000

20,000

28,000

36,000

40,000

44,000

48,000

P304 000

17

418

14

289

20

419

72,000

20

290

27

31

420

421

80,000

88,000

23

26

291

292

28

293

31

total

294

Total

PA40 B00

Cash in Bank

PS8,640

40,320

12/10/10 GCM83)400,000

440,800

Balance

12/31/10 CDJ P304,000

12/01/10 G)

Based on the application of the necessary audit procedures and appreciation of the above data, you

are to provide the answers to the following:

10.How much is the outstanding checks as of December 31, 2020?

11. How much is the adjusted book receipts for December, 2020?

12. How much is the adjusted book disbursements for December, 2020?

13. How much is the adjusted cash balance as of December 31, 2020?

14. How much is the cash shortage as of December 31, 2020?

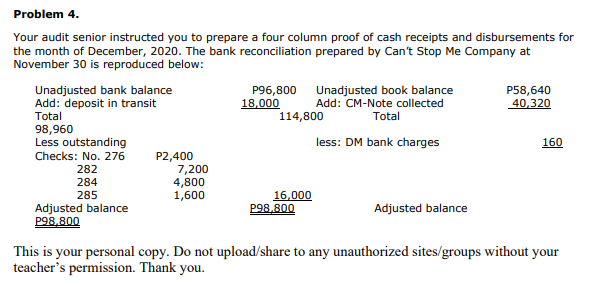

Transcribed Image Text:Problem 4.

Your audit senior instructed you to prepare a four column proof of cash receipts and disbursements for

the month of December, 2020. The bank reconciliation prepared by Can't Stop Me Company at

November 30 is reproduced below:

Unadjusted bank balance

Add: deposit in transit

P96,800

18,000

Unadjusted book balance

Add: CM-Note collected

P58,640

40,320

Total

114,800

Total

98,960

Less outstanding

less: DM bank charges

160

P2,400

7,200

4,800

1,600

Checks: No. 276

282

284

285

16,000

P98,800

Adjusted balance

P98,800

Adjusted balance

This is your personal copy. Do not upload/share to any unauthorized sites/groups without your

teacher's permission. Thank you.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage