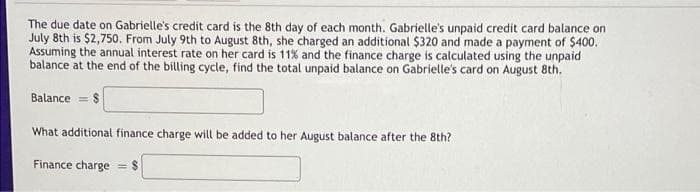

The due date on Gabrielle's credit card is the 8th day of each month. Gabrielle's unpaid credit card balance on July 8th is $2,750. From July 9th to August 8th, she charged an additional $320 and made a payment of $400. Assuming the annual interest rate on her card is 11% and the finance charge is calculated using the unpaid balance at the end of the billing cycle, find the total unpaid balance on Gabrielle's card on August 8th. Balance = $ What additional finance charge will be added to her August balance after the 8th? Finance charge

The due date on Gabrielle's credit card is the 8th day of each month. Gabrielle's unpaid credit card balance on July 8th is $2,750. From July 9th to August 8th, she charged an additional $320 and made a payment of $400. Assuming the annual interest rate on her card is 11% and the finance charge is calculated using the unpaid balance at the end of the billing cycle, find the total unpaid balance on Gabrielle's card on August 8th. Balance = $ What additional finance charge will be added to her August balance after the 8th? Finance charge

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 4Q: American Signs allows customers to pay with their Jones credit card and cash. Jones charges American...

Related questions

Question

Transcribed Image Text:The due date on Gabrielle's credit card is the 8th day of each month. Gabrielle's unpaid credit card balance on

July 8th is $2,750. From July 9th to August 8th, she charged an additional $320 and made a payment of $400.

Assuming the annual interest rate on her card is 11% and the finance charge is calculated using the unpaid

balance at the end of the billing cycle, find the total unpaid balance on Gabrielle's card on August 8th.

Balance = $

What additional finance charge will be added to her August balance after the 8th?

Finance charge

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub