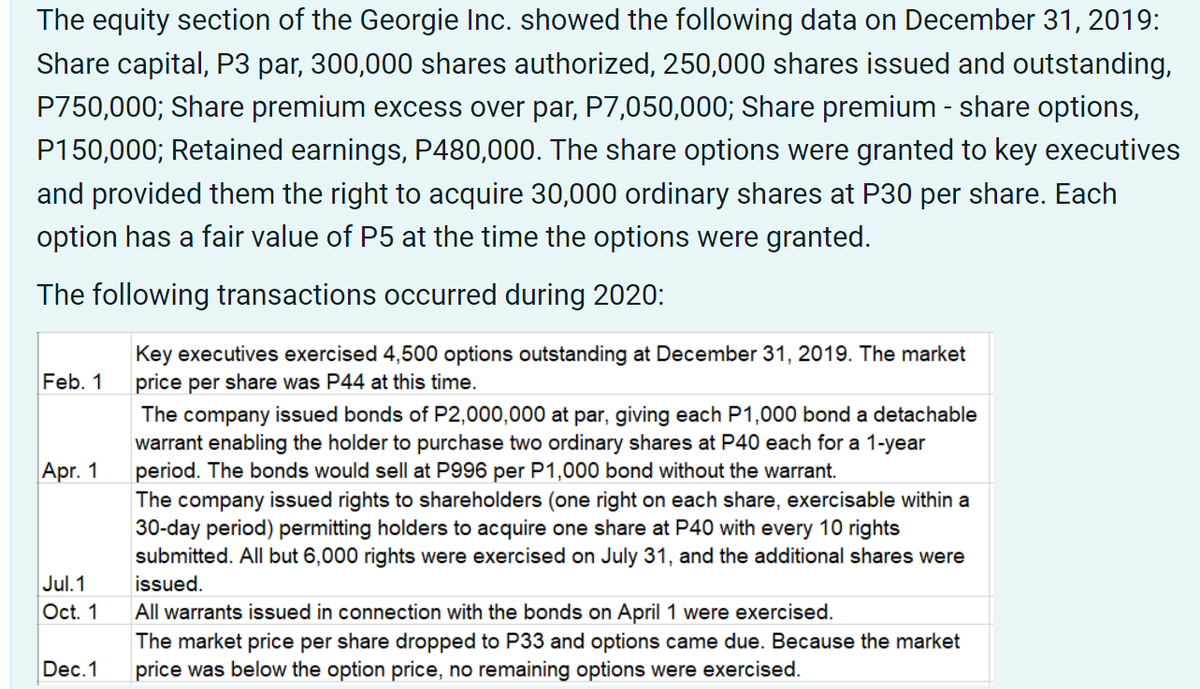

The equity section of the Georgie Inc. showed the following data on December 31, 2019: Share capital, P3 par, 300,000 shares authorized, 250,000 shares issued and outstanding, P750,000; Share premium excess over par, P7,050,000; Share premium - share options, P150,000; Retained earnings, P480,000. The share options were granted to key executives and provided them the right to acquire 30,000 ordinary shares at P30 per share. Each option has a fair value of P5 at the time the options were granted. The following transactions occurred during 2020:

The equity section of the Georgie Inc. showed the following data on December 31, 2019: Share capital, P3 par, 300,000 shares authorized, 250,000 shares issued and outstanding, P750,000; Share premium excess over par, P7,050,000; Share premium - share options, P150,000; Retained earnings, P480,000. The share options were granted to key executives and provided them the right to acquire 30,000 ordinary shares at P30 per share. Each option has a fair value of P5 at the time the options were granted. The following transactions occurred during 2020:

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 26P

Related questions

Question

1. Determine the total

choices:

780,000

858,000

580,500

730,500

2. Determine the total share premium as of December 31, 2020.

8,396,950

8,419,450

8,402,800

8,219,650

Transcribed Image Text:The equity section of the Georgie Inc. showed the following data on December 31, 2019:

Share capital, P3 par, 300,000 shares authorized, 250,000 shares issued and outstanding,

P750,000; Share premium excess over par, P7,050,000; Share premium - share options,

P150,000; Retained earnings, P480,000. The share options were granted to key executives

and provided them the right to acquire 30,000 ordinary shares at P30 per share. Each

option has a fair value of P5 at the time the options were granted.

The following transactions occurred during 2020:

Feb. 1

Apr. 1

Jul.1

Oct. 1

Dec.1

Key executives exercised 4,500 options outstanding at December 31, 2019. The market

price per share was P44 at this time.

The company issued bonds of P2,000,000 at par, giving each P1,000 bond a detachable

warrant enabling the holder to purchase two ordinary shares at P40 each for a 1-year

period. The bonds would sell at P996 per P1,000 bond without the warrant.

The company issued rights to shareholders (one right on each share, exercisable within a

30-day period) permitting holders to acquire one share at P40 with every 10 rights

submitted. All but 6,000 rights were exercised on July 31, and the additional shares were

issued.

All warrants issued in connection with the bonds on April 1 were exercised.

The market price per share dropped to P33 and options came due. Because the market

price was below the option price, no remaining options were exercised.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning