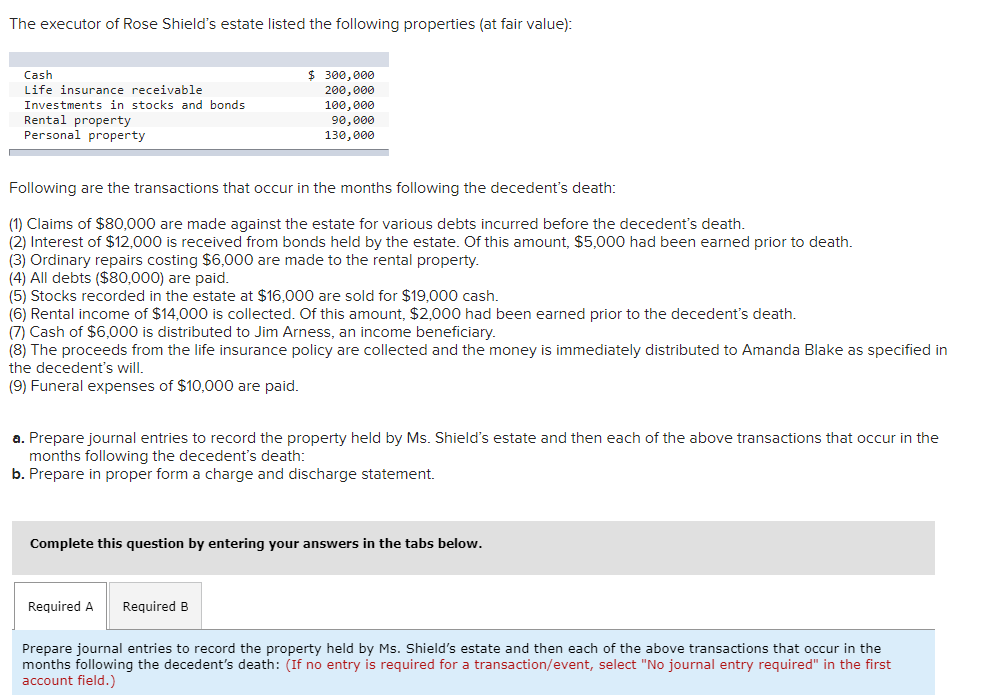

The executor of Rose Shield's estate listed the following properties (at fair value): $ 300,000 200,000 100,000 90,000 130,000 Cash Life insurance receivable Investments in stocks and bonds Rental property Personal property Following are the transactions that occur in the months following the decedent's death: (1) Claims of $80,000 are made against the estate for various debts incurred before the decedent's death. (2) Interest of $12,000 is received from bonds held by the estate. Of this amount, $5,000 had been earned prior to death. (3) Ordinary repairs costing $6,000 are made to the rental property. (4) All debts ($80,000) are paid. (5) Stocks recorded in the estate at $16,000 are sold for $19,000 cash. (6) Rental income of $14,000 is collected. Of this amount, $2,000 had been earned prior to the decedent's death. (7) Cash of $6,000 is distributed to Jim Arness, an income beneficiary. (8) The proceeds from the life insurance policy are collected and the money is immediately distributed to Amanda Blake as specified in the decedent's will. (9) Funeral expenses of $10,000 are paid. a. Prepare journal entries to record the property held by Ms. Shield's estate and then each of the above transactions that occur in the months following the decedent's death: b. Prepare in proper form a charge and discharge statement.

The executor of Rose Shield's estate listed the following properties (at fair value): $ 300,000 200,000 100,000 90,000 130,000 Cash Life insurance receivable Investments in stocks and bonds Rental property Personal property Following are the transactions that occur in the months following the decedent's death: (1) Claims of $80,000 are made against the estate for various debts incurred before the decedent's death. (2) Interest of $12,000 is received from bonds held by the estate. Of this amount, $5,000 had been earned prior to death. (3) Ordinary repairs costing $6,000 are made to the rental property. (4) All debts ($80,000) are paid. (5) Stocks recorded in the estate at $16,000 are sold for $19,000 cash. (6) Rental income of $14,000 is collected. Of this amount, $2,000 had been earned prior to the decedent's death. (7) Cash of $6,000 is distributed to Jim Arness, an income beneficiary. (8) The proceeds from the life insurance policy are collected and the money is immediately distributed to Amanda Blake as specified in the decedent's will. (9) Funeral expenses of $10,000 are paid. a. Prepare journal entries to record the property held by Ms. Shield's estate and then each of the above transactions that occur in the months following the decedent's death: b. Prepare in proper form a charge and discharge statement.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter4: Gross Income

Section: Chapter Questions

Problem 11P

Related questions

Question

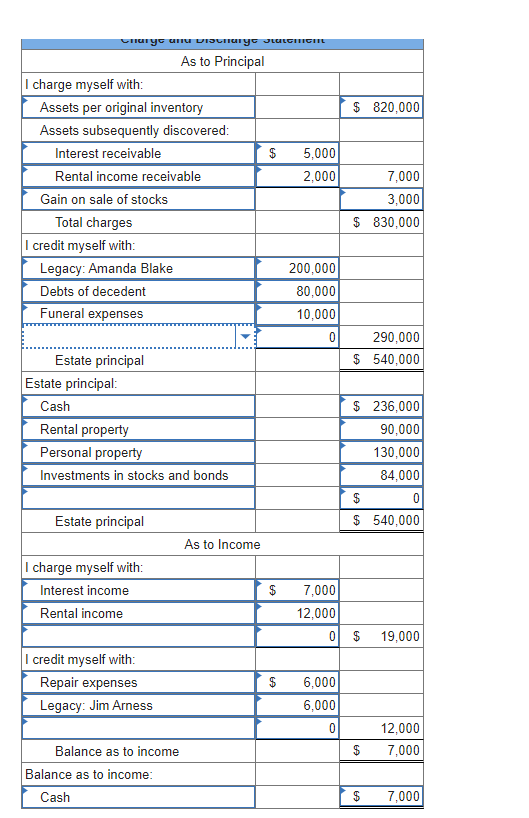

Hello, I need help with the answers under "I credit myself with" "estate principal" there are 4 of them in total that are blank. they have a zero value.

I cannot fgure them out.

Transcribed Image Text:The executor of Rose Shield's estate listed the following properties (at fair value):

Cash

$ 300,000

Life insurance receivable

200,000

Investments in stocks and bonds

Rental property

Personal property

100,000

90,000

130,000

Following are the transactions that occur in the months following the decedent's death:

(1) Claims of $80,000 are made against the estate for various debts incurred before the decedent's death.

(2) Interest of $12,000 is received from bonds held by the estate. Of this amount, $5.000 had been earned prior to death.

(3) Ordinary repairs costing $6,000 are made to the rental property.

(4) All debts ($80,000) are paid.

(5) Stocks recorded in the estate at $16.000 are sold for $19.000 cash.

(6) Rental income of $14,000 is collected. Of this amount, $2,000 had been earned prior to the decedent's death.

(7) Cash of $6,000 is distributed to Jim Arness, an income beneficiary.

(8) The proceeds from the life insurance policy are collected and the money is immediately distributed to Amanda Blake as specified in

the decedent's will.

(9) Funeral expenses of $10,000 are paid.

a. Prepare journal entries to record the property held by Ms. Shield's estate and then each of the above transactions that occur in the

months following the decedent's death:

b. Prepare in proper form a charge and discharge statement.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Prepare journal entries to record the property held by Ms. Shield's estate and then each of the above transactions that occur in the

months following the decedent's death: (If no entry is required for a transaction/event, select "No journal entry required" in the first

account field.)

Transcribed Image Text:As to Principal

I charge myself with:

Assets per original inventory

$ 820,000

Assets subsequently discovered:

Interest receivable

$

5,000

Rental income receivable

2,000

7,000

Gain on sale of stocks

3,000

Total charges

$ 830,000

I credit myself with:

Legacy: Amanda Blake

200,000

Debts of decedent

80,000

Funeral expenses

10,000

290,000

Estate principal

$ 540,000

Estate principal:

Cash

$ 236,000

Rental property

90,000

Personal property

130,000

Investments in stocks and bonds

84,000

$

Estate principal

$ 540,000

As to Income

I charge myself with:

Interest income

$

7,000

Rental income

12,000

이 S

19,000

I credit myself with:

Repair expenses

$

6,000

Legacy: Jim Arness

6,000

12,000

Balance as to income

$

7,000

Balance as to income:

Cash

$

7,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT