The expected pretax return on three stocks is divided between dividends and capital gains in the following way: Stock Expected Dividend SO Expected Capital Gain $10 10 Required: a. If each stock is priced at $140, what are the expected net percentage retums on each stock to (i) a pension fund that does not pay taxes, (i) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (ii) an individual with an effective tax rate of 15% on dividends and 10% on capital gains?

The expected pretax return on three stocks is divided between dividends and capital gains in the following way: Stock Expected Dividend SO Expected Capital Gain $10 10 Required: a. If each stock is priced at $140, what are the expected net percentage retums on each stock to (i) a pension fund that does not pay taxes, (i) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (ii) an individual with an effective tax rate of 15% on dividends and 10% on capital gains?

Chapter15: Dividend Policy

Section: Chapter Questions

Problem 11P

Related questions

Question

Please provide assistance with the attached questions regarding Finance.

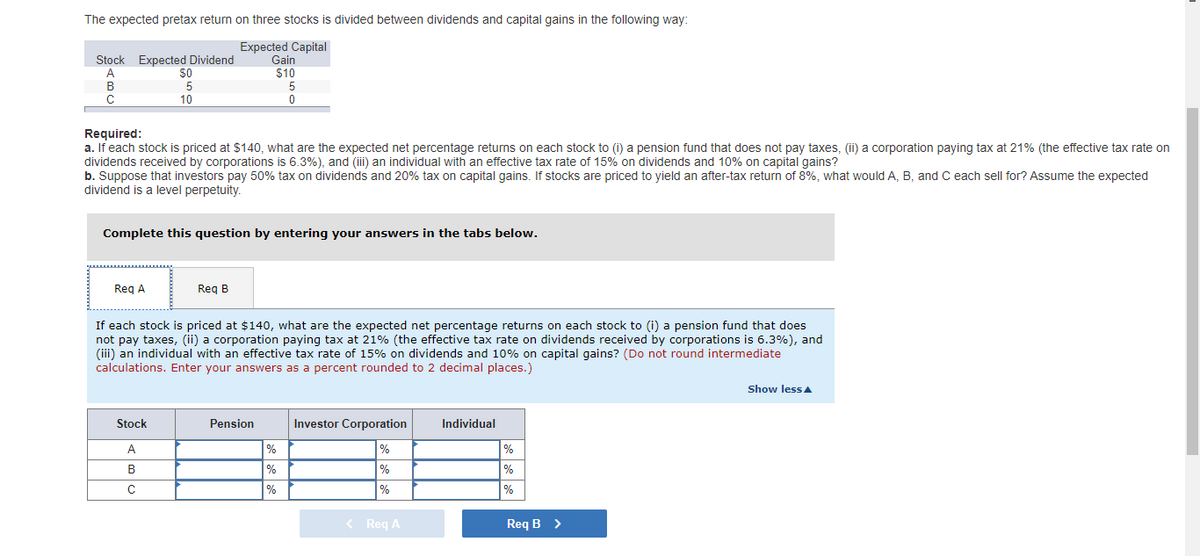

Transcribed Image Text:The expected pretax retum on three stocks is divided between dividends and capital gains in the following way:

Expected Capital

Gain

$10

Expected Dividend

Stock

A

B

5

10

Required:

a. If each stock is priced at $140, what are the expected net percentage returns on each stock to (i) a pension fund that does not pay taxes, (ii) a corporation paying tax at 21% (the effective tax rate on

dividends received by corporations is 6.3%), and (iii) an individual with an effective tax rate of 15% on dividends and 10% on capital gains?

b. Suppose that investors pay 50% tax on dividends and 20% tax on capital gains. If stocks are priced to yield an after-tax return of 8%, what would A, B, and C each sell for? Assume the expected

dividend is a level perpetuity.

Complete this question by entering your answers in the tabs below.

Reg A

Reg B

If each stock is priced at $140, what are the expected net percentage returns on each stock to (i) a pension fund that does

not pay taxes, (ii) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and

(iii) an individual with an effective tax rate of 15% on dividends and 10% on capital gains? (Do not round intermediate

calculations. Enter your answers as a percent rounded to 2 decimal places.)

Show less A

Stock

Pension

Investor Corporation

Individual

A

%

%

%

B

%

%

%

%

%

< Req A

Req B >

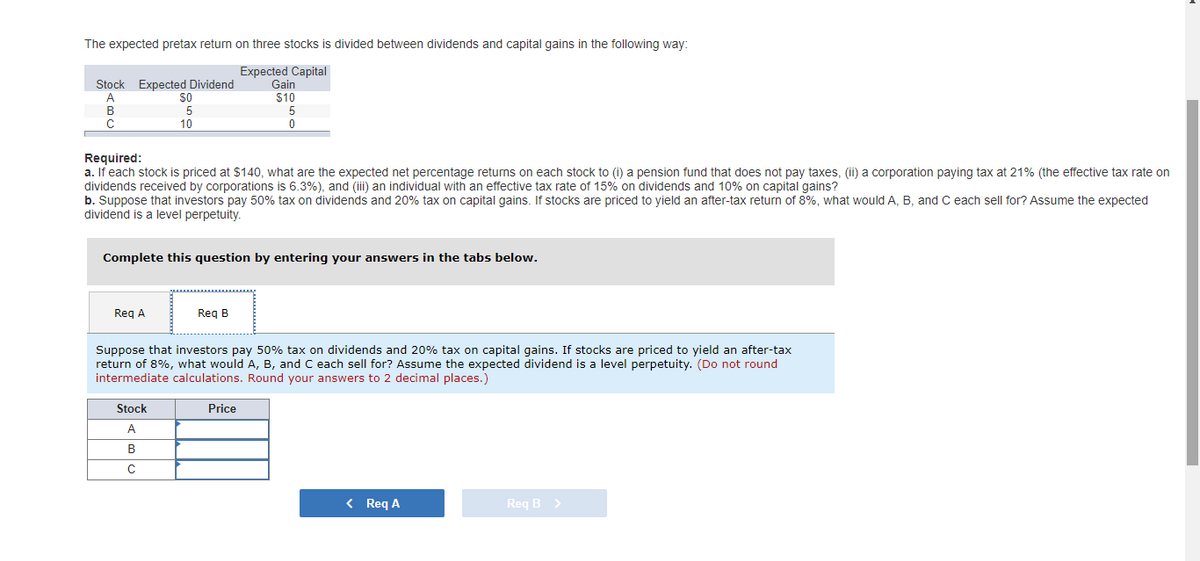

Transcribed Image Text:The expected pretax return on three stocks is divided between dividends and capital gains in the following way:

Stock Expected Dividend

A

В

C

Expected Capital

Gain

$10

5

$0

10

Required:

a. If each stock is priced at $140, what are the expected net percentage returns on each stock to (i) a pension fund that does not pay taxes, (ii) a corporation paying tax at 21% (the effective tax rate on

dividends received by corporations is 6.3%), and (iii) an individual with an effective tax rate of 15% on dividends and 10% on capital gains?

b. Suppose that investors pay 50% tax on dividends and 20% tax on capital gains. If stocks are priced to yield an after-tax return of 8%, what would A, B, and C each sell for? Assume the expected

dividend is a level perpetuity.

Complete this question by entering your answers in the tabs below.

Reg A

Reg B

Suppose that investors pay 50% tax on dividends and 20% tax on capital gains. If stocks are priced to yield an after-tax

return of 8%, what would A, B, and C each sell for? Assume the expected dividend is a level perpetuity. (Do not round

intermediate calculations. Round your answers to 2 decimal places.)

Stock

Price

A

B

< Req A

Req B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning