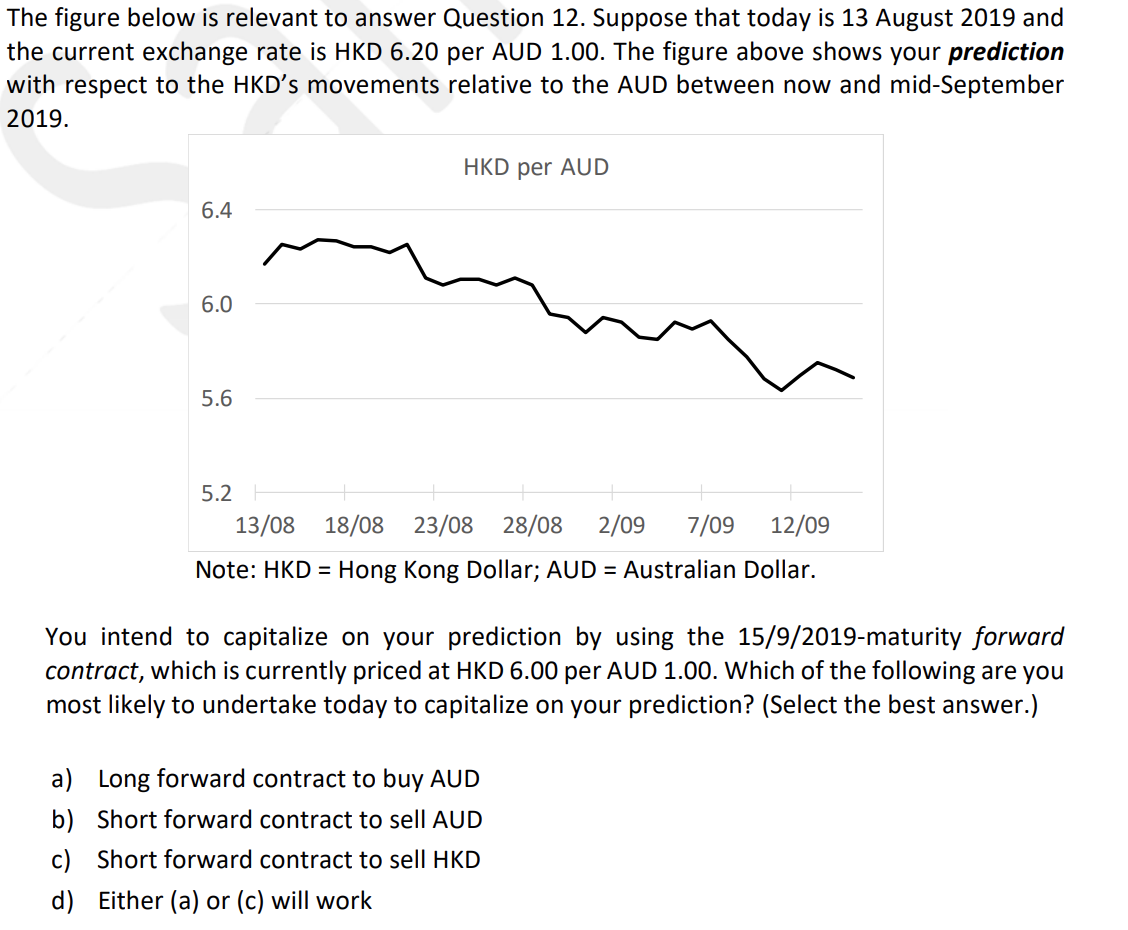

The figure below is relevant to answer Question 12. Suppose that today is 13 August 2019 and the current exchange rate is HKD 6.20 per AUD 1.00. The figure above shows your prediction with respect to the HKD's movements relative to the AUD between now and mid-September 2019. HKD per AUD 6.4 6.0 5.6 5.2 13/08 18/08 23/08 28/08 2/09 7/09 12/09 Note: HKD = Hong Kong Dollar; AUD = Australian Dollar. You intend to capitalize on your prediction by using the 15/9/2019-maturity forward contract, which is currently priced at HKD 6.00 per AUD 1.00. Which of the following are you most likely to undertake today to capitalize on your prediction? (Select the best answer.) a) Long forward contract to buy AUD b) Short forward contract to sell AUD c) Short forward contract to sell HKD d) Either (a) or (c) will work

The figure below is relevant to answer Question 12. Suppose that today is 13 August 2019 and the current exchange rate is HKD 6.20 per AUD 1.00. The figure above shows your prediction with respect to the HKD's movements relative to the AUD between now and mid-September 2019. HKD per AUD 6.4 6.0 5.6 5.2 13/08 18/08 23/08 28/08 2/09 7/09 12/09 Note: HKD = Hong Kong Dollar; AUD = Australian Dollar. You intend to capitalize on your prediction by using the 15/9/2019-maturity forward contract, which is currently priced at HKD 6.00 per AUD 1.00. Which of the following are you most likely to undertake today to capitalize on your prediction? (Select the best answer.) a) Long forward contract to buy AUD b) Short forward contract to sell AUD c) Short forward contract to sell HKD d) Either (a) or (c) will work

Chapter8: Relationships Among Inflation, Interest Rates, And Exchange Rates

Section: Chapter Questions

Problem 19QA

Related questions

Question

Transcribed Image Text:The figure below is relevant to answer Question 12. Suppose that today is 13 August 2019 and

the current exchange rate is HKD 6.20 per AUD 1.00. The figure above shows your prediction

with respect to the HKD's movements relative to the AUD between now and mid-September

2019.

HKD per AUD

6.4

6.0

5.6

5.2

13/08 18/08 23/08 28/08

2/09

7/09

12/09

Note: HKD = Hong Kong Dollar; AUD = Australian Dollar.

You intend to capitalize on your prediction by using the 15/9/2019-maturity forward

contract, which is currently priced at HKD 6.00 per AUD 1.00. Which of the following are you

most likely to undertake today to capitalize on your prediction? (Select the best answer.)

a) Long forward contract to buy AUD

b) Short forward contract to sell AUD

c) Short forward contract to sell HKD

d) Either (a) or (c) will work

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT