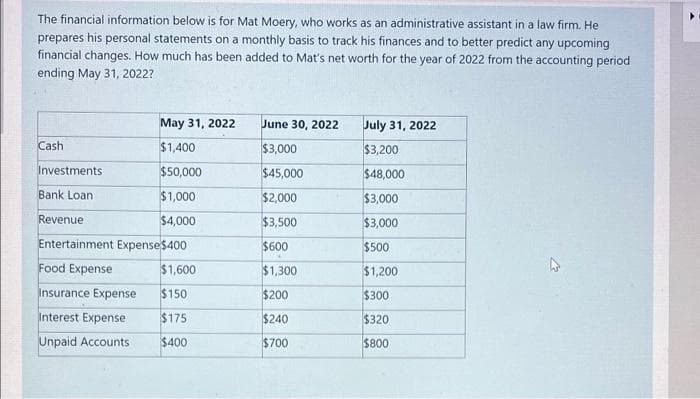

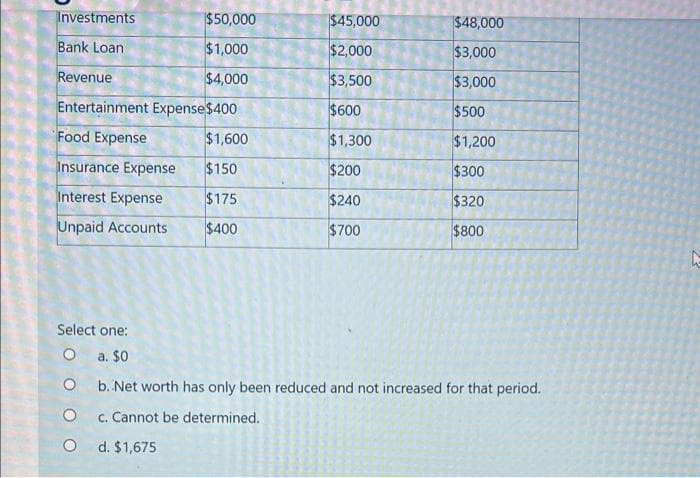

The financial information below is for Mat Moery, who works as an administrative assistant in a law firm. He prepares his personal statements on a monthly basis to track his finances and to better predict any upcoming financial changes. How much has been added to Mat's net worth for the year of 2022 from the accounting period ending May 31, 2022?

Q: The store close to your school has 12 bottles of juice for $21.45. The store close to your house has…

A: Data given Store close to school: Cost of 12 bottles of juice=$21.45 Store close to house: Cost of 8…

Q: In the news: Recently, the malware Wannacry infected many computers worldwide. In order to recover…

A: Recently the malware wannacry infected many computer worldwide. In order to recover their file, the…

Q: Change in Accruals = [(NI-OCF) + Average Assets)-[(NI₁-1-OCF₁-1) + Average Assets. In June 2004,…

A: The "Change in Accruals" metric is a measure of the change in a company's accruals, which are…

Q: As the prize in a contest, you are offered $19,000 now or $45,300 in 9 years. If the money can be…

A: Future Value refers to the value of the current asset or investment or of cash flows at a specified…

Q: You are comparing two investments. The first pays A% interest per month, compounded monthly. The…

A: Interest rate refers to the rate that is earned on the investment. The effective interest rate is…

Q: The table above represents the regression results of Stock A's monthly excess returns versus the S&P…

A: We have to use the CAPM formula as stated below. Expected return = Risk free rate + ? * ( Market…

Q: If the last dividend paid by Chemical Brothers Inc. was $1.25 and analysts expect these payments to…

A: Price of a stock is the PV of future dividends. We can determine the price of the stock next year…

Q: Queen, Inc., has a total debt ratio of 0.22. What is its debt-equity ratio?

A: Debt Ratio It is a monetary indicator that assesses the degree of leverage inside an organisation.…

Q: Scenarios: You work in the macroeconomic research department of an investment bank. Based on your…

A: A straddle is a strategy that involves buying a call option and a put option with the same strike…

Q: Olivia is researching the growth of sequoia trees and needs your assistance. She bought a Sequoia…

A: Part A: Yes, it is possible to use a model to assist in predicting the height of the tree at…

Q: Assume that $500 million of Power’s long-term debt is due and the board of directors are meeting to…

A: Altman Z-score is a numerical value that determines the likelihood of a company getting bankrupt.…

Q: Part 1 Jane Doe plans to make eleven end-of-month payments of$16,000each on a short term…

A: Solution:- a. When an equal amount is invested each period at end of period, it is known as ordinary…

Q: Roten Rooters, Inc., has an equity multiplier of 1.05, total asset turnover of 2.31, and a profit…

A: Return on equity (ROE) refers to the return that is generated from the equity capital of the…

Q: For an investment ending at time T we denote the net cash flow at time t by ct and the net rate of…

A: To adjust the cash flows for inflation, we need to multiply each cash flow by (1+e)^t, where e is…

Q: 5. Change the following linear gradient series into a geometric gradient series by determining the…

A: A linear gradient series annuity needs to be converted into a geometric gradient series annuity. The…

Q: Question 2: Consider the financial-market imperfection model with asymmetric information. The firm…

A: If both the firm and the bank can observe y perfectly, the most straightforward contract that can…

Q: Which is the better investment: common stock par value of $10 per share, or common stock with no par…

A: Common stock is a type of equity investment which will provide with appreciation in the value of…

Q: Please provide solutions and answers for the three questions. 1. Keiko buys a T-bill with a face…

A: To calculate the price of the T-bill that Keiko buys, we can use the formula: P = F / (1 + rt)…

Q: Esfandairi Enterprises is considering a new three-year expansion project that requires an initial…

A: Net Present Value: It represents the present value of the annual cash flows of a project after…

Q: A company will need $65,000 in 6 years for a new addition. To meet this goal, the company deposits…

A: Solution: When an amount is invested somewhere, it earns interest on it. The amount initially…

Q: What is the future value of $2,425 per year for 13 years at an interest rate of 6.57%? MUST USE…

A: Here amount is deposited each year which is a uniform series of deposits called annuity . We will…

Q: Given that S(SGD/USD) = 1.4400, which of the following real exchange rates for Q(SGD/USD) would be…

A: An American tourist will have to sell USD to buy SGD. The given quote is the amount of SGD that…

Q: Green Fire had Net Income for the year just ended of $34,000, and the firm paid out $8,000 in cash…

A: PE ratio refers to the Price earning Ratio which is mostly used by investor to value the company. It…

Q: Problem 7.6. Annuity payments Suppose that a fixed-pa The annuity earns a guaranteed 9 percent…

A: An annuity is a series of equal payments for a fixed period of time. It can be classified as the…

Q: An investor buys 200 shares of stock selling at $71 per share using a margin of 70%. The stock…

A: STEP 1 A rate of return for a time period that is shorter than a year but is calculated as if it…

Q: A bond has the following information - Par value: $1,000 - Maturity: seven years - Coupon rate:…

A: A debt instrument that entitles its holder to receive and obliges its issuer to repay the par worth…

Q: Hello, the explanation you offered is not very clear. Can you tell me what I did wrong?

A: Debt to equity ratio is an important leverage ratio. Debt to equity ratio = total debt/total…

Q: Adlina Rose took a housing loan that charged 6.25% compounded monthly to buy a new bungalow. She…

A: The borrowed amount refers to the total amount of money that an entity (such as a corporation or…

Q: Kaye's Kitchenware has a market/book ratio equal to 1. Its stock price is $16 per share and it has…

A: The debt-to-capital ratio refers to the measurement of the leverage associated with the company and…

Q: There are three assets with the rates of return r₁ = 214 +21B+1, 7₂ = -31₁+61B-2, 73 = 514-18 +4,…

A: To find the portfolio with the minimum variance, we need to solve the following optimization…

Q: a. An initial $700 compounded for 10 years at 8%. b. An initial $700 compounded for 10 years at 16%.…

A:

Q: A pension fund faces a promised outflow of $5 million in 6 years. Its managers plan to dedicate a…

A: Immunization is a strategy used to reduce the interest rate risk of a portfolio by matching the…

Q: If TAM's stock is currently trading at AED 50 and TAM has 15 million shares outstanding, shareholder…

A: Formulas:- 1. market-to-book ratio = Market Price per shareBook Value Per share 2. market…

Q: In December 2022, Samar Co. had a share price of AED 50. They had 12 million shares outstanding, a…

A: Formulas:- 1. P/E ratio means Price -Earnings ratio. P/E ratio = Market Price per share…

Q: Can someone help me with part B of this problem?: Verasource Microprocessor Corporation sells 200…

A: Note: Verasource Microprocessor Corporation sells 2000 computer chips a month . Selling 200 computer…

Q: Consumption-Savings Plan Exercise Assume Jacob is 30 years old and has 40 more years to work.…

A: The concept of money's time worth reveals that any sum of money is worth more currently than what it…

Q: What is the rate of return when 30 shares of Stock A, purchased for $30/share, are sold for $1100?…

A: Rate of return is the % profit from the investment. To determine the rate of return we first must…

Q: Find the amount of each payment to be made into a sinking fund which earns 6% compounded quarterly…

A: Solution:- When an equal amount is made each period at end of period, it is called ordinary annuity.…

Q: Steve Fillmore's lifelong dream is to own his own fishing boat to use in his retirement. Steve has…

A: The PV of an investment is used by investors to determine the worth of their holdings today based on…

Q: You want to purchase a new car in 6 years and expect the car to cost $37,000. Your bank offers a…

A: The Future Value of an Ordinary Annuity refers to the concept which gives out the compounded or…

Q: Pacific Packaging's ROE last year was only 2%, but its management has developed a new operating plan…

A: STEP 1 A company's management of the capital that shareholders have put in it is shown by its return…

Q: 1. Expla in the variance sources of financing. 2. What is meant by security financing? 3. What is…

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts…

Q: 5. In which situation will demand for bonds decrease? a) When wealth increases b) When expected…

A: The demand for bonds is the level of interest or willingness of investors to purchase bonds. The…

Q: 8. Mike deposits $100 into a bank account. His account is credited interest at a nominal rate of…

A: STEP 1 The nominal Rate is also known as the interest rate because compounding periods are not taken…

Q: The bonds of Falter Corporation were rated as Aaa and issued at par a few weeks ago. The bonds have…

A: Price of the bond is the PV of its future coupons and par value discounted using the yield to…

Q: Define notes to financial statements including what they indicate.

A: Any report of the financial situation or of the financial results of the operations of a…

Q: Write a brief note on any 4 recent trends in Banking Sector.

A: The banks are acting as depository institutions who are engaging in the services of accepting…

Q: Mrs. surance compa The annuity would pay her Rs 70,000 until she lives. The insurance comp expected…

A: Annuity refers to the contract between the insurance company and the person who insured the payment…

Q: The Maurer Company has a long-term debt ratio of .20 and a current ratio of 1.60. Current…

A: We will use the concept of financial ratios to solve this question. Financial ratios are based on…

Q: Question 1. Understanding market completeness/incompleteness. There are four assets and four states:…

A: (a) The payoff matrix A^(k) is as follows: A^(k) = [10-k 40-4k 0 0] [0 0 2+2k 2+2k] [10 40-4k 0 0]…

Step by step

Solved in 2 steps

- The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1.Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Musics checking account. 1.Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1.Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2.Received 1,000 cash from customers on account. 3.On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3.Paid 250 to creditors on account. 4.Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5.Purchased office equipment on account from Office Mart, 7,500. 8.Paid for a newspaper advertisement, 200. 11.Received 1,000 for serving as a disc jockey for a party. 13.Paid 700 to a local audio electronics store for rental of digital recording equipment. 14.Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16.Received 2,000 for serving as a disc jockey for a wedding reception. 18.Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22.Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23.Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27.Paid electric bill, 915. 28.Paid wages of 1,200 to receptionist and part-time assistant. 29.Paid miscellaneous expenses, 540. 30.Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31.Received 3,000 for serving as a disc jockey for a party. 31.Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31.Withdrew 1,250 cash from PS Music for personal use. PS Musics chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: Instructions 1. Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2019.The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business's operations: July 1. Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Music's checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music: store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 cash from customers on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for SO hours per month for a monthly fee of 3,600. Any additional hours beyond SO will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 to creditors on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 11. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July. 31. Withdrew l,250 cash from PS Music for personal use. PS Music's chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts receivable 1,000 14 Supplies 170 15 Prepaid insurance 17 Office Equipment 21 Accounts payable 250 23 Unearned Revenue 31 Peyton smith, Drawing 4,000 32 Fees Earned 500 41 Wages Expense 6,200 50 Office Rent Expense 400 51 Equipment Rent Expense 800 52 Utilities Expense 675 53 Supplies Expense 300 54 music Expense 1,590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1.Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2.Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3.Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4.Prepare an unadjusted trial balance as of July 31, 2019.On October 1, 2019, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Oct. 1. Jay transferred cash from a personal bank account to an account to be used for the business, 18,000. 4.Paid rent for period of October 4 to end of month, 3,000. 10.Purchased a used truck for 23,750, paying 3,750 cash and giving a note payable for the remainder. 13.Purchased equipment on account, 10,500. 14.Purchased supplies for cash, 2,100. 15.Paid annual premiums on property and casualty insurance, 3,600. 15.Received cash for job completed, 8,950. Enter the following transactions on Page 2 of the two-column journal: 21.Paid creditor a portion of the amount owed for equipment purchased on October 13, 2,000. 24.Recorded jobs completed on account and sent invoices to customers, 14,150. 26.Received an invoice for truck expenses, to be paid in November, 700. 27.Paid utilities expense, 2,240. 27.Paid miscellaneous expenses, 1,100. Oct. 29. Received cash from customers on account, 7,600. 30.Paid wages of employees, 4,800. 31.Withdrew cash for personal use, 3,500. Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2019. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?

- Discuss how each of the following transactions for Watson, International, will affect assets, liabilities, and stockholders equity, and prove the companys accounts will still be in balance. A. An investor invests an additional $25,000 into a company receiving stock in exchange. B. Services are performed for customers for a total of $4,500. Sixty percent was paid in cash, and the remaining customers asked to be billed. C. An electric bill was received for $35. Payment is due in thirty days. D. Part-time workers earned $750 and were paid. E. The electric bill in C is paid.CPK ** Associates is a mid-size legal firm, specializing in closings and real estate law in the south. In 2019, they generated $945,000 in sales revenue. Their expenses related to this year’s revenue are shown: Based on the information provided for the year, what was their net operating income?Ms. Ang put up an accounting firm on Nov. 1, 2021. The registered name of the business is "Ang Accounting Firm." The following were the transactions during the months of November and December, 2021. 1. The owner provided ₱300,000 cash as initial investment to the business on December 1, 2021. 2. Obtained a 12%, one year, bank loan for ₱50,000 on November 1, 2021. Principal and interest are due at maturity date. 3. On December 1, 2021, She purchased office supplies worth ₱60,000 for cash during the period. (the firm uses asset method). 4. The business acquired computer equipment for ₱150,000 cash on November 1, 2021, which has a useful life of 5 years with a residual value of ₱30,000. 5. On December 1, 2021, the business took one year insurance for ₱42,000 covering the months of December, 2021 to February, 2022. The business uses expense method in recording this transaction. 6. As of December 31, 2021, rendered services billed to clients are worth ₱280,000 for cash and ₱200,000 on…

- Dyle Lagomo, Attorney-at-Law, opened his office on September 1, 2019. The following transactions were completed during the month:a. Deposited P210,000 in the bank in the name of the business.b. Bought office equipment on account from Daraga Corp., P147,000.c. Invested his personal law library into the business, P57,000.d. Paid office rent for the month, P7,600.e. Bought office supplies for cash, P8,850.f. Paid the premium for a one-year fire insurance policy on the equipment and the library, P1,860.g. Received professional fees for services rendered, P24,600.h. Received and paid bill for the use of a landline, P2,280.i. Paid salaries of two part-time legal researchers, P9,600.j. Paid car rental expense, P2,880.k. Received professional fees for services rendered, P21,200.l. Paid Daraga Corp. a portion of the amount owed for the acquisition of the office equipment recorded earlier, P15,000.m. Lagomo withdrew cash for personal use, P20,750.Required: Record the transactions for the month…The following business transactions relate to John Clark (financial planner) for his first month of business operations in August 2020. 2020 August1:Commenced business operations with a $300 000 cash injection of personal funds. 2 Paid monthly rent $1500. 4Purchased office stationery $2000 on credit from Stationery Plus. 7Purchased office equipment on credit from Supplies Inc. $10 000. 9Sent invoice to client M Birt for services $3000. 11 Purchased MYOB software for laptop computer $700 cash. 13 M Birt paid amount outstanding. 14 Met with prospective client and negotiated provision of financial advice for client and family, quoting $5000. 17 Paid car parking permit $220. 19 Withdrew cash from business of $2000 for personal use. 22Paid WWW Ltd for monthly internet use $182. 29 Received interest from business bank account $15. Required: A. State the impact on the accounting equation for each transaction above. For example: 1 Aug Increased Cash $300,000…Answer the following question.On 1st March 2020, Mr Alan Richardson began a business specialising in transportation and delivery services called Alan Movers. At the end of his first month of operations, Alan decides to prepare a financial statement to assess his business performance. Following are the events that occurs from 1st to 31st March 2020. March 1 – Alan invested $500,000 cash AND he purchased several used office equipment worth $100,000. Alan was told that the equipment was originally purchased 2 years ago at a value of $120,000. March 2 – Alan Movers paid $15,000 for the rental of his office premises. March 4 – He purchased several business equipment for $12,000 on 30-day credit. March 8 – Alan Movers completed a project from a client and collected $32,000 cash. March 10 – Alan Movers completed another project and sent a bill for $27,000 to his client for payment to be paid within 30 days. March 12 – Purchased another lifting equipment for $8,000 in cash. March 15 – Paid…

- Required: post entries to the relevant accounts in the general ledger and balance the accounts: On 1/1/2023, Jassim started his commercial business with a capital of $3,735,000 distributed over the following assets: 1500,000 cash, 700,000 cars, 350,000 goods, 1,185,000 bank, If you know that the following operations took place during January 2023: 1. On 1/3 he bought a building for $950,000 by check, and the costs of registering it amounted to $5200 and the expenses of preparing it for use amounted to $43000, which I paid in cash. 2. On 9/1 he sold his goods on account to Mahmoud for $280,000. 3. On 1/10, he bought goods from Daoud for $324,000, he paid half of them in cash, and wrote the rest as a promissory note due after two months. He also paid the costs of transporting the purchased goods, amounting to $1,800. 4. On 1/12 he sold his goods to Al-Tafa'il stores for the amount of $198,000 in cash, of which $65,000 was deposited in the bank. 5. On 1/15, he sold the most valuable car…Apex Systems Co. Offers it's services to residents in the Seattle area. Selected accounts from the Ledger of Apex Systems Co. For the fiscal year ended in December 31,2019, are as follows: Bart Nesbit, Capital Dec.31 78,000 Jan. 1 (2019) 1,334,000 Dec.31 347,000 Bart Nesbit , Drawing Mar.31 19,500 Dec.31 78,000 June 30 19,500 Sept. 30 19,500 Dec.31 19,500 Required: Repair a statement of owners equity for the year. No additional investments were made during the year. if a net loss has been incurred or there has been a decrease in owner's equity, enter that amount as a negative number using a minus sign. Be sure to complete the statement heading.Scenario: For the past three years, Carol Dixon operated part-time as shipping agent and in 2022 she decided to move to a rented office and to operate the business on a full-time basis. She registered the business as CD Shipping Agent Ltd but has no accounting personal to prepare her financial information and has approached your group for assistance. The company’s financial year end is December 31 each year. They have provided the following information and transactions for 2022: Jan 1. Balances from 2021 – Cash $280,000; Accounts Receivable $125,000; Supplies $105,000; Furniture and Equipment $440,000; Other Creditors $115,000; and Capital $835,000. Jan 2. The following assets were received from Carol Dixon in exchange for capital in the company: cash - $120,000, accounts receivable - $20,500, supplies - $25,050, and office equipment - $100,000. Feb 1. Paid fifteen (15) months’ rent on a lease rental contract, $375,000. Mar 30. Paid the…