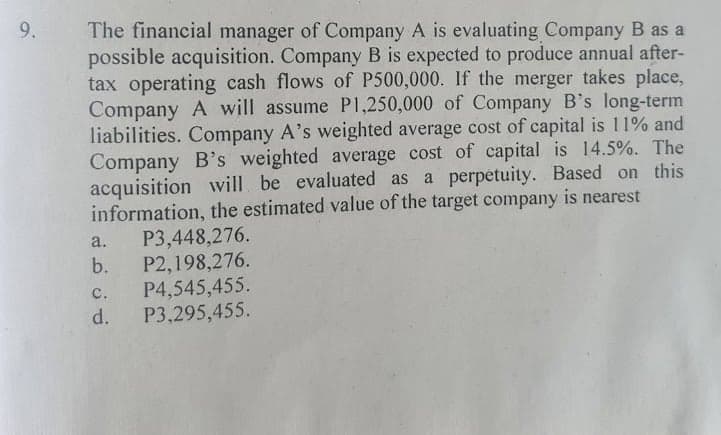

The financial manager of Company A is evaluating Company B as a possible acquisition. Company B is expected to produce annual after- tax operating cash flows of P500,000. If the merger takes place, Company A will assume P1,250,000 of Company B's long-term liabilities. Company A's weighted average cost of capital is 11% and Company B's weighted average cost of capital is 14.5%. The acquisition wvill be evaluated as a perpetuity. Based on this information, the estimated value of the target company is nearest P3,448,276. b. a. P2,198,276. P4,545,455. P3,295,455. с. d.

Q: Stuck on Journal Entries problem: Prepaid expenses of $1500 expired (representing prepaid insurance)…

A: Adjusting Entry – Adjusting Entries are the entries that make the accrual principle work for the…

Q: Cash Budget

A: A budget is a statement containing an estimate of future expenses and income. A budget helps us to…

Q: Write down journal entries.

A:

Q: In terms of economic size, the country, which is a large country, is in the state of food (F) export…

A: Answer:- Import meaning:- A import can be defined as a product or service purchased in one nation…

Q: . The cost incurred were as follows: Cost of trademark, P5,000,000 Expenditure on promoting the new…

A: Intangible assets are those assets which have no physical existence. In simple, these are those…

Q: 10. To remove a director, the required number of votes is: Group of answer choices 25% of members…

A: the director is the person that is appointed by the board of directors of the company. The director…

Q: bond will mature in 5-y

A: Bond refers to the acknowledgment of debt. It is a promise to pay a fixed sum at some future date.…

Q: n January 1, 2020, Christine Company borrowed P30,000,000 at 12% to finance partly the construction…

A: Interest to be capitalised on Decemeber 31, 2020 = 12% x P30000000 =P 3600000 = P3600000

Q: One is not a qualification to be a director: Group of answer choices Resident of Philippines at…

A: qualification to be a director:Should be holding shares in the company.. Not been convicted in the…

Q: At December 31, 2022, before any year-end adjustments, Dallis Company's Prepaid Insurance account…

A: Lets understand the basics. Adjustment entry is required to pass to record revenue and expenses in…

Q: Swifty Corporation’s comparative balance sheets are presented below. SWIFTY CORPORATION Balance…

A: The ratio analysis helps to analyse the financial statements of the business on basis of various…

Q: ig B Stores uses the conventional retail method to value its ending inventory. The following…

A: The cost to retail ratio is calculated as inventory amount on cost divided by inventory amount on…

Q: 3. 3.Each year, 20/20 Vision Clinic sells 10,000 frames for eyeglasses. The clinic orders frames…

A: Optimal Order Quantity: It is the computation that an organizations play out that addresses their…

Q: Rainey Enterprises loaned $50,000 to Small Company on June 1, Year 1, for one year at 7 percent…

A: The journal entries are prepared to record day to day transactions of the business on regular basis.…

Q: Under what conditions will the weighted average and FIFO methods give essentially the same results?

A: Under the FIFO (First in first out) method of inventory valuation, goods which are purchased first…

Q: Multiple Choice

A: $265,600 Explanation: Non-cash expenditures like depreciation and amortization are excluded from…

Q: residence

A: As per the given information Seiji changed his own house to a rental property in 2021,. He paid…

Q: Question 10 In the preparation of the worksheet of a merchandising business, the ending balance of…

A: Income Statement - This statement shows the income earned and loss incurred by the organization in…

Q: used. If the desired after-tax return on investment is 10% per year, which de should be chosen?…

A: The net present value is the difference between the present value of cash flow and initial…

Q: Balance of Cleaning Equipment Rental Expense The trial balance for Ariel Certified Cleaners appears…

A: Trial balance is the summary of all general ledger account balances in the business. Total debits…

Q: You are provided with the following information for Keon Company, You are asked to assist ln the…

A: Budget refers to the financial plan for the defined set of period, usually a year and it also…

Q: Required: Prepare the following 1. Income Statement 2. Statement of Changes in Owner’s Equity 3.…

A: Financial statements are those statements which are prepared at the end of accounting cycle period…

Q: 2.Gross com. operates a product. Output from the process for a month was as follows: Units of output…

A: Lets understand the basics. In Physical measurement of allocating joint cost method, cost are…

Q: Define and explain the cost management information system's two major subsystems.

A: The Cost Accounting Information System (CAIS) is a financial accounting system that computes and…

Q: Accrued interest on the mortgage payable is P10,000. Credit: The a beance tor A Cerfed Ceaners…

A: Assets are recorded in the balance sheet and have debit balance and liabilities have credit balance.…

Q: Estimated depreciation on the building for the year is P128,000. Credit: The tral balance for Are…

A: The adjustment entries are prepared at year end to adjust the revenue and expenses of the current…

Q: define cash flow activities used in Business

A: A cash flow statement is a basic financial statement that shows a company's cash inflows or cash…

Q: 4. Which of the following statements about promissory notes is incorrect? a. Interest is the revenue…

A: A promissory note is a financial instrument that contains a written promise by one party to pay…

Q: list price of ₱90,000, subj

A: Given as, Merchandise Inventory list price = P 90,000 Trade discounts = 20% Another discounts = 10%

Q: A trader purchases goods for Rs. 2500000, of these 70% of goods were seld during the year. As the…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: One of the companies decided to check the debtors' balance of 264,000 dinars as it appears in the…

A: Debtors are the customer accounts to whom business has made credit sales on account and due amount…

Q: You are provided with the following information for Keon Company, You are asked to assist in tne…

A: Direct material purchase budget is prepared to determine the amount of direct material to be…

Q: 1. Eberley Corporation's cost formula for its manufacturing overhead is $25,700 per month plus $10…

A: Spending variance for manufacturing overhead = Total standard manufacturing overhead - Total Actual…

Q: 3.16 A company had income of P40,000 using variable costing for a given period. Beginning and ending…

A: Absorption costing is also called full costing method, considers all costs associated with…

Q: What is modified breakeven analysis?

A: Break even analysis refers to the financial computation that weights the new business cost, product…

Q: Company Name Lowe's Company Part 1 1. Read the business summaries and management’s discussion and…

A: Here given the multi sub part question we will solve for first three sub part question for you. If…

Q: Balance of Cleaning Supplies Expense The trial balance for Ariel Certified Cleaners appears as…

A: Trial balance is the summary of all general ledger account balances in the business. Total debits…

Q: Budgeted Income Statement Coral Seas Jewelry Company makes and sells costume jewelry. For the…

A: Budgeted income statement budgeted revenues and budgeted expenses of the business and at the end it…

Q: An inventory of cleaning supplies showed P12,440 on hand. Asset Method - Amount: The trial balance…

A: The revenue and expenses are recorded on the basis of amount recognised or not for the period.

Q: Lakeesha Barnett owns and operates a package mailing store in a college town. Her store, Send It…

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: Permits limited lobbying activities Exempt organization under 1. University of Virginia § 501(c)(3)…

A: Answer:- Exempt organization meaning:- A private foundation, NGOs, or other similar organization…

Q: Balance of Deprec

A: A decrease in the value of an asset over a period of time / over a useful life is known as…

Q: Ms. Ann Chavez, the owner of the business, transferred cash from personal bank account to the…

A: Debit Credit Cash 902,750.00 -…

Q: From a corporation’s point of view, how does preferred stock differ from common stock?

A: Ownership of an organization can be broken down into small parts or units also known as Shares.…

Q: Anthoney Inc's trial balance contains the following balances: Accounts Payable $344 Expenses $205…

A: Introduction: Trial Balance: All final ledger account balances are posted in trial balance to check…

Q: 1. At the end of a period, the inventory account is _______

A: Disclaimer: “Since you have asked multiple questions, we will solve the first question for you. If…

Q: Yuki (age 45 at year-end) has been contributing to a traditional IRA for years (all deductible…

A: A personal retirement account (IRA) is a tax-advantageous savings account that an individual can…

Q: The payback period at i= 0% is determined to be years. The payback period at i= 12% is determined to…

A: Payback Period The payback period is the amount of time it would take for an investor to recover a…

Q: The Western Company presents the production and cost data for the first six months of the 2015.…

A: Mixed costs is the combination of variable and fixed costs. High-low method is used to bifurcate the…

Q: Steiner's required rate of return on similar projects is 20 percent. How much more/(less) would…

A: Steiner company recently established a subsidiary in Belarus. A rival has offered Steiner to…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Hasting Corporation estimates that if it acquires Vandell Corporation, synergies will cause Vandell’s free cash flows to be $2.5 million, $2.9 million, $3.4 million, and $3.57 million at Years 1 through 4, respectively, after which the free cash flows will grow at a constant 5% rate. Hasting plans to assume Vandell’s $10.19 million in debt (which has an 8% interest rate) and raise additional debt financing at the time of the acquisition. Hastings estimates that interest payments will be $1.5 million eachyear for Years 1, 2, and 3. After Year 3, a target capital structure of 30% debt will be maintained. Interest at Year 4 will be $1.472 million, after which the interest and the tax shield will grow at 5%. As described in Problem 22-4, Vandell currently has 1.5 million shares outstanding and a target capital structure consisting of 30% debt; its current beta is 1.4 (i.e., based on its target capital structure). Vandell and Hastings each have a 25% combined federal-plus-state tax rate.…Almony Ltd has announced a cash offer to acquire Bricker Co. Almony Ltd’s shares are trading at $27 and there are 3 million shares of outstanding. Bricker Co’s shares are trading at $4 and there are 1.5 million shares outstanding. Almony Ltd estimates that the acquisition will incur integration costs of $400,000 each year for the first three years. Almony Ltd expects to be able to reduce overlapping capital expenditures by $750,000 in the first five years of the acquisition. The required rate of return for Almony Ltd is 8%. Assume cash flows occur at the end of each year. Based on this information , what is the maximum price Almony Ltd can offer before destroying shareholder value? * with detailed calculation.Spentworth Industries Corp. is considering an acquisition of Keedsler Motors Co., and estimates that acquiring Keedsler will result in incremental after-tax net cash flows in years 1–3 of $9 million, $13.5 million, and $16.2 million, respectively. After the first three years, the incremental cash flows contributed by the Keedsler acquisition are expected to grow at a constant rate of 3% per year. Spentworth’s current beta is 1.60, but its post-merger beta is expected to be 2.08. The risk-free rate is 4.5%, and the market risk premium is 6.60%. Based on this information, complete the following table by selecting the appropriate values. (Note: Round your intermediate calculations to two decimal places.) Value Post-merger cost of equity Projected value of the cash flows at the end of three years The value of Keedsler Motors Co.’s contribution to Spentworth Industries Corp.

- Orilla Ltd is considering expansion by acquiring Norioll Ltd. The market value of the equity in Oriolla is $ 126 million and Norioll is $ 21 million. The takeover is expected to increase in after-tax operating cash flows of $ 3 million in perpetuity. Orilla is considering a cash offer of $ 29.4 million to Norioll shareholders for all their shares OR issue new shares of Orilla to Norioll so that they will own 20 % of the combined entity after the merger. The cost of capital for both companies is 12 % a)What is the gain in present value terms for the merger? b) What are the cost of the cash offer and share offer to Oriolla? c) What is the NPV of the acquisitions from Oriolla's perspective of the cash offer and the share offer?Velcro Saddles is contemplating the acquisition of Skiers’ Airbags Inc. The values of the two companies as separate entities are $42 million and $21 million, respectively. Velcro Saddles estimates that by combining the two companies, it will reduce marketing and administrative costs by $610,000 per year in perpetuity. Velcro Saddles considers offering Skiers’ shareholders a 50% holding in Velcro Saddles. The opportunity cost of capital is 10%. a. What is the value of the stock in the merged company held by the original Skiers’ shareholders? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) b. What is the cost of the stock alternative? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) c. What is the merger’s NPV under the stock offer? (A negative amount should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer in millions…TransWorld Communications Inc., a large telecommunications company,is evaluating the possible acquisition of Georgia Cable Company (GCC), a regionalcable company. TransWorld’s analysts project the following post-merger data for GCC (inthousands of dollars): If the acquisition is made, it will occur on January 1, 2018. All cash flows shown in the incomestatements are assumed to occur at the end of the year. GCC currently has a capital structureof 40% debt, but Trans World would increase that to 50% if the acquisition were made. GCC,if independent, would pay taxes at 20%, but its income would be taxed at 35% if it wereconsolidated. GCC’s current market-determined beta is 1.40, and its investment bankersthink that its beta would rise to 1.50 if the debt ratio were increased to 50%. The cost of goodssold is expected to be 65% of sales, but it could vary somewhat. Depreciation-generatedfunds would be used to replace worn-out equipment, so they would not be available toTransWorld’s…

- DoPharm is evaluating a takeover of Phaneuf Accelerator Inc. by using the FCF and FCFE valuation approaches. DoPharm has collected the following information for the current year:• Phaneuf has sales of $1,000 million with 40% operating margin, depreciation of $90 million, capital expenditures of $170 million, and an increase in working capital of $40 million.• Interest expenses are $50 million. The current market value of Phaneuf’s outstanding debt is $1,500 million. The company has retired the existing bonds for $10 million.• FCF and FCFE are expected to grow at 10% for the next five years and 6% after that.• The tax rate is 30%.• Phaneuf financed with 40% debt and 60% equity. Its before-tax cost of debt is 9%, and its cost of equity is 13%. The number of shares outstanding is 100 million. Question: Estimate the current year’s free cash flow of Phaneuf in millions.Velcro Saddles is contemplating the acquisition of Skiers Airbags Incorporated. The values of the two companies as separate entities are $46 million and $23 million, respectively. Velcro Saddles estimates that by combining the two companies, it will reduce marketing and administrative costs by $630,000 per year in perpetuity, Velcro Saddles is willing to pay $28 million cash for Skiers'. The opportunity cost of capital is 7%. What is the gain from the merger? Note: Enter your answer in millions rounded to 2 decimal places. What is the cost of the cash offer? Note: Enter your answer in millions. What is the NPV of the acquisition under the cash offer? Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.TransWorld Communications Inc., a large telecommunications company, is evaluating the possible acquisition of Georgia Cable Company (GCC), a regional cable company. TransWorld's analysts project the post-merger data for GCC (in thousands of dollars) gathered in the Excel Online file below. If the acquisition is made, it will occur on January 1, 2018. All cash flows shown in the income statements are assumed to occur at the end of the year. GCC currently has a capital structure of 40% debt, but Trans World would increase that to 50% if the acquisition were made. GCC, if independent, would pay taxes at 20%; but its income would be taxed at 30% if it were consolidated. GCC's current market-determined beta is 1.35, and its investment bankers think that its beta will rise to 1.50 if the debt ratio were increased to 50%. The cost of goods sold is expected to be 65% of sales, but it could vary somewhat. Depreciation-generated funds would be used to replace worn-out equipment, so they would…

- Company A is preparing a deal to acquire company B. One analyst estimated that the merger would produce 85 million dollars of annual cost savings, from operations, general and administrative expenses and marketing. These annual cost savings are expected to begin two years from now, and grow at 2.5% a year. In addition the analyst is assuming an after-tax integration cost of 0.1 billion, and taxes of 20%. Assume that the integration cost of 0.1 billion happens one year after the merger is completed (year 1). The analyst is using a cost of capital of 10% to value the synergies. Company B’s equity is trading at 2.3 B dollars (market value of equity). Company A is planning to pay a 32% premium for company B. a) Compute the value of the synergy as estimated by the analyst. b) does the estimate of synergies justify the premium? Could you show me how to work this out in an excel sheet?RTE Telecom Inc., which is considering the acquisition of Lucky Coro, estimates that acquiring Lucky will result in an incremental value for the firm. The analysts involved in the deal have collected the following information from the projected financial statements of the target company: Data Collected (in millions of dollars) Year 1 Year 2 Year 3 EBIT $120 $14.4 $18.0 Interest expense 505560 Debt 29.7 35.1 37.8 Total net operating capital 109.2 111.3 1134) Lucky Corp is a pubicly traded company, and its market- determined pre-merger beta is 1.20 You also have the following information about the company and the projected statements: Lucky currently has a $12.00 million market value of equity and S 7:80 million in debt. The risk-free rate is 3.5%, there is a 5.60% market risk premium, and the Capital Asset Pricing Model produces a pre merger required rate of return on equity rs of 10.22% Lucky's cost of debt is 5.50% al a laxtale of 35% The projections assume that the company will have…EFG Holdings Corporation will be acquiring 100% ownership of HIJ Corporation. The latter currently has an equity value of P3,600,000, a Jrequired rate of return of 16%, excess earnings of 2%, and a remaining business life of 5 years. If EFG Holding Corporation acquires HIJ, this life will be extended by 15 years but its operating risk will also increase. The required rate of return on HIJ would become 20%. If the agreed price is P4,000,000, how much would the value of control over HIJ which EFG Corporation would still avoid be?