The first cash flow at t = 1 is $100. Every year thereafter, the payment increases by 3% over g. the previous year's payment. This continues on forever. What is the present value of this growing perpetuity if the effective annual discount rate is .1 (10 %)? h. The first cash flow at t = 1 is $100. Every year thereafter, the payment increases by 3% over the previous year's payment. This continues on forever. What is the present value of this growing perpetuity if the effective annual discount rate is .05 (5%)? i. The first cash flow at t = 1 is $100. Every year thereafter, the payment increases by 3% over the previous year's payment. This continues on forever. What is the present value of this growing perpetuity if the effective annual discount rate is .035 (3.5%)?

The first cash flow at t = 1 is $100. Every year thereafter, the payment increases by 3% over g. the previous year's payment. This continues on forever. What is the present value of this growing perpetuity if the effective annual discount rate is .1 (10 %)? h. The first cash flow at t = 1 is $100. Every year thereafter, the payment increases by 3% over the previous year's payment. This continues on forever. What is the present value of this growing perpetuity if the effective annual discount rate is .05 (5%)? i. The first cash flow at t = 1 is $100. Every year thereafter, the payment increases by 3% over the previous year's payment. This continues on forever. What is the present value of this growing perpetuity if the effective annual discount rate is .035 (3.5%)?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA3: Time Value Of Money

Section: Chapter Questions

Problem 17E

Related questions

Question

need parts g, h, i, j, and k

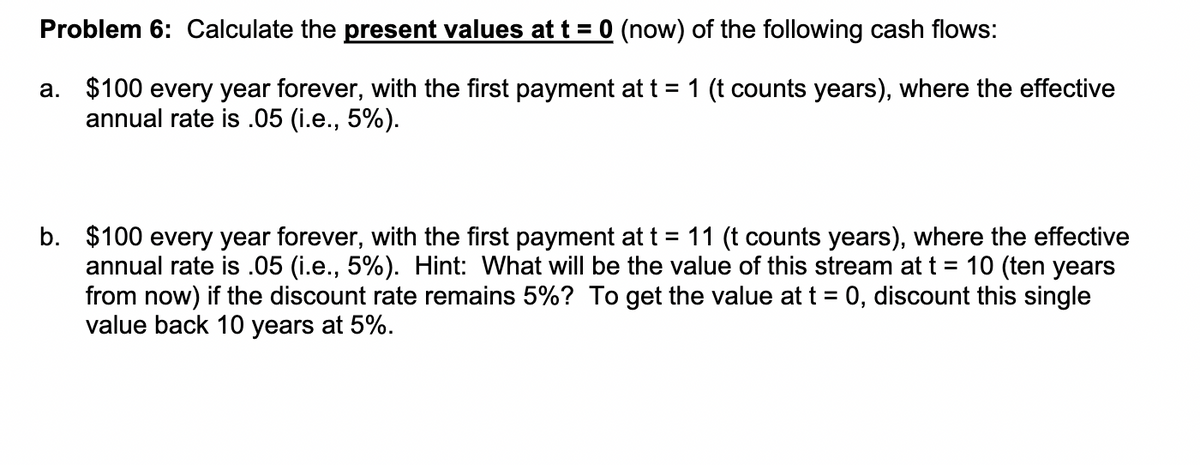

Transcribed Image Text:Problem 6: Calculate the present values at t = 0 (now) of the following cash flows:

a. $100 every year forever, with the first payment at t = 1 (t counts years), where the effective

annual rate is .05 (i.e., 5%).

b. $100 every year forever, with the first payment at t = 11 (t counts years), where the effective

annual rate is .05 (i.e., 5%). Hint: What will be the value of this stream at t = 10 (ten years

from now) if the discount rate remains 5%? To get the value at t = 0, discount this single

value back 10 years at 5%.

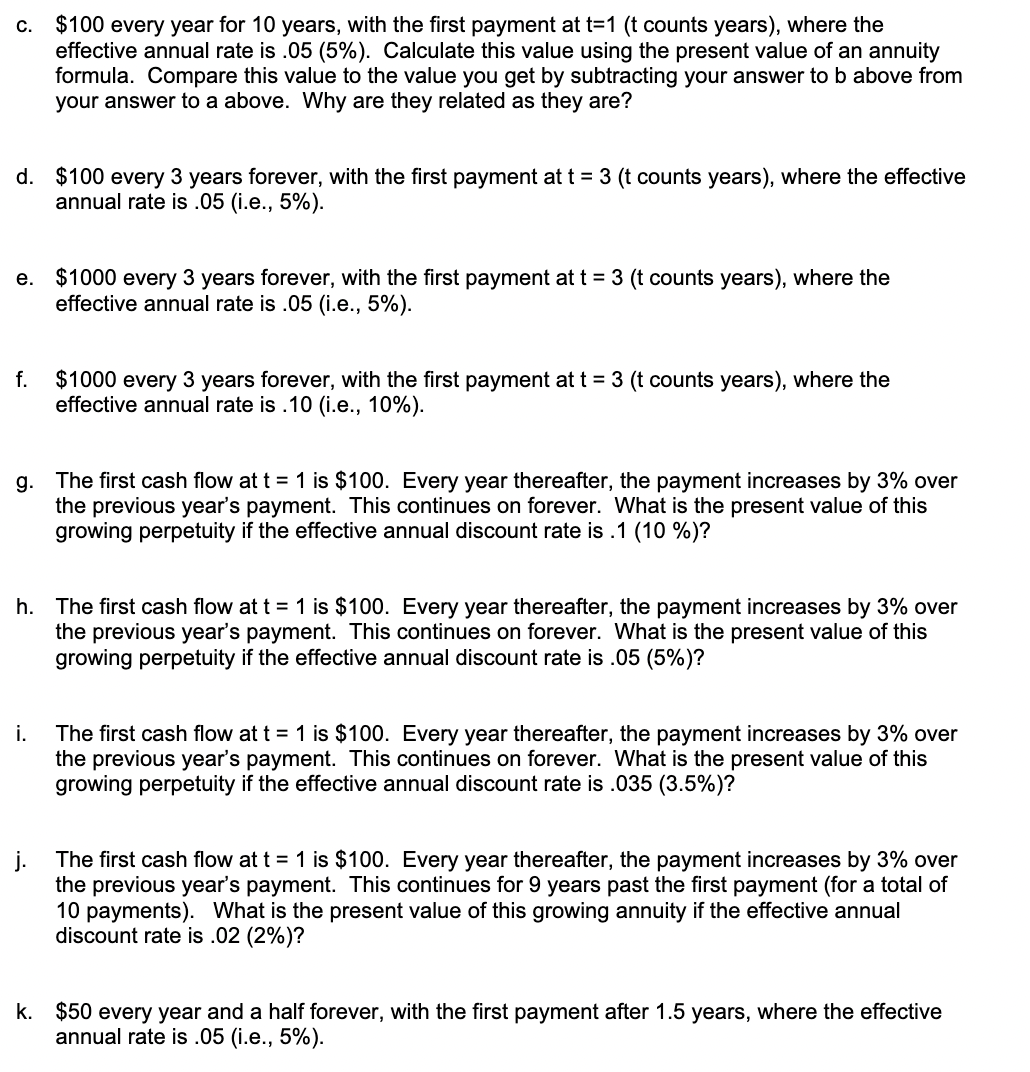

Transcribed Image Text:c. $100 every year for 10 years, with the first payment at t=1 (t counts years), where the

effective annual rate is .05 (5%). Calculate this value using the present value of an annuity

formula. Compare this value to the value you get by subtracting your answer to b above from

your answer to a above. Why are they related as they are?

d. $100 every 3 years forever, with the first payment at t = 3 (t counts years), where the effective

annual rate is .05 (i.e., 5%).

e. $1000 every 3 years forever, with the first payment at t = 3 (t counts years), where the

effective annual rate is .05 (i.e., 5%).

$1000 every 3 years forever, with the first payment at t = 3 (t counts years), where the

effective annual rate is .10 (i.e., 10%).

f.

g. The first cash flow at t = 1 is $100. Every year thereafter, the payment increases by 3% over

the previous year's payment. This continues on forever. What is the present value of this

growing perpetuity if the effective annual discount rate is .1 (10 %)?

h. The first cash flow at t = 1 is $100. Every year thereafter, the payment increases by 3% over

the previous year's payment. This continues on forever. What is the present value of this

growing perpetuity if the effective annual discount rate is .05 (5%)?

i.

The first cash flow at t = 1 is $100. Every year thereafter, the payment increases by 3% over

the previous year's payment. This continues on forever. What is the present value of this

growing perpetuity if the effective annual discount rate is .035 (3.5%)?

The first cash flow at t = 1 is $100. Every year thereafter, the payment increases by 3% over

the previous year's payment. This continues for 9 years past the first payment (for a total of

10 payments). What is the present value of this growing annuity if the effective annual

discount rate is .02 (2%)?

k. $50 every year and a half forever, with the first payment after 1.5 years, where the effective

annual rate is .05 (i.e., 5%).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College