The first page includes a sample income statement and balance sheet for the years 2021 and 2022. The second page provides the ratios of the year 2023. A)Use the given the information provided in the first page to calculate it with ratios in order to creat the following for the year 2023: 1- income statement 2- balance sheet 3- cash flow statement B) Based on your initial projections, how much external financing (long-term debt and/or stockholders' equity) will a firm need to fund its growth at projected increases in sales?

The first page includes a sample income statement and balance sheet for the years 2021 and 2022. The second page provides the ratios of the year 2023. A)Use the given the information provided in the first page to calculate it with ratios in order to creat the following for the year 2023: 1- income statement 2- balance sheet 3- cash flow statement B) Based on your initial projections, how much external financing (long-term debt and/or stockholders' equity) will a firm need to fund its growth at projected increases in sales?

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 24P: Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of...

Related questions

Concept explainers

Financial Ratios

A Ratio refers to a figure calculated as a reference to the relationship of two or more numbers and can be expressed as a fraction, proportion, percentage, or the number of times. When the number is determined by taking two accounting numbers derived from the financial statements, it is termed as the accounting ratio.

Return on Equity

The Return on Equity (RoE) is a measure of the profitability of a business concerning the funds by its stockholders/shareholders. ROE is a metric used generally to determine how well the company utilizes its funds provided by the equity shareholders.

Topic Video

Question

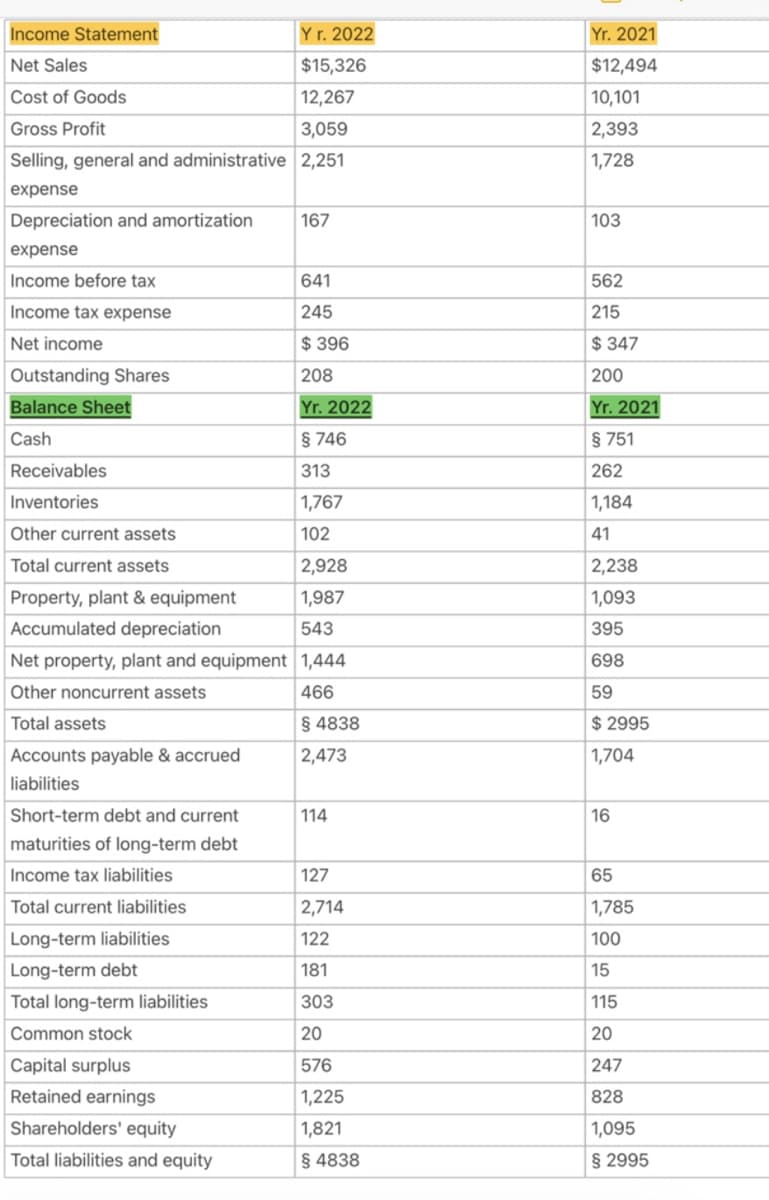

The first page includes a sample income statement and balance sheet for the years 2021 and 2022.

The second page provides the ratios of the year 2023.

A)Use the given the information provided in the first page to calculate it with ratios in order to creat the following for the year 2023:

1- income statement

2- balance sheet

3- cash flow statement

B) Based on your initial projections, how much external financing (long-term debt and/or stockholders' equity ) will a firm need to fund its growth at projected increases in sales?

Transcribed Image Text:Income Statement

Y r. 2022

Net Sales

$15,326

Cost of Goods

12,267

Gross Profit

3,059

Selling, general and administrative 2,251

expense

Depreciation and amortization

expense

Income before tax

Income tax expense

Net income

Outstanding Shares

Balance Sheet

Cash

Receivables

Inventories

Accounts payable & accrued

liabilities

Other current assets

Total current assets

2,928

Property, plant & equipment

1,987

Accumulated depreciation

543

Net property, plant and equipment 1,444

Other noncurrent assets

466

Total assets

§ 4838

2,473

Short-term debt and current

maturities of long-term debt

Income tax liabilities

Total current liabilities

Long-term liabilities

Long-term debt

Total long-term liabilities

Common stock

Capital surplus

Retained earnings

167

Shareholders' equity

Total liabilities and equity

641

245

$396

208

Yr. 2022

§ 746

313

1,767

102

114

127

2,714

122

181

303

20

576

1,225

1,821

§ 4838

Yr. 2021

$12,494

10,101

2,393

1,728

103

562

215

$347

200

Yr. 2021

§ 751

262

1,184

41

2,238

1,093

395

698

59

$2995

1,704

16

65

1,785

100

15

115

20

247

828

1,095

§ 2995

Transcribed Image Text:9:42

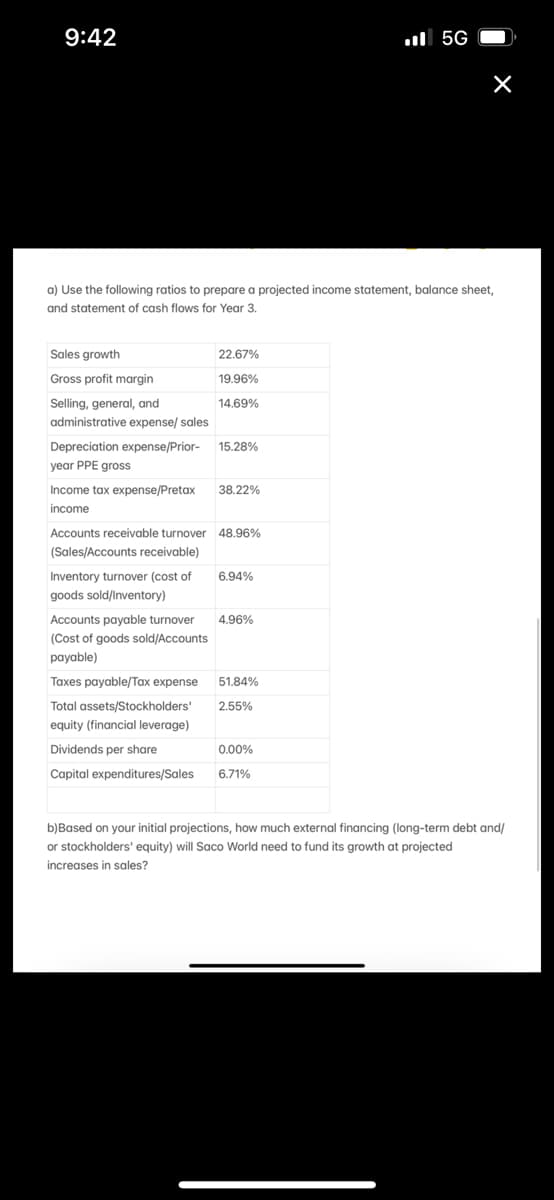

a) Use the following ratios to prepare a projected income statement, balance sheet,

and statement of cash flows for Year 3.

Sales growth

Gross profit margin

Selling, general, and

administrative expense/ sales

Depreciation expense/Prior-

year PPE gross

Income tax expense/Pretax

income

22.67%

19.96%

14.69%

Inventory turnover (cost of

goods sold/Inventory)

15.28%

38.22%

Accounts receivable turnover 48.96%

(Sales/Accounts receivable)

6.94%

Accounts payable turnover

(Cost of goods sold/Accounts

payable)

Taxes payable/Tax expense

51.84%

Total assets/Stockholders' 2.55%

equity (financial leverage)

Dividends per share

Capital expenditures/Sales

4.96%

5G

0.00%

6.71%

b) Based on your initial projections, how much external financing (long-term debt and/

or stockholders' equity) will Saco World need to fund its growth at projected

increases in sales?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning