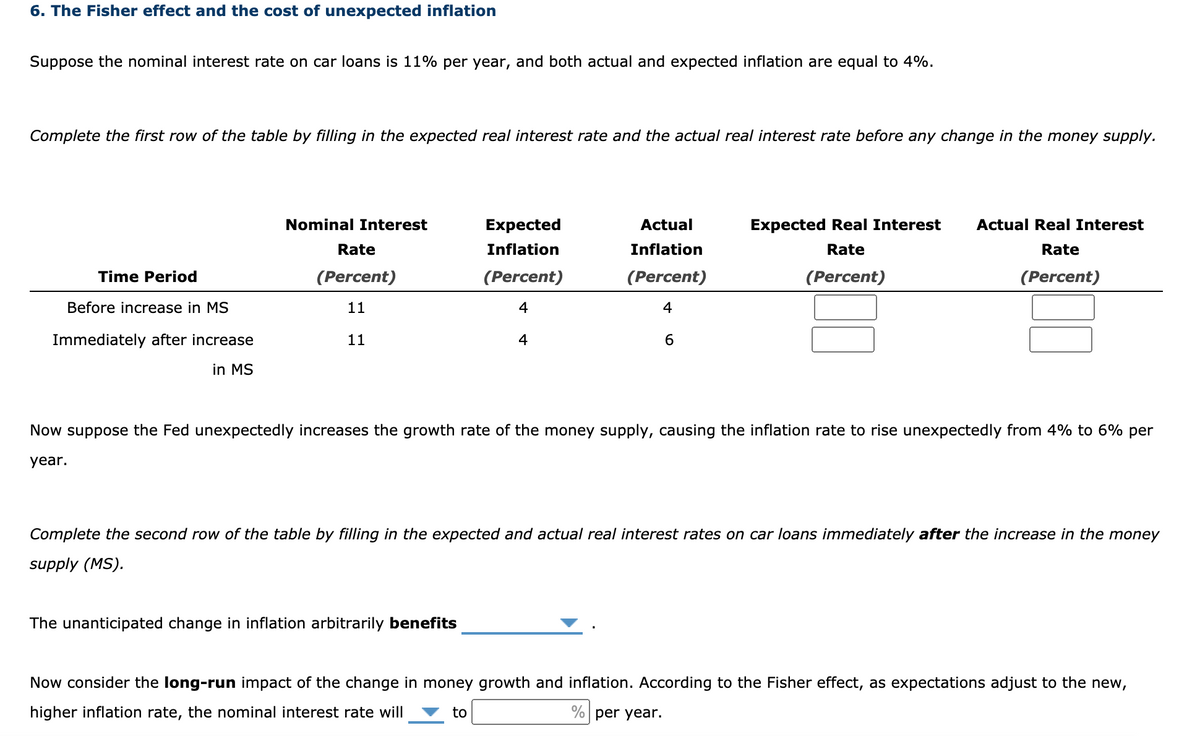

The Fisher effect and the cost of unexpected inflation Suppose the nominal interest rate on car loans is 11% per year, and both actual and expected inflation are equal to 4%. Complete the first row of the table by filling in the expected real interest rate and the actual real interest rate before any change in the money supply. Time Period Nominal Interest Rate Expected Inflation Actual Inflation Expected Real Interest Rate Actual Real Interest Rate (Percent) (Percent) (Percent) (Percent) (Percent) Before increase in MS 11 4 4 Immediately after increase in MS 11 4 6 Now suppose the Fed unexpectedly increases the growth rate of the money supply, causing the inflation rate to rise unexpectedly from 4% to 6% per year. Complete the second row of the table by filling in the expected and actual real interest rates on car loans immediately after the increase in the money supply (MS). The unanticipated change in inflation arbitrarily benefits __borrowers/lenders__. Now consider the long-run impact of the change in money growth and inflation. According to the Fisher effect, as expectations adjust to the new, higher inflation rate, the nominal interest rate will _rise/fall_ to__%___per year.

6. The Fisher effect and the cost of unexpected inflation

Suppose the nominal interest rate on car loans is 11% per year, and both actual and expected inflation are equal to 4%.

Complete the first row of the table by filling in the expected real interest rate and the actual real interest rate before any change in the money supply.

|

Time Period |

Nominal Interest Rate |

Expected Inflation |

Actual Inflation |

Expected Real Interest Rate |

Actual Real Interest Rate |

|

|

(Percent) |

(Percent) |

(Percent) |

(Percent) |

(Percent) |

|

Before increase in MS |

11 |

4 |

4 |

|

|

|

Immediately after increase in MS |

11 |

4 |

6 |

|

|

Now suppose the Fed unexpectedly increases the growth rate of the money supply, causing the inflation rate to rise unexpectedly from 4% to 6% per year.

Complete the second row of the table by filling in the expected and actual real interest rates on car loans immediately after the increase in the money supply (MS).

The unanticipated change in inflation arbitrarily benefits __borrowers/lenders__.

Now consider the long-run impact of the change in money growth and inflation. According to the Fisher effect, as expectations adjust to the new, higher inflation rate, the nominal interest rate will _rise/fall_ to__%___per year.

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 1 images