The following accounts are extracted from the worksheet of X Company on December 31, 2020: Income from Operations $302,000 Interest Revenue 72,000 Operating Expenses 248,000 Loss from sale of land 45,000 • During the year, the company suffered from abnormal and infrequent hurricane damages that had resulted in a S8s0,000 pretax tax loss • During the year also, the company stopped the activities of its BB segment which had resulted in a net of tax operating loss of $30,000 and a pretax loss on disposal $26,000 • Tax Rate was 30% Based on the data above, gross profit was: $350,000 O $54,000 $550,000

The following accounts are extracted from the worksheet of X Company on December 31, 2020: Income from Operations $302,000 Interest Revenue 72,000 Operating Expenses 248,000 Loss from sale of land 45,000 • During the year, the company suffered from abnormal and infrequent hurricane damages that had resulted in a S8s0,000 pretax tax loss • During the year also, the company stopped the activities of its BB segment which had resulted in a net of tax operating loss of $30,000 and a pretax loss on disposal $26,000 • Tax Rate was 30% Based on the data above, gross profit was: $350,000 O $54,000 $550,000

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter14: Financial Statement Analysis

Section: Chapter Questions

Problem 14.2BE: Vertical analysis Income statement information for Einsworth Corporation follows: Sales 1,200,000...

Related questions

Question

Transcribed Image Text:2:24 O E

令.ll 30%!

docs.google.com/forms/d/e/1|

8

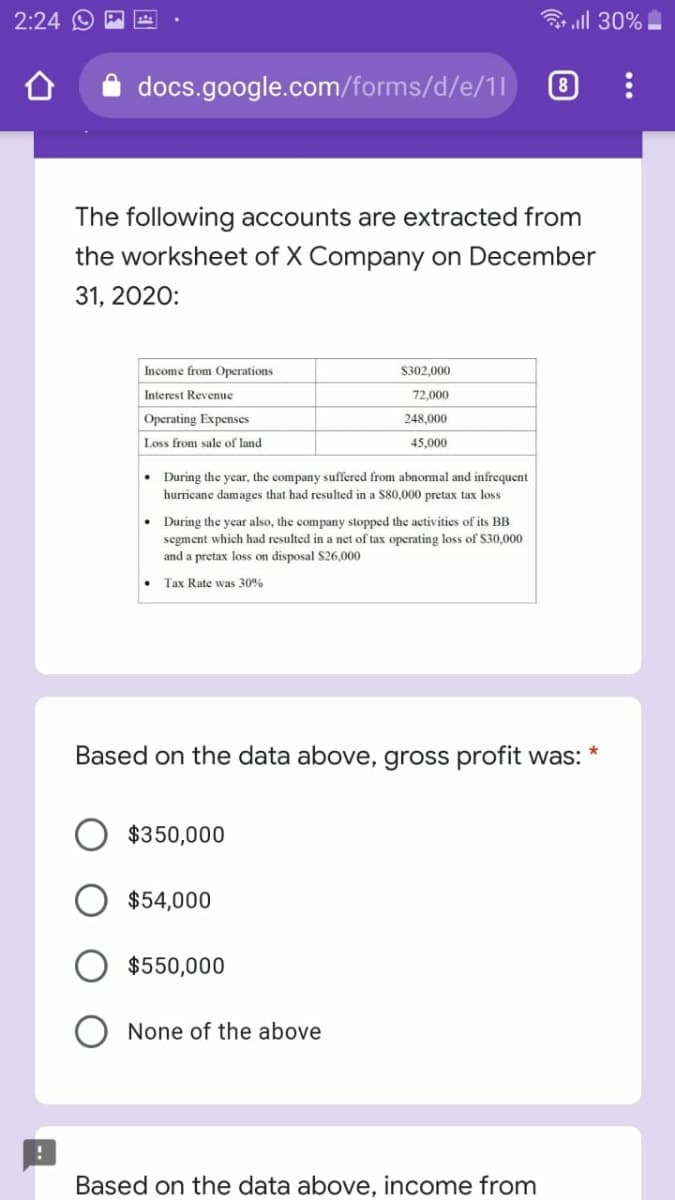

The following accounts are extracted from

the worksheet of X Company on December

31, 2020:

Income from Operations

S302,000

Interest Revenue

72,000

Operating Expenses

248,000

Loss from sale of land

45,000

• During the year, the company suffered from abnomal and infrequent

hurricane damages that had resulted in a S80,000 pretax tax loss

• During the year also, the company stopped the activities of its BB

segment which had resulted in a net of tax operating loss of S30,000

and a pretax loss on disposal $26,000

Tax Rate was 30%

Based on the data above, gross profit was:

$350,000

$54,000

$550,000

None of the above

Based on the data above, income from

Transcribed Image Text:2:24

令l 30%

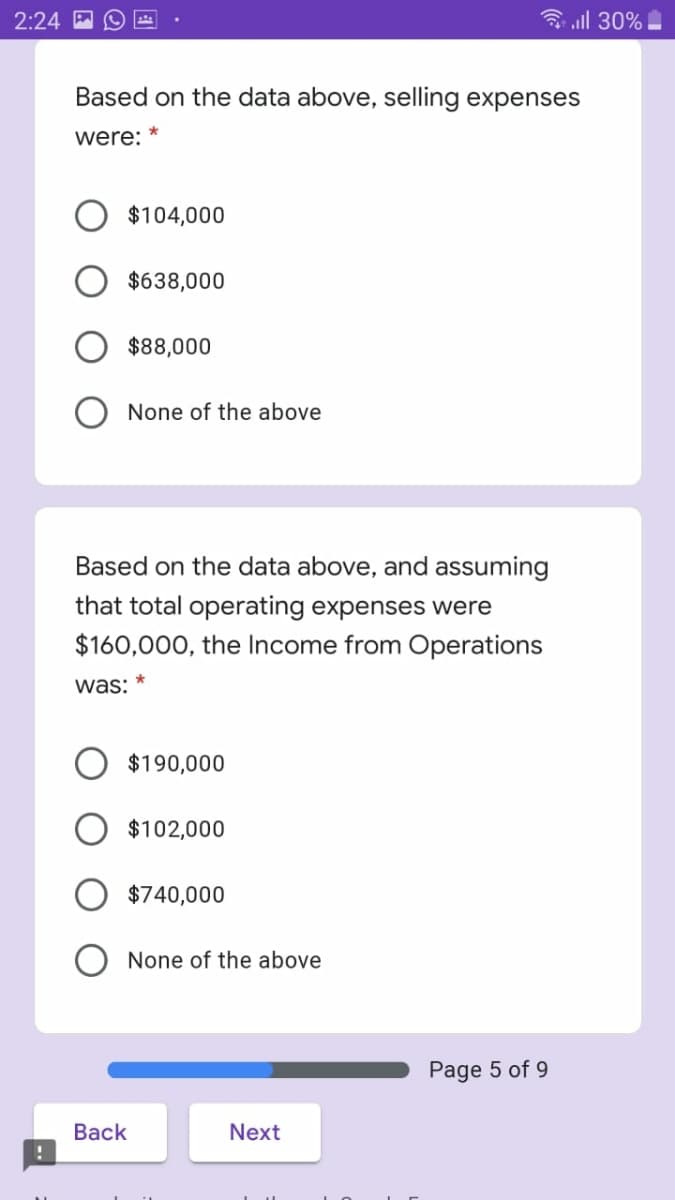

Based on the data above, selling expenses

were:

$104,000

$638,000

$88,000

None of the above

Based on the data above, and assuming

that total operating expenses were

$160,000, the Income from Operations

was:

$190,000

$102,000

$740,000

O None of the above

Page 5 of 9

Вack

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning