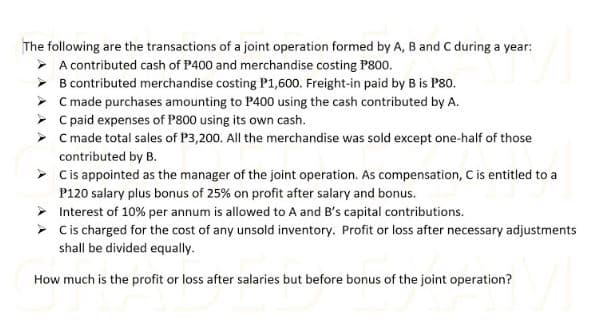

The following are the transactions of a joint operation formed by A, B and C during a year: > A contributed cash of P400 and merchandise costing P800. > B contributed merchandise costing P1,600. Freight-in paid by B is P80. > C made purchases amounting to P400 using the cash contributed by A. > C paid expenses of P800 using its own cash. > C made total sales of P3,200. All the merchandise was sold except one-half of those contributed by B. - Cis appointed as the manager of the joint operation. As compensation, C is entitled to a P120 salary plus bonus of 25% on profit after salary and bonus. > Interest of 10% per annum is allowed to A and B's capital contributions. - Cis charged for the cost of any unsold inventory. Profit or loss after necessary adjustments shall be divided equally. How much is the profit or loss after salaries but before bonus of the joint operation?

The following are the transactions of a joint operation formed by A, B and C during a year: > A contributed cash of P400 and merchandise costing P800. > B contributed merchandise costing P1,600. Freight-in paid by B is P80. > C made purchases amounting to P400 using the cash contributed by A. > C paid expenses of P800 using its own cash. > C made total sales of P3,200. All the merchandise was sold except one-half of those contributed by B. - Cis appointed as the manager of the joint operation. As compensation, C is entitled to a P120 salary plus bonus of 25% on profit after salary and bonus. > Interest of 10% per annum is allowed to A and B's capital contributions. - Cis charged for the cost of any unsold inventory. Profit or loss after necessary adjustments shall be divided equally. How much is the profit or loss after salaries but before bonus of the joint operation?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter6: Losses And Loss Limitations

Section: Chapter Questions

Problem 21P

Related questions

Question

Transcribed Image Text:The following are the transactions of a joint operation formed by A, B and C during a year:

> A contributed cash of P400 and merchandise costing P800.

> B contributed merchandise costing P1,600. Freight-in paid by B is P80.

> C made purchases amounting to P400 using the cash contributed by A.

> C paid expenses of P800 using its own cash.

> C made total sales of P3,200. All the merchandise was sold except one-half of those

contributed by B.

> Cis appointed as the manager of the joint operation. As compensation, C is entitled to a

P120 salary plus bonus of 25% on profit after salary and bonus.

> Interest of 10% per annum is allowed to A and B's capital contributions.

> Cis charged for the cost of any unsold inventory. Profit or loss after necessary adjustments

shall be divided equally.

How much is the profit or loss after salaries but before bonus of the joint operation?

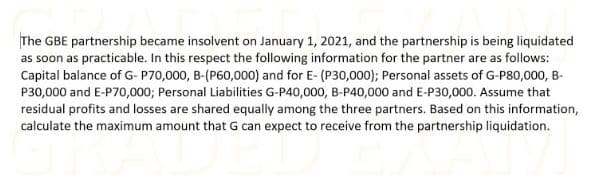

Transcribed Image Text:The GBE partnership became insolvent on January 1, 2021, and the partnership is being liquidated

as soon as practicable. In this respect the following information for the partner are as follows:

Capital balance of G- P70,000, B-(P60,000) and for E- (P30,000); Personal assets of G-P80,000, B-

P30,000 and E-P70,000; Personal Liabilities G-P40,000, B-P40,000 and E-P30,000. Assume that

residual profits and losses are shared equally among the three partners. Based on this information,

calculate the maximum amount that G can expect to receive from the partnership liquidation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT