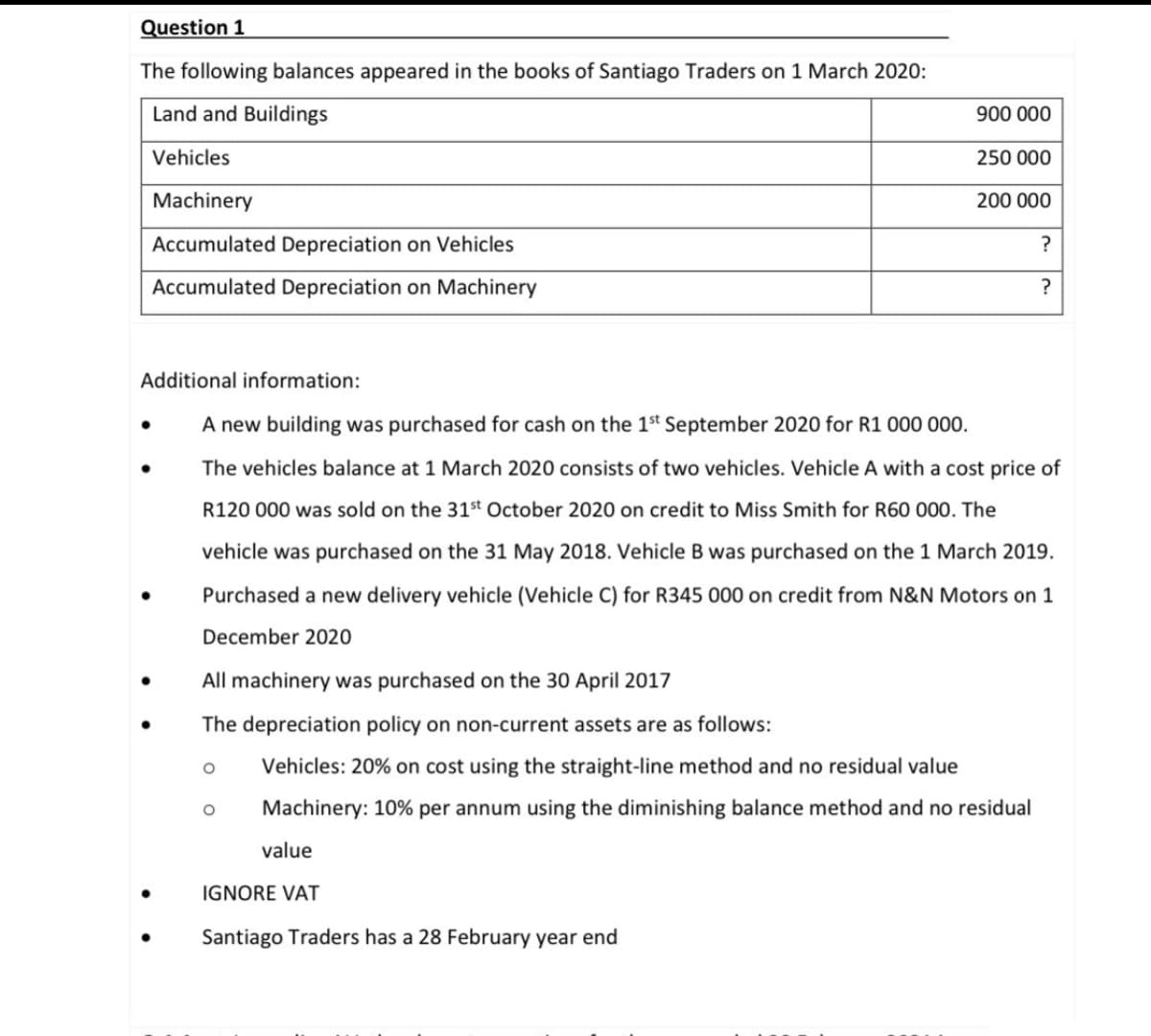

The following balances appeared in the books of Santiago Traders on 1 March 2020: Land and Buildings 900 000 Vehicles 250 000 Machinery 200 000 Accumulated Depreciation on Vehicles Accumulated Depreciation on Machinery ?

The following balances appeared in the books of Santiago Traders on 1 March 2020: Land and Buildings 900 000 Vehicles 250 000 Machinery 200 000 Accumulated Depreciation on Vehicles Accumulated Depreciation on Machinery ?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 8P: At the beginning of 2020, Holden Companys controller asked you to prepare correcting entries for the...

Related questions

Question

100%

Please help with the following accounting question from information provided:

If Santiago Traders wants to sell Vehicle C on 31 May 2021 and make a profit on sale of the vehicle, how much should Santiago Traders sell the vehicle for? Provide calculations to support your answer

Transcribed Image Text:Question 1

The following balances appeared in the books of Santiago Traders on 1 March 2020:

Land and Buildings

900 000

Vehicles

250 000

Machinery

200 000

Accumulated Depreciation on Vehicles

?

Accumulated Depreciation on Machinery

?

Additional information:

A new building was purchased for cash on the 1$t September 2020 for R1 000 000.

The vehicles balance at 1 March 2020 consists of two vehicles. Vehicle A with a cost price of

R120 000 was sold on the 31st October 2020 on credit to Miss Smith for R60 000. The

vehicle was purchased on the 31 May 2018. Vehicle B was purchased on the 1 March 2019.

Purchased a new delivery vehicle (Vehicle C) for R345 000 on credit from N&N Motors on 1

December 2020

All machinery was purchased on the 30 April 2017

The depreciation policy on non-current assets are as follows:

Vehicles: 20% on cost using the straight-line method and no residual value

Machinery: 10% per annum using the diminishing balance method and no residual

value

IGNORE VAT

Santiago Traders has a 28 February year end

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning