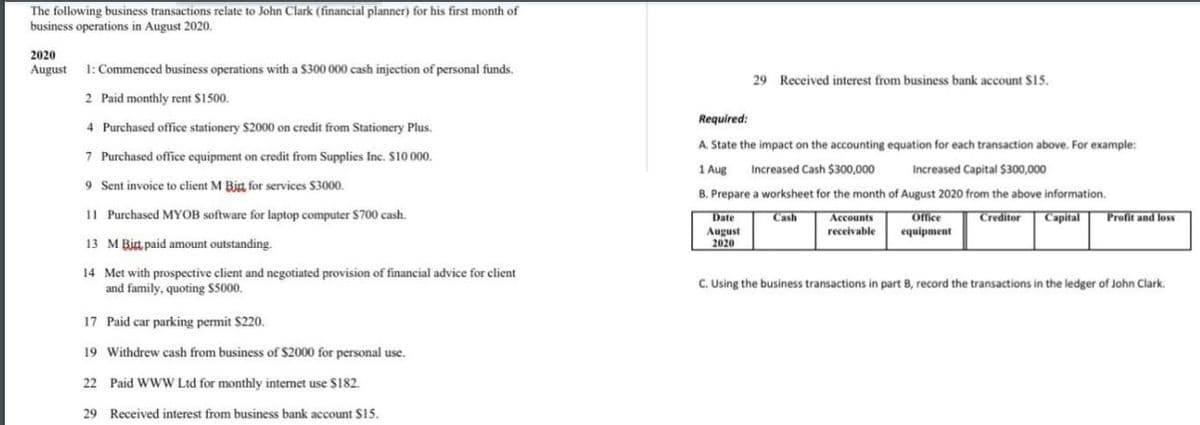

The following business transactions relate to John Clark (financial planner) for his first month of business operations in August 2020. 2020 August 1: Commenced business operations with a $300 000 cash injection of personal funds. 29 Received interest from business bank account $15. 2 Paid monthly rent S1500. Required: 4 Purchased office stationery $2000 on credit from Stationery Plus. A. State the impact on the accounting equation for each transaction above. For example: 7 Purchased office equipment on credit from Supplies Inc. S10 000. 1 Aug Increased Cash S300,000 Increased Capital $300,000 9 Sent invoice to client M Bit for services $3000. B. Prepare a worksheet for the month of August 2020 from the above information. 11 Purchased MYOB software for laptop computer $700 cash. Creditor Accounts receivable Date Cash Capital Office equipment Profit and loss 13 M Bit paid amount outstanding. August 2020 14 Met with prospective client and negotiated provision of financial advice for client and family, quoting $5000. C. Using the business transactions in part B, record the transactions in the ledger of John Clark. 17 Paid car parking permit $220. 19 Withdrew cash from business of $2000 for personal use. 22 Paid WWW Ltd for monthly internet use S182. 29 Received interest from business bank account S15.

The following business transactions relate to John Clark (financial planner) for his first month of business operations in August 2020. 2020 August 1: Commenced business operations with a $300 000 cash injection of personal funds. 29 Received interest from business bank account $15. 2 Paid monthly rent S1500. Required: 4 Purchased office stationery $2000 on credit from Stationery Plus. A. State the impact on the accounting equation for each transaction above. For example: 7 Purchased office equipment on credit from Supplies Inc. S10 000. 1 Aug Increased Cash S300,000 Increased Capital $300,000 9 Sent invoice to client M Bit for services $3000. B. Prepare a worksheet for the month of August 2020 from the above information. 11 Purchased MYOB software for laptop computer $700 cash. Creditor Accounts receivable Date Cash Capital Office equipment Profit and loss 13 M Bit paid amount outstanding. August 2020 14 Met with prospective client and negotiated provision of financial advice for client and family, quoting $5000. C. Using the business transactions in part B, record the transactions in the ledger of John Clark. 17 Paid car parking permit $220. 19 Withdrew cash from business of $2000 for personal use. 22 Paid WWW Ltd for monthly internet use S182. 29 Received interest from business bank account S15.

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 3PB: Hajun Company started its business on May 1, 2019. The following transactions occurred during the...

Related questions

Question

Transcribed Image Text:The following business transactions relate to John Clark (financial planner) for his first month of

business operations in August 2020.

2020

August

1: Commenced business operations with a $300 000 cash injection of personal funds.

29 Received interest from business bank account $15.

2 Paid monthly rent $1500.

Required:

4 Purchased office stationery $2000 on credit from Stationery Plus.

A. State the impact on the accounting equation for each transaction above. For example:

7 Purchased office equipment on credit from Supplies Inc. S10 000.

1 Aug

Increased Cash $300,000

Increased Capital $300,000

9 Sent invoice to client M Bint for services $3000.

B. Prepare a worksheet for the month of August 2020 from the above information.

11 Purchased MYOB software for laptop computer $700 cash.

Date

Cash

Accounts

Office

Creditor

Capital

Profit and loss

August

2020

receivable

equipment

13 M Birt paid amount outstanding.

14 Met with prospective client and negotiated provision of financial advice for client

and family, quoting $5000.

C. Using the business transactions in part B, record the transactions in the ledger of John Clark.

17 Paid car parking permit $220.

19 Withdrew cash from business of $2000 for personal use.

22 Paid WWW Ltd for monthly internet use $182.

29 Received interest from business bank account $15.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning