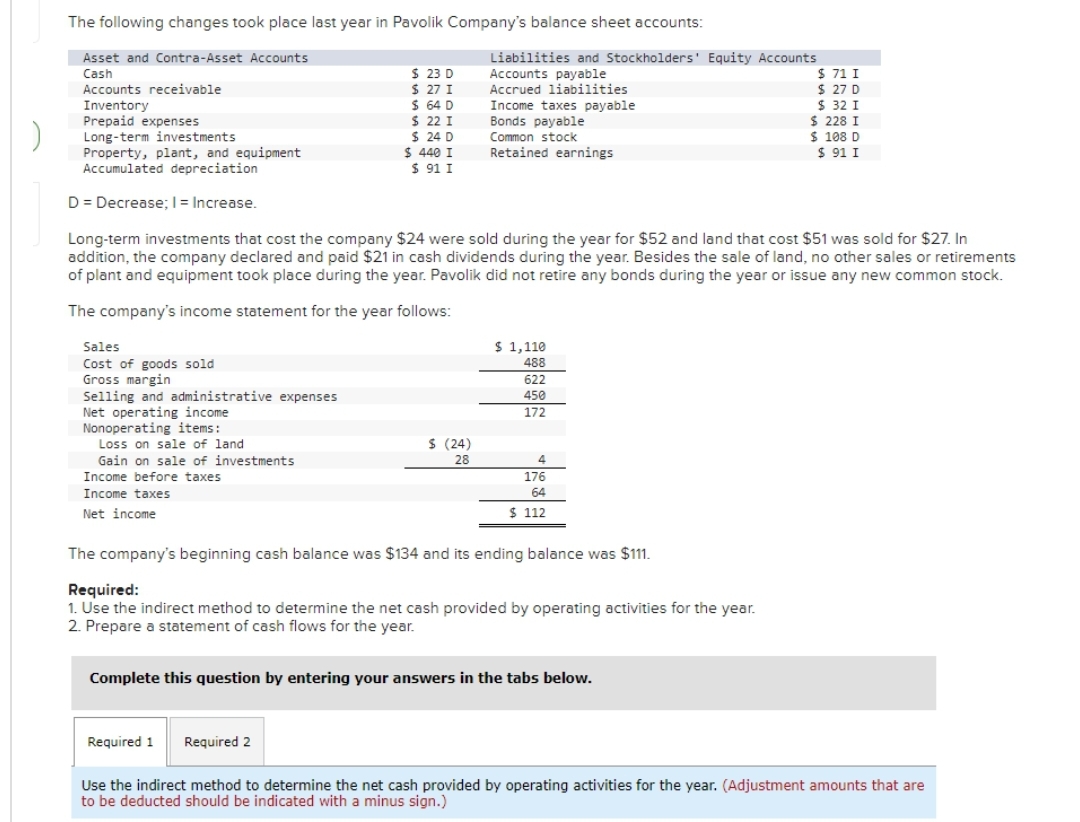

The following changes took place last year in Pavolik Company's balance sheet accounts: Asset and Contra-Asset Accounts Cash Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Nonoperating items: $ 23 D $ 27 I $ 64 D $ 22 I S 24 D $ 440 I $ 91 I Accounts receivable Inventory Prepaid expenses Long-term investments Property, plant, and equipment Accumulated depreciation D = Decrease; I = Increase. Long-term investments that cost the company $24 were sold during the year for $52 and land that cost $51 was sold for $27. In addition, the company declared and paid $21 in cash dividends during the year. Besides the sale of land, no other sales or retirements of plant and equipment took place during the year. Pavolik did not retire any bonds during the year or issue any new common stock. The company's income statement for the year follows: Loss on sale of land Gain on sale of investments Income before taxes Income taxes Net income Liabilities and Stockholders' Equity Accounts Accounts payable Accrued liabilities $ (24) 28 Income taxes payable Bonds payable Common stock Retained earnings $ 1,110 488 622 450 172 176 64 $ 112 $ 71 I $ 27 D $ 32 I $ 228 I $ 108 D $91 I The company's beginning cash balance was $134 and its ending balance was $111. Required: 1. Use the indirect method to determine the net cash provided by operating activities for the year. 2. Prepare a statement of cash flows for the year.

The following changes took place last year in Pavolik Company's balance sheet accounts: Asset and Contra-Asset Accounts Cash Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Nonoperating items: $ 23 D $ 27 I $ 64 D $ 22 I S 24 D $ 440 I $ 91 I Accounts receivable Inventory Prepaid expenses Long-term investments Property, plant, and equipment Accumulated depreciation D = Decrease; I = Increase. Long-term investments that cost the company $24 were sold during the year for $52 and land that cost $51 was sold for $27. In addition, the company declared and paid $21 in cash dividends during the year. Besides the sale of land, no other sales or retirements of plant and equipment took place during the year. Pavolik did not retire any bonds during the year or issue any new common stock. The company's income statement for the year follows: Loss on sale of land Gain on sale of investments Income before taxes Income taxes Net income Liabilities and Stockholders' Equity Accounts Accounts payable Accrued liabilities $ (24) 28 Income taxes payable Bonds payable Common stock Retained earnings $ 1,110 488 622 450 172 176 64 $ 112 $ 71 I $ 27 D $ 32 I $ 228 I $ 108 D $91 I The company's beginning cash balance was $134 and its ending balance was $111. Required: 1. Use the indirect method to determine the net cash provided by operating activities for the year. 2. Prepare a statement of cash flows for the year.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter6: Statement Of Cash Flows

Section: Chapter Questions

Problem 25E

Related questions

Question

Nn.21.

Subject :- Account

Transcribed Image Text:)

The following changes took place last year in Pavolik Company's balance sheet accounts:

Asset and Contra-Asset Accounts

Cash

Sales

Cost of goods sold

Gross margin

Selling and administrative expenses

Net operating income.

Nonoperating items:

Accounts receivable

Inventory

Prepaid expenses

Long-term investments

Property, plant, and equipment

Accumulated depreciation

D = Decrease; I= Increase.

Long-term investments that cost the company $24 were sold during the year for $52 and land that cost $51 was sold for $27. In

addition, the company declared and paid $21 in cash dividends during the year. Besides the sale of land, no other sales or retirements

of plant and equipment took place during the year. Pavolik did not retire any bonds during the year or issue any new common stock.

The company's income statement for the year follows:

Loss on sale of land.

Gain on sale of investments

Income before taxes

Income taxes

Net income

$ 23 D

$ 27 I

$ 64 D

$ 22 I

$24 D

$ 440 I

$ 91 I

Liabilities and Stockholders' Equity Accounts

Accounts payable

Accrued liabilities

$ (24)

28

Required 1 Required 2

Income taxes payable

Bonds payable

Common stock

Retained earnings

2**

$ 1,110

488

622

450

172

4

176

64

$ 112

The company's beginning cash balance was $134 and its ending balance was $111.

Required:

1. Use the indirect method to determine the net cash provided by operating activities for the year.

2. Prepare a statement of cash flows for the year.

Complete this question by entering your answers in the tabs below.

$ 71 I

$ 27 D

$ 32 I

$ 228 I

$ 108 D

$ 91 I

Use the indirect method to determine the net cash provided by operating activities for the year. (Adjustment amounts that are

to be deducted should be indicated with a minus sign.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,