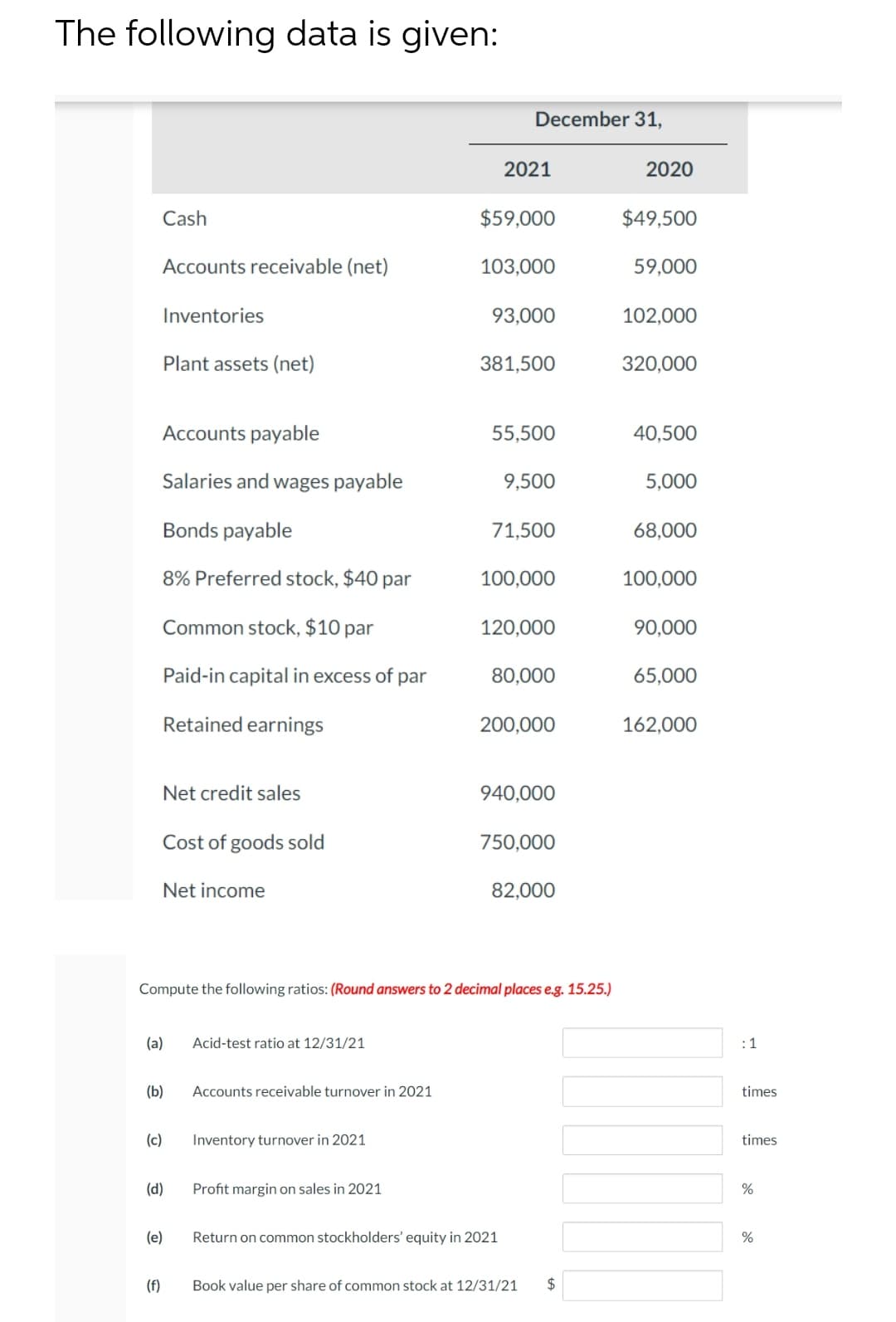

The following data is given: December 31, 2021 2020 Cash $59,000 $49,500 Accounts receivable (net) 103,000 59,000 Inventories 93,000 102,000

The following data is given: December 31, 2021 2020 Cash $59,000 $49,500 Accounts receivable (net) 103,000 59,000 Inventories 93,000 102,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 10MC

Related questions

Question

Transcribed Image Text:The following data is given:

December 31,

2021

2020

Cash

$59,000

$49,500

Accounts receivable (net)

103,000

59,000

Inventories

93,000

102,000

Plant assets (net)

381,500

320,000

Accounts payable

55,500

40,500

Salaries and wages payable

9,500

5,000

Bonds payable

71,500

68,000

8% Preferred stock, $40 par

100,000

100,000

Common stock, $10 par

120,000

90,000

Paid-in capital in excess of par

80,000

65,000

Retained earnings

200,000

162,000

Net credit sales

940,000

Cost of goods sold

750,000

Net income

82,000

Compute the following ratios: (Round answers to 2 decimal places e.g. 15.25.)

(a)

Acid-test ratio at 12/31/21

:1

(b)

Accounts receivable turnover in 2021

times

(c)

Inventory turnover in 2021

times

(d)

Profit margin on sales in 2021

(e)

Return on common stockholders' equity in 2021

%

(f)

Book value per share of common stock at 12/31/21

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,