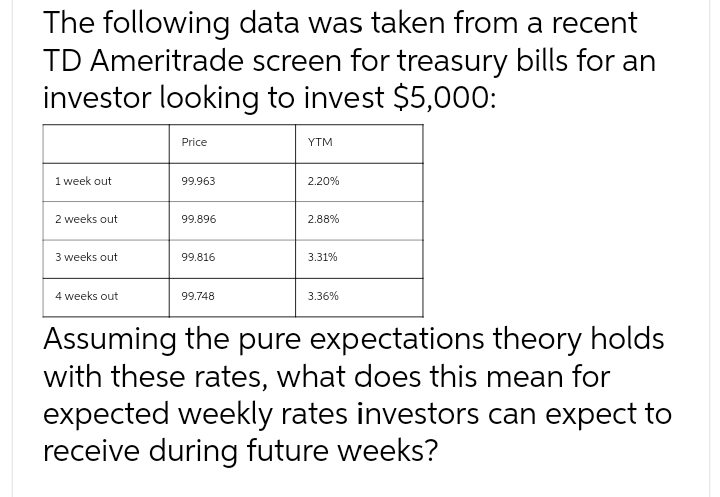

The following data was taken from a recent TD Ameritrade screen for treasury bills for an investor looking to invest $5,000: 1 week out 2 weeks out 3 weeks out 4 weeks out Price 99.963 99.896 99.816 99.748 YTM 2.20% 2.88% 3.31% 3.36% Assuming the pure expectations theory holds with these rates, what does this mean for expected weekly rates investors can expect to receive during future weeks?

Q: The nominal rate of return is, % earned by an investor in a bond that was purchased for $973, has an…

A: Solution:- Nominal rate of return means the percentage of return earned by investors on the amount…

Q: SAB Company The SAB Company is considering the purchase of a new machine at a cost of $ 14,000 to…

A: The company may need to decide whether to replace the old machine with a new machine or not. The…

Q: Gains and losses are recognized daily IMR = $2,530, MMR = $2,300, for a T-Bond futures $100,000.…

A: Initial Margin (IMR) = $ 2530 Maintenance Margin (MMR) = $2300 T-bond contract initial investment =…

Q: pose at the end of 12 years you our retirement account. You decide to leav ney in the account for…

A: As per the given information: Amount in retirement account after 12 years - $105,000Amount left in…

Q: Which of the following are significant flaws with the Payback Period Method? (Select all that apply)…

A: Payback period method is a capital budgeting method which will help in finding time period within…

Q: You own 87 shares of Costco Wholesale. They offer a $5.65 per share dividend. How much Current…

A: The current income received from dividends is the total amount of dividends received which would be…

Q: Suppose the common stock of United Industries has a beta of 0.83 and an expected return of 8.7…

A: Expected Return = Risk Free Rate + (Beta x Market Risk Premium)

Q: Ursus, Incorporated, is considering a project that would have a five-year life and would require a…

A: Net present value is the difference between present value of all cash inflows and initial…

Q: Consider a bond at par initially issued for a 30-year term. Its nominal rate (annual coupon) is 5%.…

A: Bonds are securities with fixed coupon payments and redemption at par on maturity. This phenomenon…

Q: Required: Calculate the net present value of this investment opportunity. (Round your final answer…

A: Net present value is an important capital budgeting tool. It is the sum of all present values of…

Q: Suppose you considering investing $33 to earn $5.9 every year for 9 years. If the annual interest…

A: If the payback period is less than the total estimated time required to recover the cost of the…

Q: A bond that has a face value of $1,500 and coupon rate of 3.20% payable semi-annually was redeemable…

A: Purchase value of bond is computed by discounting cash flows associated with the bonds to present…

Q: Blue Sky Ski Resort plans to install a new chair lift. Construction is estimated to require an…

A: IRR is the internal rate of return. IRR is the rate at which net present value is equal to zero.

Q: Array intends to allocate her savings into various types of financial investments. She has $194,400…

A: Total Investment = 194400 Stock : Bond : Mutual fund ratio = (4/3) : (1/9) :…

Q: Suppose you observe the following situation: Security Peat Co. Re-Peat Co. Beta 1.70 .85 Expected…

A: In the given case, beta and the expected return of each security is given . So , the risk free…

Q: Damilola owns and manages a small all-equity firm. If she works 40 hours a week, the firm's annual…

A: Answer - EBIT if she works 40 hours a week EBIT1 = $53,000 EBIT if she works 45 hours a week EBIT2…

Q: Which statement regarding a portfolio is CORRECT? Multiple Choice O Investors are always looking to…

A: Alpha is a measure of the excess return of a portfolio relative to the return of a benchmark index.

Q: A $10,000, five-year bond redeemable at par and bearing interest at 6.5% payable semi-annually is…

A: Bonda are long term debt instrument indicating that corporation has borrowed a certain sum of money…

Q: To find the selling price directly, what single factor can be used to multiply the original price of…

A: The organization sells merchandise to its customers. The organization must determine what the…

Q: Annual additions to qualified retirement plans include interest and dividend income. forfeitures…

A: The qualified retirement plan is a retirement plan fund allocation done inside a firm or an…

Q: What would be the price of a stock that pays an annual fixed dividend of $1.9 for ten years, and…

A: The amount of dividend from years 1 to 10 is $1.9 The constant growth rate from the 10th year is 1%…

Q: If the Apiando's share price at 6 August 2022 is $43.88 whereas beta is 1.97. US government bond at…

A: Cost of equity: The cost of equity represents the return expected by the equity investors for…

Q: The expected constant-growth rate of dividends is ______% for a stock currently priced at $78, that…

A: In the given case, the current paid dividend or last paid dividend = D0 is given , the required…

Q: could you list the name of the recommended strategy as long call, write call, long put, or write…

A: Option strategies help to protect from any potential risk to be resulted from the movement of the…

Q: Maharlika Fund has a target capital structure that consists of 30% debt, 50% common equity, and 20%…

A: Cost of equity calculation Next year dividend (D1) = 5 Current…

Q: Use the information for Daniels Company to answer the questions that follow. Daniels Company…

A: The Income statement is a summary of Incomes and expenses of the business. Expenses are the costs…

Q: A firm is expected to pay a $5.70 dividend per share next year. The stock is selling in the market…

A: Stock valuation is a process to estimate to intrinsic price of a stock. Sum of all the expected…

Q: Providing safeguards against corruption and incompetence, removing conflict of interest, and…

A: The CEO (Chief Executive Officer) is the top executive in a company, responsible for the overall…

Q: An association had an initial balance of $200 on 1st Jan and also had deposits of $25 on 31st March,…

A: Dollar weighted return is equal to internal rate of return. Internal rate of return is return at…

Q: 20,000

A: Spot price = 2500 / 1000 KG The future of stock palm oil is 1000 kg lot. Take it is being sold…

Q: ces Required information Section Break (8-11) [The following information applies to the questions…

A: The question is related to the Portfolio Management. The minimum variance Portfolio is the optimum…

Q: Complete the statement of sources and uses of cash from the following entries: Net…

A: Statement of sources refers to the report providing the performance of the firm in an accounting…

Q: sent Value of $1; 1 (1+r) n eriods 4% 2 3 4 5 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19%…

A: The capital budgeting concept is used y the company for decision making whether the company should…

Q: 3. Which interest rate does not typically move with the bank rate? the rate on loans negotiated by…

A: The bank rate is the benchmark for different types of loans like personal credit lines, mortgages,…

Q: Mary Blake is considering whether to buy stocks or bonds. She has a good understanding of the pros…

A: Yield, The return an investor receives from his/her investment is called the rate of return or…

Q: 2. Bond Question: 1. The Rio Tinto Corporation is planning a capital project that would involve…

A: The bonds generally sell at a discount when the coupon rate offered by the bond is lower than the…

Q: According to the CAPM, the stocks which are located above the security market line (SML) are those…

A: Security Market Line: SML is a representation of the capital asset pricing model in a graph view.…

Q: Sisters Berhad collects its accounts receivable in 48 The firm has a net profit margin of 8.6%. On…

A: The Cash Conversion cycle is calculated with the help of following formula Cash Conversion Cycle =…

Q: CIBC issued a loan of $76,000 at 8.37% compounded semi-annually. The loan was repaid by payments of…

A: A loan is a financial arrangement in which one or more people, companies, or other entities lend…

Q: Isabella had a gross income of $98,212 in 2010. What was her net income in 2010? Use the income tax…

A: The progressive tax rate slabs will be reflecting that the tax rate are going to increase over the…

Q: Suppose the interest rates in the market for one-year, zero-coupon Treasury strips and for one-year,…

A: The interest rates in the market for one-year, zero-coupon Treasury strips (i) = 2.05%…

Q: 14. Pear, Inc. is a manufacturer that is heavily dependent on plastic parts shipped from Malaysia.…

A: Given: Correlation for futures of commodity A is 0.70 Correlation for futures of commodity B is 0.80…

Q: Use the Panera annual report to answer this question. You are going to start a fast casual…

A: Financial data for 2012: Bakery Cafe Sales, Net=$1,879,280,000 Cost of Food and Paper Products=…

Q: Which of the following statement about the payback period method for capital budgeting decisions is…

A: Payback period is the length of time it takes to recover an investment. It is a simple method of…

Q: Suppose you considering investing $34 to earn $4.8 every year for forever. If the annual interest…

A: The difference between the current value of cash inflows and outflow of cash over a period of time…

Q: F4. You buy a TIPS at issue at par for $1,000. The bond has a 4.94% annual pay coupon. Inflation…

A: Coupon rate A coupon rate is a rate of interest that is received by the bondholder from the date of…

Q: Jane started to work this August. Since she received her first salary at the beginning of August,…

A: A loan is a financial arrangement in which one or more people, companies, or other entities lend…

Q: You have a $50,000 twenty year growing annuity earning 8 percent interest compounded annually.…

A: Given a certain rate of return, present value (PV) is the current worth of a future sum of money or…

Q: Ma4. SNV Corp. expects earnings at the end of this year of $5 per share. The company announced…

A: As per the given information: Expected earnings at the end of this year - $5 per shareDividend cut…

Q: Ay 2. supposed you have the following bonds: Bond A has a 7% annual coupon, matures in 12 years,…

A: Bond: The bond represents a debt financial instrument that a company/issuer uses to raise debt…

Mf1.

Step by step

Solved in 2 steps

- The following information is about a hypothetical government security dealer named M.P. Jorgan. Market yields are in parenthesis, and amounts are in millions. Assets Liabilities and Equity Cash $20 Overnight repos $210 1-month T-bills (7.05%) 80 3 month CD 70 3-month T-bills (7.25%) 95 7-year fixed rate (8.55%) 260 2-year T-notes (7.50%) 100 Subordinated debt 8-year T-notes (8.96%) 200 5-year munis (floating rate) (8.20% reset every 6 months) 105 Equity 60 Total assets $600 Total liabilities & equity $600…Based on economists’ forecasts and analysis, 1-year Treasury bill rates and liquidity premiums for the next four years are expected to be as follows: R1 = 2.00 % E(2r1) = 2.90 % L2 = 0.06 % E(3r1) = 3.30 % L3 = 0.08 % E(4r1) = 3.75 % L4 = 0.13 % Using the liquidity premium theory, determine the current (long-term) rates. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Based on economists’ forecasts and analysis, 1-year Treasury bill rates and liquidity premiums for the next four years are expected to be as follows: R1 = 2.00 % E(2r1) = 2.90 % L2 = 0.06 % E(3r1) = 3.30 % L3 = 0.08 % E(4r1) = 3.75 % L4 = 0.13 % Using the liquidity premium theory, determine the current (long-term) rates. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Years Current (Long-term) Rates 1 % 2 % 3 % 4 %Based on economists’ forecasts and analysis, 1-year Treasury bill rates and liquidity premiums for the next four years are expected to be as follows: R1 = 0.90 % E(2r1) = 2.05 % L2 = 0.09 % E(3r1) = 2.15 % L3 = 0.12 % E(4r1) = 2.45 % L4 = 0.14 % Using the liquidity premium theory, determine the current (long-term) rates. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

- Suppose you purchase a T-bills that is 125 days from maturity for $9,765. The T-bills has a face value of $10,000.a. Calculate the T-bills’s quoted discount rate. b. Calculate the T-bills’s annualized rate.c. Who are the major issuers of and investors in money market securities?Based on economists' forecasts and analysis, 1-year Treasury bill rates and liquidity premiums for the next four years are expected to be as follows: R1 = 0.40% E(271) 1.55% 1.65% E(371) = E(471) = 1.95% 42- 0.05% L3 = 0.10% L4 - 0.12% Years 1 2 3 4 M Using the liquidity premium theory, determine the current (long-term) rates. Note: Do not round intermediate calculations. Round your percentage answers to 2 decimal places (i.e., 0.1234 should be entered as 12.34). Current (Long-term) Rates % % % %Use the following information about a hypothetical government security dealer named M.P. Jorgan. Market yields are in parenthesis, and amounts are in millions. All securities are selling at par equal to book value. (4 points) Assets Liabilities and Equity Cash $10 Overnight repos $250 1-month T-bills (7.05%) 85 Subordinated debt 3-month T-bills (7.25%) 100 7-year fixed rate (8.55%) 140 2-year T-notes (7.50%) 90 8-year T-notes (8.96%) 100 5-year munis (floating rate) (8.20% reset every 6 months) 50 Equity 45 Total assets $435 Total liabilities &…

- A credit analyst is evaluating the solvency of Alcatel-Lucent (Euronext Paris: ALU) asof the beginning of 2010. Th e following data are gathered from the company’s 2009annual report (in € millions):2009 2008Total equity 4,309 5,224Accrued pension 5,043 4,807Long-term debt 4,179 3,998Other long term liabilities* 1,267 1,595Current liabilities* 9,050 11,687Total equity + Liabilities (equals Total assets) 23,848 27,311*For purposes of this example, assume that these items are non-interest bearing, and that longterm debt equals total debt. In practice, an analyst could refer to Alcatel’s footnotes to confi rmdetails, rather than making an assumption.1 . A . Calculate the company’s fi nancial leverage ratio for 2009.B . Interpret the fi nancial leverage ratio calculated in Part A.2 . A . What are the company’s debt-to-assets, debt-to-capital, and debt-to-equity ratiosfor the two years?B . Is there any discernable trend over the two years?Consider the following table for an eight-year period: Year T-bill return Inflation 1 7.47 % 8.53 % 2 8.94 12.16 3 6.05 6.76 4 5.97 5.04 5 5.63 6.52 6 8.54 8.84 7 10.74 13.11 8 13.00 12.34 Calculate the average return for Treasury bills and the average annual inflation rate (consumer price index) for this period. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Average return for Treasury bills % Average annual inflation rate % Calculate the standard deviation of Treasury bill returns and inflation over this time period. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Standard deviation of Treasury bills % Standard deviation of inflation % Calculate the real return for each year. (A negative answer should be indicated by a minus sign. Leave no cells…Suppose we have the following Treasury bill returns and inflation rates over an eight year period: Year Treasury Bills Inflation 1 10.45% 12.55% 2 11.36 16.00 3 9.06 10.29 4 8.34 7.97 5 8.88 10.29 6 11.23 12.77 7 14.11 16.98 8 15.97 16.90 a. Calculate the average return for Treasury bills and the average annual inflation rate for this period. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Treasury bills % Inflation % b. Calculate the standard deviation of Treasury bill returns and inflation over this period. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Treasury bills % Inflation %…

- Suppose the Fed conducts an open marketpurchase by buying $10 million in Treasurybonds from Acme Bank. Sketch out thebalance sheet changes that will occur asAcme converts the bond sale proceeds tonew loans. The initial Acme bank balancesheet contains the following information:Assets – reserves 30, bonds 50, and loans 50;Liabilities – deposits 100 and equity 30.1, Consider the following table for an eight-year period: Year T-bill return Inflation 1 7.47% 8.53% 2 8.94 12.16 3 6.05 6.76 4 5.97 5.04 5 5.63 6.52 6 8.54 8.84 7 10.74 13.11 8 13.00 12.34 a, Calculate the average return for Treasury bills and the average annual inflation rate (consumer price index) for this period. b, Calculate the standard deviation of Treasury bill returns and inflation over this time period. c, Calculate the real return for each year. d, What is the average real return for Treasury bills?The table shows the average returns and betas for the five ETFs, S&P 500, and Treasury. VONF IJT PDP FTA FNY S&P 500 TreasuryAnnualize mean 0.07148 0.11941 0.09613 0.07483 0.10233 0.09637 0.02541Beta 1.01106 1.11377 1.01507 1.02652 1.09928 1.00000 0.00000 Create a SML with the S&P 500 index's and the Treasury's average returns and betas. Determine whether the ETFs have return and beta combinations above or below the line you generated. Explain the arbitrage strategy you would form with one of the ETFs, index, or Treasury.