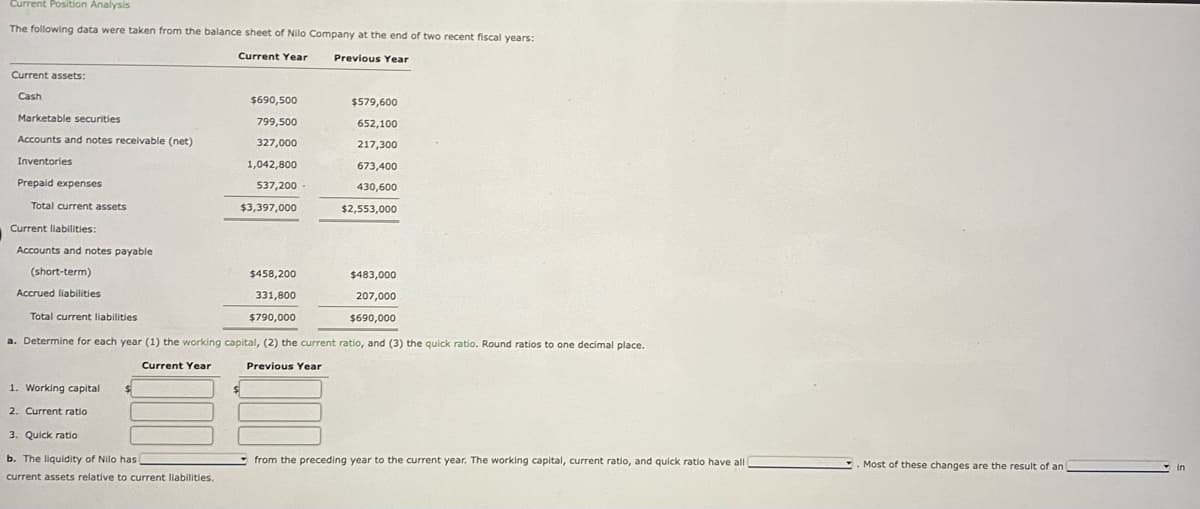

The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash Marketable securities Accounts and notes receivable (net) Inventories Prepaid expenses Total current assets Current liabilities: Accounts and notes payable (short-term) Accrued liabilities $458,200 $483,000 331,800 $790,000 207,000 $690,000 Total current liabilities a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year 1. Working capital $ 2. Current ratio $690,500 799,500 327,000 1,042,800 537,200 $3,397,000 3. Quick ratio b. The liquidity of Nilo has current assets relative to current liabilities. $579,600 652,100 217,300 673,400 430,600 $2,553,000 from the preceding year to the current year. The working capital, current ratio, and quick ratio have all i Most of these changes are the result of an [ in

The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash Marketable securities Accounts and notes receivable (net) Inventories Prepaid expenses Total current assets Current liabilities: Accounts and notes payable (short-term) Accrued liabilities $458,200 $483,000 331,800 $790,000 207,000 $690,000 Total current liabilities a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year 1. Working capital $ 2. Current ratio $690,500 799,500 327,000 1,042,800 537,200 $3,397,000 3. Quick ratio b. The liquidity of Nilo has current assets relative to current liabilities. $579,600 652,100 217,300 673,400 430,600 $2,553,000 from the preceding year to the current year. The working capital, current ratio, and quick ratio have all i Most of these changes are the result of an [ in

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 13E: Ratio of liabilities to stockholders equity and times interest earned The following data were taken...

Related questions

Question

Transcribed Image Text:Current Position Analysis

The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years:

Current Year

Previous Year

Current assets:

Cash

Marketable securities

Accounts and notes receivable (net)

Inventories

Prepaid expenses

Total current assets

Current liabilities:

Accounts and notes payable

(short-term)

Accrued liabilities

Total current liabilities

a. Determine for each year (1) the working

Current Year

1. Working capital

2. Current ratio

3. Quick ratio

b. The liquidity of Nilo has

current assets relative to current liabilities.

$690,500

799,500

327,000

1,042,800

537,200.

$3,397,000

$458,200

$579,600

652,100

217,300

673,400

430,600

$2,553,000

$483,000

331,800

207,000

$790,000

$690,000

capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place.

Previous Year

from the preceding year to the current year. The working capital, current ratio, and quick ratio have all

. Most of these changes are the result of an

in

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning