The following defined pension data of Grouper Corp. apply to the year 2020. For 2020, prepare a pension worksheet for Grouper Corp. that shows the journal entry for pension expense and the year-end balances in the related pension accounts. (Enter all amounts as positive.) Projected benefit obligation, 1/1/20 (before amendment) $509,000 Plan assets, 1/1/20 496,000 Pension liability 13,000 On January 1, 2020, Grouper Corp., through plan amendment, grants prior service benefits having a present value of 123,000 Settlement rate 9 % Service cost 58,300 Contributions (funding) 59,600 Actual (expected) return on plan assets 48,300 Benefits paid to retirees 43,500 Prior service cost amortization for 2020 16,400

The following defined pension data of Grouper Corp. apply to the year 2020. For 2020, prepare a pension worksheet for Grouper Corp. that shows the journal entry for pension expense and the year-end balances in the related pension accounts. (Enter all amounts as positive.) Projected benefit obligation, 1/1/20 (before amendment) $509,000 Plan assets, 1/1/20 496,000 Pension liability 13,000 On January 1, 2020, Grouper Corp., through plan amendment, grants prior service benefits having a present value of 123,000 Settlement rate 9 % Service cost 58,300 Contributions (funding) 59,600 Actual (expected) return on plan assets 48,300 Benefits paid to retirees 43,500 Prior service cost amortization for 2020 16,400

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter19: Accounting For Post Retirement Benefits

Section: Chapter Questions

Problem 7RE

Related questions

Question

The following defined pension data of Grouper Corp. apply to the year 2020.

For 2020, prepare a pension worksheet for Grouper Corp. that shows the

| Projected benefit obligation, 1/1/20 (before amendment) | $509,000 | ||

| Plan assets, 1/1/20 | 496,000 | ||

| Pension liability | 13,000 | ||

| On January 1, 2020, Grouper Corp., through plan amendment, grants prior service benefits having a present value of |

123,000 | ||

| Settlement rate | 9 | % | |

| Service cost | 58,300 | ||

| Contributions (funding) | 59,600 | ||

| Actual (expected) return on plan assets | 48,300 | ||

| Benefits paid to retirees | 43,500 | ||

| Prior service cost amortization for 2020 |

16,400

|

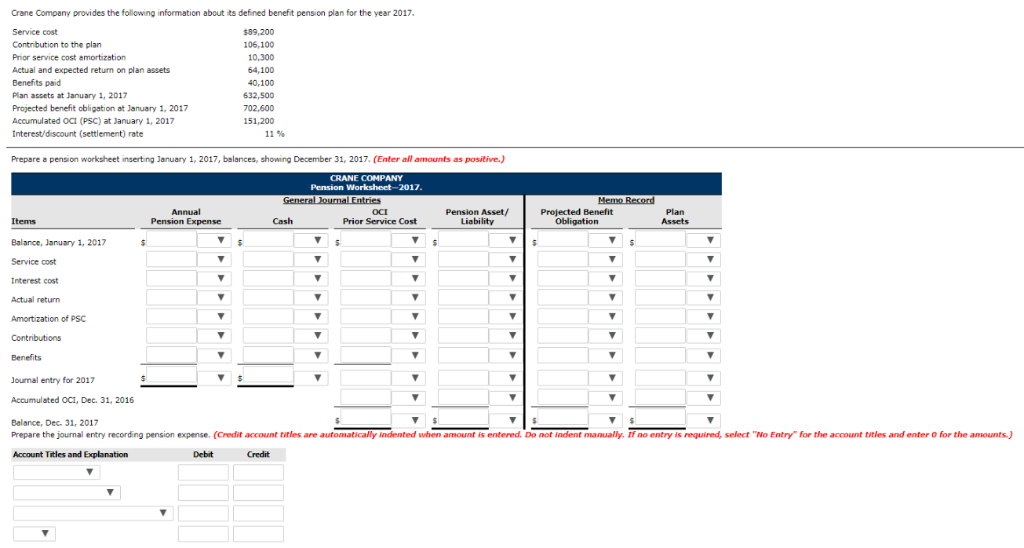

Transcribed Image Text:Crane Company provides the following information about its defined benefit pension plan for the year 2017.

Service cost

$9,200

Contribution to the plan

106,100

Prior service cost amortization

10,300

Actual and expected return on plan assets

64,100

Benefits paid

40,100

Plan assets at January 1, 2017

Projected benefit obligation at January 1, 2017

632,500

702,600

Accumulated OCI (PSC) at January 1, 2017

151,200

Interest/discount (settlement) rate

11 %

Prepare a pension worksheet inserting January 1, 2017, balances, showing December 31, 2017. (Enter all amounts as positive.)

CRANE COMPANY

Pension Worksheet-2017.

General Journal Entries

Memo Record

Projected Benefit

Obligation

OCI

Annual

Pension Expense

Pension Asset/

Liability

Plan

Assets

Items

Cash

Prior Service Cost

Balance, January 1, 2017

Service cost

Interest cost

Actual return

Amortization of PSC

Contributions

Benefits

Journal entry for 2017

Accumulated OCI, Dec. 31, 2016

Balance, Dec. 31, 2017

Prepare the journal entry recording pension expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.)

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT