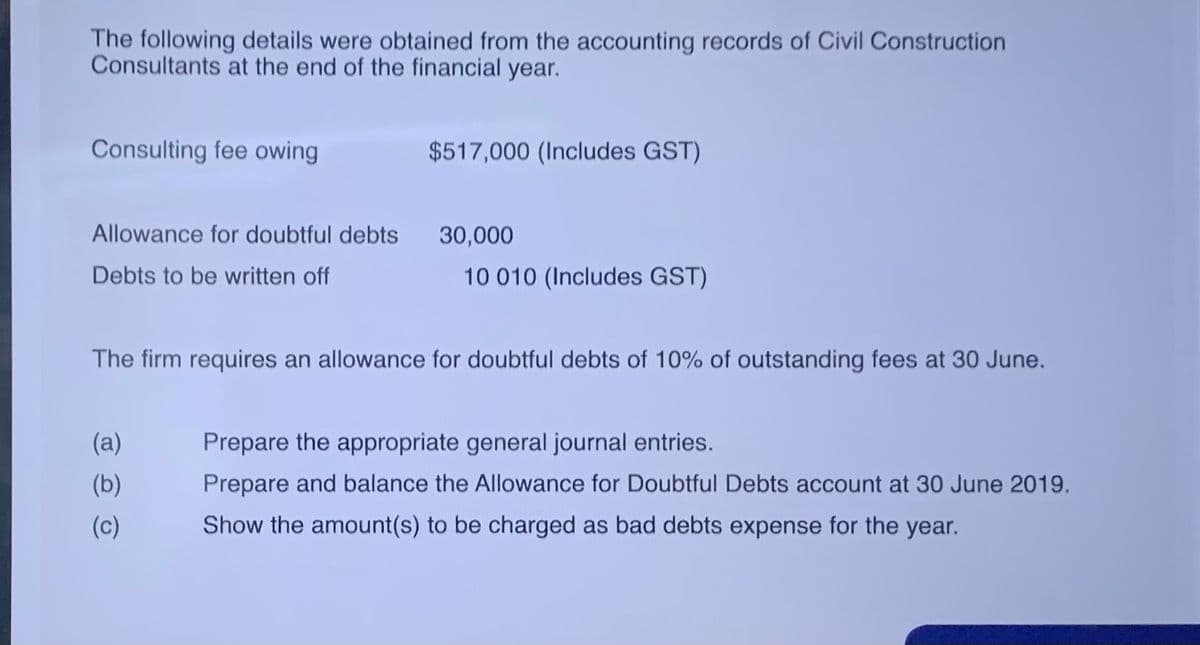

The following details were obtained from the accounting records of Civil Construction Consultants at the end of the financial year. Consulting fee owing $517,000 (Includes GST) Allowance for doubtful debts 30,000 Debts to be written off 10 010 (Includes GST) The firm requires an allowance for doubtful debts of 10% of outstanding fees at 30 June. (a) Prepare the appropriate general journal entries. (b) Prepare and balance the Allowance for Doubtful Debts account at 30 June 2019. (c) Show the amount(s) to be charged as bad debts expense for the year.

The following details were obtained from the accounting records of Civil Construction Consultants at the end of the financial year. Consulting fee owing $517,000 (Includes GST) Allowance for doubtful debts 30,000 Debts to be written off 10 010 (Includes GST) The firm requires an allowance for doubtful debts of 10% of outstanding fees at 30 June. (a) Prepare the appropriate general journal entries. (b) Prepare and balance the Allowance for Doubtful Debts account at 30 June 2019. (c) Show the amount(s) to be charged as bad debts expense for the year.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 25E: Koolman Construction Company began work on a contract in 2019. The contract price is 3,000,000, and...

Related questions

Question

Transcribed Image Text:The following details were obtained from the accounting records of Civil Construction

Consultants at the end of the financial year.

Consulting fee owing

$517,000 (Includes GST)

Allowance for doubtful debts

30,000

Debts to be written off

10 010 (Includes GST)

The firm requires an allowance for doubtful debts of 10% of outstanding fees at 30 June.

(a)

Prepare the appropriate general journal entries.

(b)

Prepare and balance the Allowance for Doubtful Debts account at 30 June 2019.

(c)

Show the amount(s) to be charged as bad debts expense for the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage