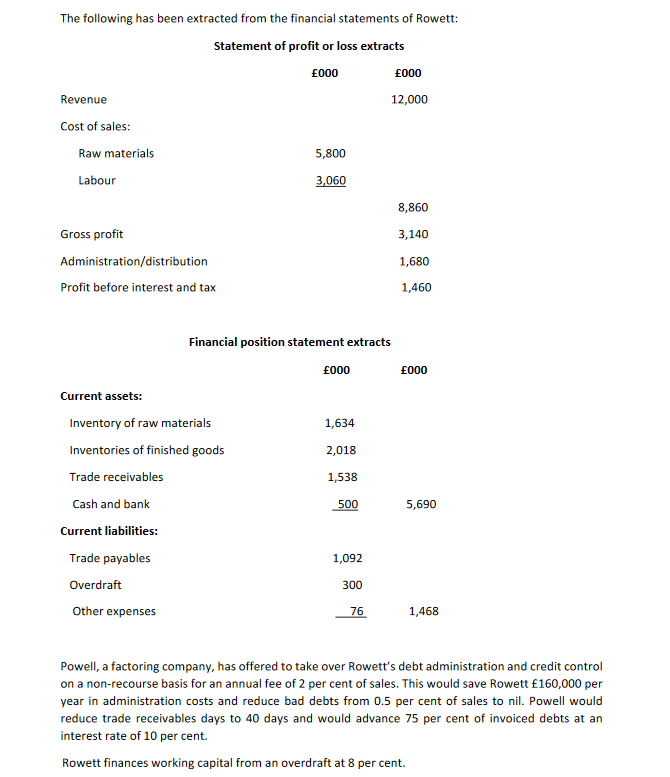

The following has been extracted from the financial statements of Rowett: Statement of profit or loss extracts £000 Revenue Cost of sales: Raw materials Labour Gross profit Administration/distribution Profit before interest and tax 5,800 3,060 Current assets: Inventory of raw materials Inventories of finished goods Trade receivables Cash and bank Current liabilities: Trade payables Overdraft Other expenses Financial position statement extracts £000 1,634 2,018 1,538 500 1,092 300 76 £000 12,000 8,860 3,140 1,680 1,460 £000 5,690 1,468 Powell, a factoring company, has offered to take over Rowett's debt administration and credit control on a non-recourse basis for an annual fee of 2 per cent of sales. This would save Rowett £160,000 per year in administration costs and reduce bad debts from 0.5 per cent of sales to nil. Powell would reduce trade receivables days to 40 days and would advance 75 per cent of invoiced debts at an interest rate of 10 per cent. Rowett finances working capital from an overdraft at 8 per cent.

Powell, a factoring company, has offered to take over Rowett’s debt administration and credit control

on a non-recourse basis for an annual fee of 2 per cent of sales. This would save Rowett £160,000 per

year in administration costs and reduce

reduce trade receivables days to 40 days and would advance 75 per cent of invoiced debts at an

interest rate of 10 per cent.

Rowett finances working capital from an overdraft at 8 per cent.

(a). Calculate the length of Rowet’s cash conversion cycle and discuss it significance to the company.

(b). Using the information given, assess whether Rowett should accept the factoring service offered

by Powell. What use should the company make of any finance provided by the factor?

Step by step

Solved in 4 steps with 4 images