the following independent scenarios? A, Peppers is insolvent, and the land and related mortgage are the only asset and debt, respectively. B. the mortgage is seller financing, and Peppers is solvent. C. Peppers has filed for bankruptcy and the debt is discharged by that action.

the following independent scenarios? A, Peppers is insolvent, and the land and related mortgage are the only asset and debt, respectively. B. the mortgage is seller financing, and Peppers is solvent. C. Peppers has filed for bankruptcy and the debt is discharged by that action.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter4: Gross Income

Section: Chapter Questions

Problem 4CE

Related questions

Question

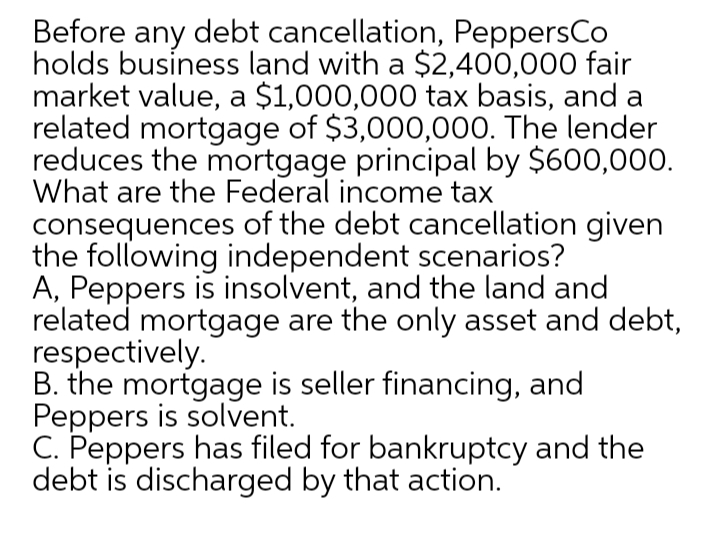

Transcribed Image Text:Before any debt cancellation, PeppersCo

holds business land with a $2,400,000 fair

market value, a $1,000,000 tax basis, and a

related mortgage of $3,000,000. The lender

reduces the mortgage principal by $600,000.

What are the Federal income tax

consequences of the debt cancellation given

the following independent scenarios?

A, Peppers is insolvent, and the land and

related mortgage are the only asset and debt,

respectively.

B. the mortgage is seller financing, and

Peppers is solvent.

C. Peppers has filed for bankruptcy and the

debt is discharged by that action.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT