(The following information applies to the questions displayed below.) At the beginning of the year, Foster & Long Company bought machinery, shelving, and a forklift. The machinery initially cost $31,600 but had to be overhauled (at a cost of $2,400) before it could be installed (at a cost of $1,200) and finally put into use. The machinery's total life was estimated as 40,000 hours, with an estimated residual value of $1,000. The machinery was actually used 5,000 hours in year 1 and 7,000 hours in year 2. Repair costs were $500 in each year. The shelving cost $10,050 and was expected to last 5 years, with a residual value of $750. The forklift cost $17,550 and was expected to last six years, with a residual value of $2,300. 4. Compute year 2 straight-line depreciation expense for the shelving and give the journal entry to record it. Complete this question by entering your answers In the tabs below. Req 4A Req 48 Compute year 2 straight-line depreciation expense for the shelving. Year 2 straight-ine depreciation experse

(The following information applies to the questions displayed below.) At the beginning of the year, Foster & Long Company bought machinery, shelving, and a forklift. The machinery initially cost $31,600 but had to be overhauled (at a cost of $2,400) before it could be installed (at a cost of $1,200) and finally put into use. The machinery's total life was estimated as 40,000 hours, with an estimated residual value of $1,000. The machinery was actually used 5,000 hours in year 1 and 7,000 hours in year 2. Repair costs were $500 in each year. The shelving cost $10,050 and was expected to last 5 years, with a residual value of $750. The forklift cost $17,550 and was expected to last six years, with a residual value of $2,300. 4. Compute year 2 straight-line depreciation expense for the shelving and give the journal entry to record it. Complete this question by entering your answers In the tabs below. Req 4A Req 48 Compute year 2 straight-line depreciation expense for the shelving. Year 2 straight-ine depreciation experse

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter19: Accounting For Plant Assets, Depreciation, And Intangible Assets

Section: Chapter Questions

Problem 1CP

Related questions

Question

Transcribed Image Text:[The following information applies to the questions displayed below.)

At the beginning of the year, Foster & Long Company bought machinery, shelving, and a forklift. The machinery initially

cost $31,600 but had to be overhauled (at a cost of $2,400) before it could be installed (at a cost of $1,200) and finally put

into use. The machinery's total life was estimated as 40,000 hours, with an estimated residual value of $1,000. The

machinery was actually used 5,000 hours in year 1 and 7,000 hours in year 2. Repair costs were $500 in each year.

The shelving cost $10,050 and was expected to last 5 years, with a residual value of $750. The forklift cost $17,550 and

was expected to last six years, with a residual value of $2,300.

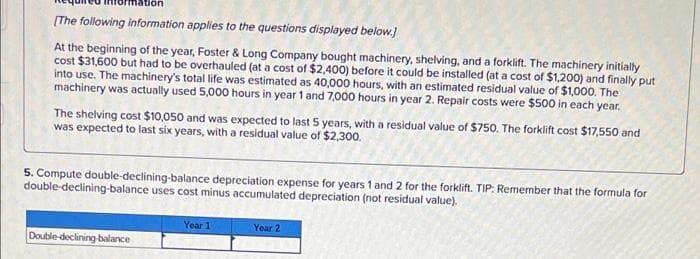

5. Compute double-declining-balance depreciation expense for years 1 and 2 for the forklift. TIP: Remember that the formula for

double-declining-balance uses cost minus accumulated depreciation (not residual value).

Year 1

Year 2

Double-declining-balance

Transcribed Image Text:(The following information applies to the questions displayed below.}

At the beginning of the year, Foster & Long Company bought machinery, shelving, and a forklift. The machinery initially

cost $31,600 but had to be overhauled (at a cost of $2,400) before it could be installed (at a cost of $1,200) and finally put

into use. The machinery's total life was estimated as 40,000 hours, with an estimated residual value of $1,000. The

machinery was actually used 5,000 hours in year 1 and 7,000 hours in year 2. Repair costs were $500 in each year.

The shelving cost $10,050 and was expected to last 5 years, with a residual value of $750. The forklift cost $17,550 and

was expected to last six years, with a residual value of $2,300.

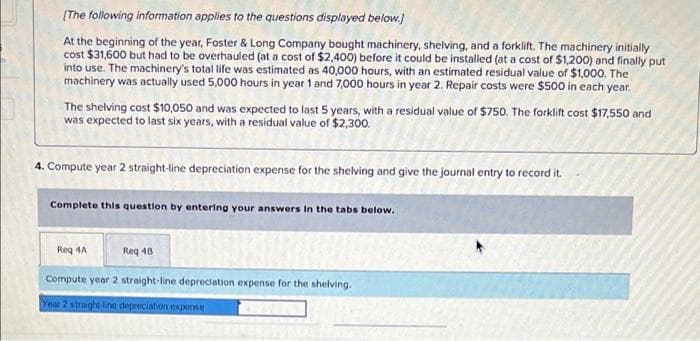

4. Compute year 2 straight-line depreciation expense for the shelving and give the journal entry to record it.

Complete this question by entering your answers in the tabs below.

Req 4A

Req 48

Compute year 2 straight-line depreciation expense for the shelving.

Year 2 straight-lne depreciation expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning