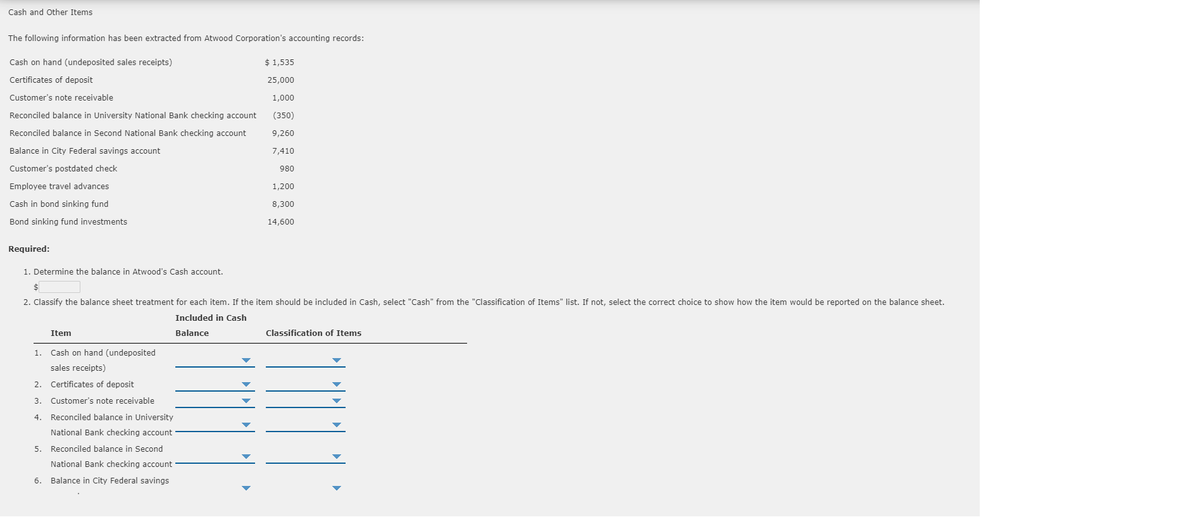

The following information has been extracted from Atwood Corporation's accounting records: Cash on hand (undeposited sales receipts) $1,535 Certificates of deposit 25,000 Customer's note receivable 1,000 Reconciled balance in University National Bank checking account (350) Reconciled balance in Second National Bank checking account 9,260 Balance in City Federal savings account 7,410 Customer's postdated check 980 Employee travel advances 1,200 Cash in bond sinking fund 8,300 Bond sinking fund investments 14,600 Required: 1. Determine the balance in Atwood's Cash account. 2. Classify the balance sheet treatment for each item. If the item should be included in Cash, select "Cash" from the "Classification of Items" list. If not, select the correct choice to show how the item would be reported on the balance sheet. Included in Cash Item Balance Classification of Items 1. Cash on hand (undeposited sales receipts) 2. Certificates of deposit 3. Customer's note receivable 4. Reconciled balance in University Nabional Bank checking account 5. Reconciled balance in Second National Bank checking account 6. Balance in City Federal savings

The following information has been extracted from Atwood Corporation's accounting records: Cash on hand (undeposited sales receipts) $1,535 Certificates of deposit 25,000 Customer's note receivable 1,000 Reconciled balance in University National Bank checking account (350) Reconciled balance in Second National Bank checking account 9,260 Balance in City Federal savings account 7,410 Customer's postdated check 980 Employee travel advances 1,200 Cash in bond sinking fund 8,300 Bond sinking fund investments 14,600 Required: 1. Determine the balance in Atwood's Cash account. 2. Classify the balance sheet treatment for each item. If the item should be included in Cash, select "Cash" from the "Classification of Items" list. If not, select the correct choice to show how the item would be reported on the balance sheet. Included in Cash Item Balance Classification of Items 1. Cash on hand (undeposited sales receipts) 2. Certificates of deposit 3. Customer's note receivable 4. Reconciled balance in University Nabional Bank checking account 5. Reconciled balance in Second National Bank checking account 6. Balance in City Federal savings

Chapter4: Operating Activities: Sales And Cash Receipts

Section: Chapter Questions

Problem 3.6C

Related questions

Question

Transcribed Image Text:Cash and Other Items

The following information has been extracted from Atwood Corporation's accounting records:

Cash on hand (undeposited sales receipts)

$ 1,535

Certificates of deposit

25,000

Customer's note receivable

1,000

Reconciled balance in University National Bank checking account

(350)

Reconciled balance in Second National Bank checking account

9,260

Balance in City Federal savings account

7,410

Customer's postdated check

980

Employee travel advances

1,200

Cash in bond sinking fund

8,300

Bond sinking fund investments

14,600

Required:

1. Determine the balance in Atwood's Cash account.

2. Classify the balance sheet treatment for each item. If the item should be included in Cash, select "Cash" from the "Classification of Items" list. If not, select the correct choice to show how the item would be reported on the balance sheet.

Included in Cash

Item

Balance

Classification of Items

1

Cash on hand (undeposited

sales receipts)

2. Certificates of deposit

3.

Customer's note receivable

4. Reconciled balance in University

National Bank checking account

5. Reconciled balance in Second

National Bank checking account

6. Balance in City Federal savings

Transcribed Image Text:6. Balance in City Federal savings

account

7. Customer's postdated check

8. Employee travel advances

9. Cash in bond sinking fund

10. Bond sinking fund investments

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College