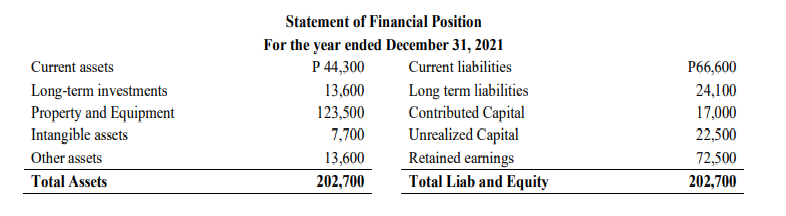

The following information is also available: 1. Current assets include cash P3,800, accounts receivables P18,500, note receivables (maturity date is on July 1, 2023) P10,000 and land P12,000. 2. Long term investments include a P4,600 investment in fair value though other comprehensive income securities that is expected to be sold in 2022 and a P9,000 investment in AllDay company bonds that are expected to be held until their December 31, 2029 maturity date. 3. Property and equipment include buildings costing P63,400, inventories costing P30,500 and equipment costing P29,600. 4. Intangible assets include patents that cost P8,200 and on which P2,300 amortization have accumulated, and treasury shares that costs P1,800. 5. Other assets include prepaid insurance (which expires on November 30, 2022) P2,900, sinking fund for bond retirement P7,000 and trademarks that cost P5,200 and on which P1,500 amortization has accumulated. 6. Current liabilities include accounts payable P19,400, bonds payable (maturity date December 31, 2022) P40,000, and accrued income taxes payable P7,200. 7. Long-term liabilities include accrued wages P4,100 and mortgage payable (which is due in five equal annual payments staring December 31, 2022) P20,000. 8. Contributed capital includes ordinary shares P11,000 and preference shares P6,000. 9. Unrealized capital includes premiums on bonds payable P4,300, premium on preference shares P2,400, premium on ordinary shares P14,700 and unrealized increase in value of trading securities P1,100. 10. Retained earnings includes unrestricted retained earnings, P37,800, allowance for doubtful accounts P700 and accumulated depreciation on buildings and equipment of P21,000 and P13,000, respectively. Based on the above data, compute for the following as of December 31, 2021: 4. Total shareholder’s equity

The following information is also available:

1. Current assets include cash P3,800, accounts receivables P18,500, note receivables (maturity date is on July 1,

2023) P10,000 and land P12,000.

2. Long term investments include a P4,600 investment in fair value though other comprehensive income securities

that is expected to be sold in 2022 and a P9,000 investment in AllDay company bonds that are expected to be held

until their December 31, 2029 maturity date.

3. Property and equipment include buildings costing P63,400, inventories costing P30,500 and equipment costing

P29,600.

4. Intangible assets include patents that cost P8,200 and on which P2,300 amortization have accumulated, and

treasury shares that costs P1,800.

5. Other assets include prepaid insurance (which expires on November 30, 2022) P2,900, sinking fund for bond

retirement P7,000 and trademarks that cost P5,200 and on which P1,500 amortization has accumulated.

6. Current liabilities include accounts payable P19,400, bonds payable (maturity date December 31, 2022) P40,000,

and accrued income taxes payable P7,200.

7. Long-term liabilities include accrued wages P4,100 and mortgage payable (which is due in five equal annual

payments staring December 31, 2022) P20,000.

8. Contributed capital includes ordinary shares P11,000 and

9. Unrealized capital includes premiums on bonds payable P4,300, premium on preference shares P2,400, premium

on ordinary shares P14,700 and unrealized increase in value of trading securities P1,100.

10.

Based on the above data, compute for the following as of December 31, 2021:

4. Total shareholder’s equity

Step by step

Solved in 3 steps