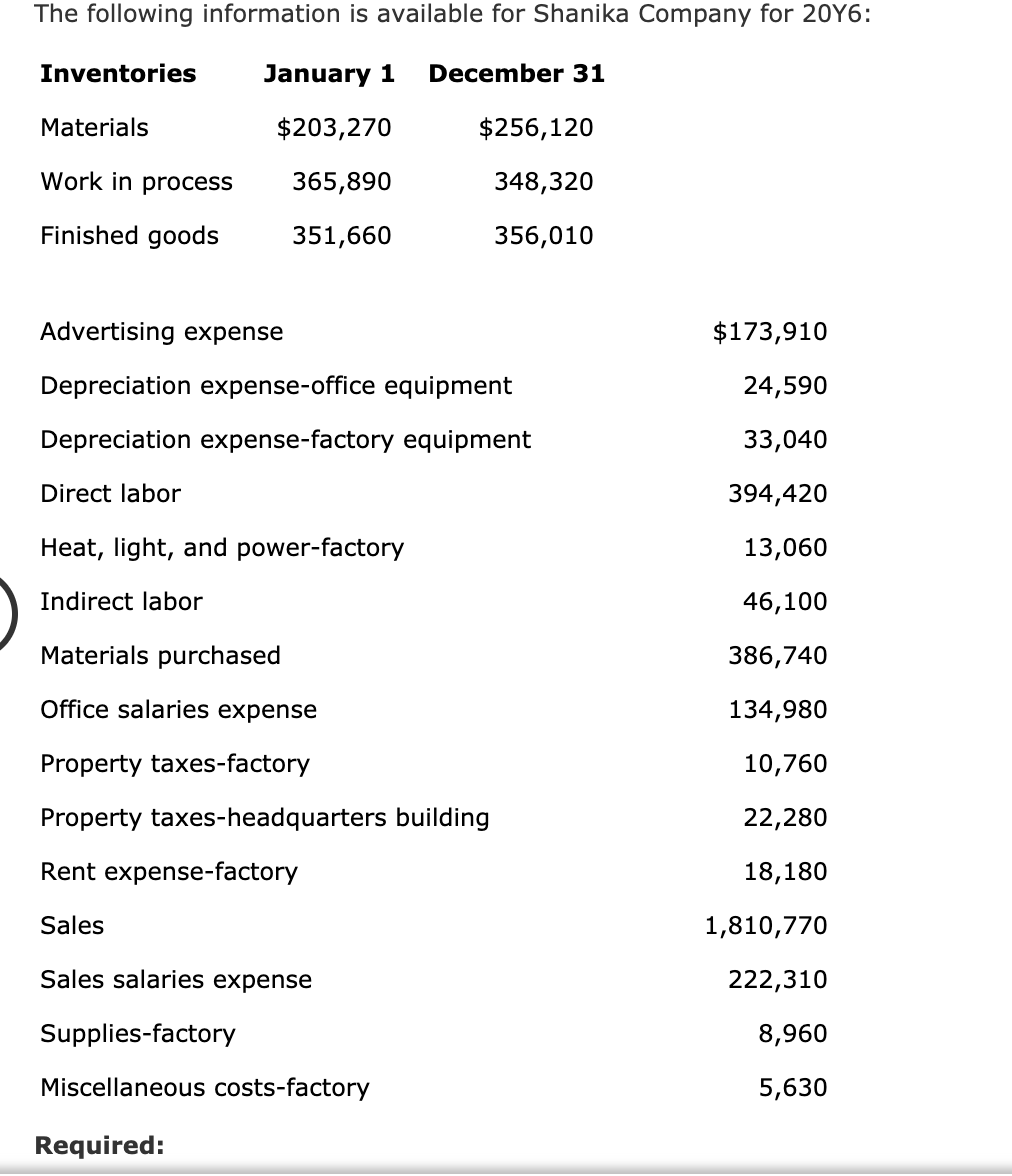

The following information is available for Shanika Company for 20Y6: Inventories January 1 December 31 Materials $203,270 $256,120 Work in process 365,890 348,320 Finished goods 351,660 356,010 Advertising expense $173,910 Depreciation expense-office equipment 24,590 Depreciation expense-factory equipment 33,040 Direct labor 394,420 Heat, light, and power-factory 13,060 Indirect labor 46,100 Materials purchased 386,740 Office salaries expense 134,980 Property taxes-factory 10,760 Property taxes-headquarters building 22,280 Rent expense-factory 18,180 Sales 1,810,770 Sales salaries expense 222,310 Supplies-factory 8,960 Miscellaneous costs-factory 5,630 Required:

The following information is available for Shanika Company for 20Y6: Inventories January 1 December 31 Materials $203,270 $256,120 Work in process 365,890 348,320 Finished goods 351,660 356,010 Advertising expense $173,910 Depreciation expense-office equipment 24,590 Depreciation expense-factory equipment 33,040 Direct labor 394,420 Heat, light, and power-factory 13,060 Indirect labor 46,100 Materials purchased 386,740 Office salaries expense 134,980 Property taxes-factory 10,760 Property taxes-headquarters building 22,280 Rent expense-factory 18,180 Sales 1,810,770 Sales salaries expense 222,310 Supplies-factory 8,960 Miscellaneous costs-factory 5,630 Required:

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter5: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 5.26EX

Related questions

Question

Transcribed Image Text:The following information is available for Shanika Company for 20Y6:

Inventories

January 1

December 31

Materials

$203,270

$256,120

Work in process

365,890

348,320

Finished goods

351,660

356,010

Advertising expense

$173,910

Depreciation expense-office equipment

24,590

Depreciation expense-factory equipment

33,040

Direct labor

394,420

Heat, light, and power-factory

13,060

Indirect labor

46,100

Materials purchased

386,740

Office salaries expense

134,980

Property taxes-factory

10,760

Property taxes-headquarters building

22,280

Rent expense-factory

18,180

Sales

1,810,770

Sales salaries expense

222,310

Supplies-factory

8,960

Miscellaneous costs-factory

5,630

Required:

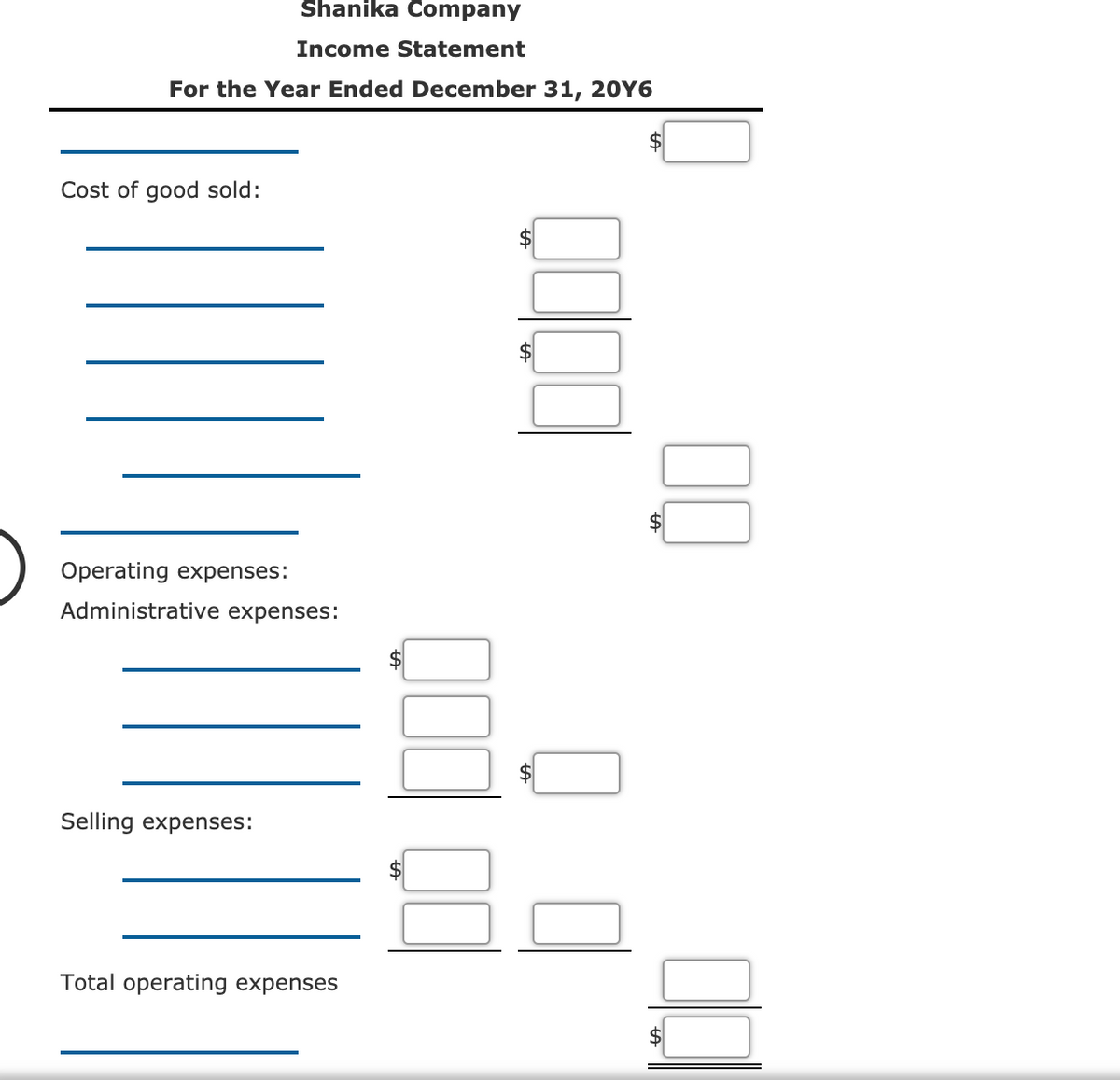

Transcribed Image Text:Shanika Company

Income Statement

For the Year Ended December 31, 20Y6

Cost of good sold:

$4

Operating expenses:

Administrative expenses:

Selling expenses:

Total operating expenses

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning