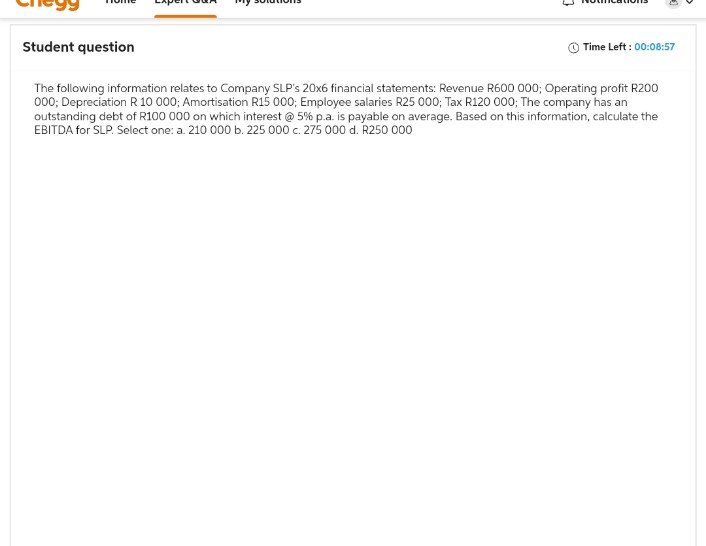

The following information relates to Company SLP's 20x6 financial statements: Revenue R600 000; Operating profit R200 000; Depreciation R 10 000; Amortisation R15 000; Employee salaries R25 000; Tax R120 000; The company has an outstanding debt of R100 000 on which interest @ 5% p.a. is payable on average. Based on this information, calculate the EBITDA for SLP. Select one: a. 210 000 b. 225 000 c. 275 000 d. R250 000

Q: Ingrid is planning to expand her business by taking on a new product that costs $6.74. In order to…

A: Break even point :— It is the point of production where total cost is equal to total revenue. At…

Q: Module 6 - Excel Lab Data Sheet Exercise 15.1 Barnaby's Hideaway uses Jim Beam Bourbon to prepare…

A: “Since you have posted multiple questions, we will provide the solution only to the first five…

Q: Garden Pro Corporation has sales of $4,953,171; income tax of $343,835; the selling, general and…

A: The net income is considered as an excess of total revenue over the total cost incurred. The…

Q: Leonardo, who is married but files separately, earns $66,000 of taxable income. He also has $17,600…

A: Effective tax rate is basically calculated by dividing total tax burden by total taxable income. It…

Q: Product Stock on Hand Number Sold Price Product X 150 R Product Y 200 Product Z 300 500 550 400…

A: Answer:- FormulaAverage price = Total revenue of product sold / Total number of products sold

Q: 0) THE BURKEY'S PURCHASED A CAR. IF THE TOTAL COST INCLUDING A 5% SALES TAX WAS $12,836.25, FIND THE…

A: Let take Total cost = 100Gst = $100×5%= $5Thus total cost plus gst = $105

Q: An audit includes a number of letters between the auditors and the company such as the report to…

A: Auditors are the professionals who check each detail furnished by the client through his/her…

Q: What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes?

A: Decision to discontinue a product line majorly depends on the profitability of the product and…

Q: Part D of this question asks what the gross profit would be for each plan. I am having trouble…

A: Gross profit is the income earned from an activity after deducting all the direct expenses from…

Q: California imposes a Non-Economic Substance Penalty (NEST) on a taxpayer with an understatement of…

A: If a transaction is found to lack economic substance, it might be disallowed for tax purposes, and…

Q: 2. Haag Corp.'s 2021 income statement showed pretax accounting income of $2,500,000. To compute…

A: The corporation has to pay income taxes. The income taxes are paid on the taxable income using the…

Q: From the following data: 1- Selling price per unit = $80 2- Manufacturing costs: Direct material per…

A: Income statement:— It is one of the financial statements that shows profitability, total revenue and…

Q: Record the adjusting entries. Post the adjusting entries to the general ledger. Prepare the adjusted…

A:

Q: Wildhorse Ltd. reported the following information in its balance sheet and income statement for the…

A: A cash flow statement indicates cash inflow and outflow information for a particular time period and…

Q: The adjusting entry to record a contingent liability requires a debit to a loss (or expense) account…

A: Contingent liability is a potential liability that arises as a result of past transactions but the…

Q: On 1 January 20X5 a company purchased some plant. The invoice showed $ Cost of plant 48,000…

A: Lets understand the basics.As per IAS 16 "Property plant and equipment", plant and machinery should…

Q: Phoebe, who files single, holds several crypto wallets with large account balances. Her adjusted…

A: Cryptocurrencies can be treated as property, securities, or currencies for tax purposes depending on…

Q: Kraft Company made the following journal entry in late 2014 for rent on property it leases to…

A: Income statement :- It is one of financial statements that shows profitability, total revenue and…

Q: following information applies to the questions displayed below.] The Platter Valley factory of Bybee…

A: According to the question given, we need to compute the overhead variances Variance:variance refers…

Q: Crosby Company owns a chain of hardware stores throughout the state. The company uses a periodic…

A: Cost of goods of sold in simple terms is the amount or price at which the seller sells the goods or…

Q: Consider the following income statement: Sales $ 912,400 Costs 593,600 Depreciation 135,000 Taxes…

A: The income statement is one of the important financial statements of the business. The net income is…

Q: Nokia Corporation is a global leader in providing integrated communications and electronic solutions…

A: Financial Leverage is one of useful leverage ratio being used in business. This is calculated by…

Q: Assume the following (1) variable expenses = $302,000, (2) unit sales = 10,000, (3) the contribution…

A: Income statement :— It is one of the financial statements that shows profitability, total revenue…

Q: 3. XYZ Ltd incurred $500 000 of manufacturing overhead costs during the financial year 2021.…

A: Lets understand the basics.There are two method of closing overhead account which are,(1) Closing to…

Q: Bramble Corp. has income from continuing operations of $236,000 for the year ended December 31,…

A: Multi-Step Income Statement includes a detailed statement showing continuing and discontinued…

Q: At her death, Chow owned 55% of the stock in Finch Corporation, with the balance held by family…

A: When one firm buys another, goodwill frequently results because the acquisition price was greater…

Q: Wildhorse Corporation purchased a machine on January 2, 2020, for $4900000. The machine has an…

A: Lets understand the basics.When temporary difference arise between the book profit and taxable…

Q: A partnership is considering possible liquidation because one of the partners (Bell) is personally…

A: According to the question given, we need to prepare the statement of liquidation.Partnership…

Q: 3. Given the following transactions for Clip Corporation, prepare a trial balance as of March 31,…

A: The journal entries are prepared to record the transactions on regular basis. The trial balance is…

Q: Crystal Charm Company makes handcrafted silver charms that attach to jewelry such as a necklace or…

A: For the purpose of determining the direct material variation the actual costs incurred are required…

Q: "In order to determine whether internal control operated effectively to minimize errors of failure…

A: Internal control is a procedure that is aimed to offer reasonable confidence that information is…

Q: How does a seller allocate a transaction price to a contract’s performance obligations?

A: Transaction Price is the price expected to be realised on transferring the promised goods and…

Q: e. Compute the price and usage variances for direct materials and direct labor. f. Compute the fixed…

A: The variance is the difference between the actual data and standard output of the production.

Q: Miss Take Corp. is a small private corporation that does NOT prepare comparative statements. At the…

A: Rectification of Errors is the process of correcting errors that are made when transactions are…

Q: If the taxpayer materially participated in an activity for any __5_ of the _10__taxable years that…

A: Material participation refers to being actively involved in a trade, business, or other…

Q: IIIIIIIIs (Cash Flow Reporting) Brockman Guitar Company is in the business of manufacturing…

A: An ethical issue is a dilemma or circumstance in which a person must make a decision between two…

Q: [The following information applies to the questions displayed below.] Carlberg Company has two…

A: Under weighted average method, cost per equivalent unit is calculated by adding the beginning work…

Q: Exercise 6-4 Alternative cost flow assumptions-perpetual inventory system LO2 Sport Box sells a wide…

A: FIFO is an acronym for first-in, first-out which states that the inventory purchased first will be…

Q: When determining whether a liability exists, the intentions or actions of management do not need to…

A: Liability refers to the legal responsibility or obligation that an individual, association, or…

Q: The following information is provided for the sales of merchandise item PQ for the first week of…

A: Inventory valuation method you to calculate the total amount of purchases, total amount of issues of…

Q: Trey is in the 32% tax bracket. He acquired 4,000 shares of stock in Midlands Corporation ten years…

A: Calculating tax liability for redeeming qualified stocks involves applying the favorable tax rate on…

Q: The following condensed balance sheet is for the partnership of Gulian, Singh, and Zahiri, who share…

A: Liquidation is the process of closing a business and distributing its assets to claimants in…

Q: Aubergine Ltd. currently owns 12% of the outstanding common shares of Benz Ltd. Borchoi Ltd. and…

A: In order to determine the minimum percentage of additional common shares that Aubergine Ltd. needs…

Q: Which of the following is NOT a function of the XRB? Select one alternative: O Developing and…

A: The XRB is the External Reporting Board of New Zealand. It is responsible for developing and issuing…

Q: Company operates a small factory in which it manufactures two products: C and D. Production and…

A: Marginal costing provides a clearer understanding of the cost behavior of a business, enabling…

Q: Indicate which of the following features would be considered an advantage of acquiring assets rather…

A: When acquiring a company, the buyer can choose to acquire assets or shares. Acquiring assets allows…

Q: The degree to which a particular stakeholder may be able to positively or negatively affect a…

A: Certainly! Stakeholder influence, often referred to as stakeholder power or influence level, is a…

Q: Total Pop's data show the following information: Estimated sales in units Sales price per unit…

A: Budgets are the estimates or forecasts made for future period. Production budget shows how many…

Q: Prepare a bank reconciliation statement.

A: A crucial financial instrument for balancing disparities between a company's internal financial…

Q: thcheck Corp. manufactures an antacid product that passes through two departments. Data for June for…

A: The equivalent units are calculated on the basis of the percentage of the work completed during the…

Plz I need fast without plagiarism plz I definitely give up vote

Step by step

Solved in 3 steps

- A company has pre-tax or operating income of $120,000. If the tax rate is 40%, what is the companys after-tax income? A. $300,000 B. $240,000 C. $48,000 D. $72,000Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of $160,000 for 2019. The corporation also has $30,000 in dividends from publicly traded domestic corporations in which the ownership percentage was 45 percent. Calculate the corporation's dividends received deduction for 2019. $_____________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $135,000. Calculate the corporation's dividends received deduction for 2019. $___________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $158,000. Calculate the corporation's dividends received deduction for 2019. $_____________Shareholders' equity in a firm is $500. The firm owes a total of $400 of which 75 percent is payable this year. In addition, credit sales to customers total 5000 of which 80 percent is due this year The firm has net fixed assets of $600. What is the amount of the net working capital? Options : a. $0 b. $3200 c. $3700 d. -$4200 e. -$4100

- Income Statements for the Year Ended 31st Dec 2020 KM Ltd ROW Ltd £'000 £'000 Sales revenue 8,320 11,250 Cost of sales (6,020) (9,030) Gross profit 2,300 2,220 Operating expenses (1,048) (1,535) Operating profit 1,252 685 Finance charges (20) (70) Profit before tax 1,232 615 Taxation (62) (30) Profit for the year 1,170 585 SOFP (Balance Sheet) as at 31st Dec 2020 KM Ltd ROW Ltd £'000 £'000 £'000 £'000 Non-current assets 502 198 Current assets Inventory 1,290 2,437 Trade receivables 730 1,990 2,020 4,427 Total assets 2,522 4,625 Equity Share capital 1,350 800 Reserves 580 1,145 1,930 1,945…Income Statements for the Year Ended 31st Dec 2020 KM Ltd ROW Ltd £'000 £'000 Sales revenue 8,320 11,250 Cost of sales (6,020) (9,030) Gross profit 2,300 2,220 Operating expenses (1,048) (1,535) Operating profit 1,252 685 Finance charges (20) (70) Profit before tax 1,232 615 Taxation (62) (30) Profit for the year 1,170 585 SOFP (Balance Sheet) as at 31st Dec 2020 KM Ltd ROW Ltd £'000 £'000 £'000 £'000 Non-current assets 502 198 Current assets Inventory 1,290 2,437 Trade receivables 730 1,990 2,020 4,427 Total assets 2,522 4,625 Equity Share capital 1,350 800 Reserves 580 1,145 1,930 1,945…Income Statements for the Year Ended 31st Dec 2020 KM Ltd ROW Ltd £'000 £'000 Sales revenue 8,320 11,250 Cost of sales (6,020) (9,030) Gross profit 2,300 2,220 Operating expenses (1,048) (1,535) Operating profit 1,252 685 Finance charges (20) (70) Profit before tax 1,232 615 Taxation (62) (30) Profit for the year 1,170 585 SOFP (Balance Sheet) as at 31st Dec 2020 KM Ltd ROW Ltd £'000 £'000 £'000 £'000 Non-current assets 502 198 Current assets Inventory 1,290 2,437 Trade receivables 730 1,990 2,020 4,427 Total assets 2,522 4,625 Equity Share capital 1,350 800 Reserves 580 1,145 1,930 1,945…

- Capital 1 January 2019 350 000 Drawings 20 000 Sales (70% on credit) 950 000 Gross profit 250 000 Total expenses 80 000 Bank favourable 26 000 Net profit 74 000 Trade creditors 26 000 Property, plant and equipment 350 000 Fixed deposit 20 000 Inventory 72 000 Trade Debtors 80 000 Mortgage Loan 100 000 Calculate the following ratios and explain what each ratio means in relation to the industry average given in brackets. Show your calculations as marks will be awarded for these. Round off to 2 decimal places. Q.2.1.4 Current ratio (2:1).A company's net income before interest & tax was OMR 400000 for its most recent year. The company's income statement included Income Tax Expense of OMR 140000 and Interest Expense of OMR 60000. At the beginning of the year the company's shareholders' equity was OMR 1900000 and at the end of the year it was OMR 2100000. Long term loan ( Debt) was OMR 800000. Calculate return on capital employed Select one: a. 13.7% b. 16.1% c. 11.7% d. 9.5%The hypothetical company XYZ Inc started its operations in 2020. On December 31 2020, it had the following adjusted trial balance: Account Balance ($) Notes Payable 20,000 Wages Payable 8,000 Additional Paid In Capital 300,000 Common Stock at par value 60,000 A/P 60,000 PP&E (at cost) 110,000 Inventory 62,000 Cash 419,000 Unearned Revenues 10,000 Accumulated Depreciation 10,000 Account Receivables ? Retained Earnings 230,000 During 2021 the following transactions occurred: A dividend of $20,000 was declared during 2021. These dividends will be paid in 2022. During the year the company performed and delivered services and billed its clients for $900,000. Collections from customers were $800,000. In addition to the transactions described in items 3 above, products were shipped to the customers who paid $10,000 in advance (see December 31, 2020 balances). The selling price was $80,000…

- The hypothetical company XYZ Inc started its operations in 2020. On December 31 2020, it had the following adjusted trial balance: Account Balance ($) Notes Payable 20,000 Wages Payable 8,000 Additional Paid In Capital 300,000 Common Stock at par value 60,000 A/P 60,000 PP&E (at cost) 110,000 Inventory 62,000 Cash 419,000 Unearned Revenues 10,000 Accumulated Depreciation 10,000 Account Receivables ? Retained Earnings 230,000 During 2021 the following transactions occurred: A dividend of $20,000 was declared during 2021. These dividends will be paid in 2022. During the year the company performed and delivered services and billed its clients for $900,000. Collections from customers were $800,000. In addition to the transactions described in items 3 above, products were shipped to the customers who paid $10,000 in advance (see December 31, 2020 balances). The selling price was $80,000…The hypothetical company XYZ Inc started its operations in 2020. On December 31 2020, it had the following adjusted trial balance: Account Balance ($) Notes Payable 20,000 Wages Payable 8,000 Additional Paid In Capital 300,000 Common Stock at par value 60,000 A/P 60,000 PP&E (at cost) 110,000 Inventory 62,000 Cash 419,000 Unearned Revenues 10,000 Accumulated Depreciation 10,000 Account Receivables ? Retained Earnings 230,000 During 2021 the following transactions occurred: A dividend of $20,000 was declared during 2021. These dividends will be paid in 2022. During the year the company performed and delivered services and billed its clients for $900,000. Collections from customers were $800,000. In addition to the transactions described in items 3 above, products were shipped to the customers who paid $10,000 in advance (see December 31, 2020 balances). The selling price was $80,000…The following trial balance relates to Queenie as at 30 September 2019: RM'000RM'000 Revenue (note (i)) 312,890 Cost of sales 148,900 Distribution costs 42,125 Administrative expenses (note (ii))34,680 Loan note interest and dividend paid (notes (ii) and (iii)) 19,500 Investment income3200 Equity shares of 25 cents each 50,000 5% loan note (note (ii)) 30,000 Retained earnings at 1 October 20187,300 Plant and equipment at cost (note (iv)) 90,000 Accumulated depreciation at 1 October 2018: plant and equipment 32,400 Equity financial asset investments (note (v))40,000 Inventory at 30 September 201930,040 Trade receivables 42,900 Bank10,845 Current tax (note (vi)) 1,100 Deferred tax (note (vi)) 900 Trade payables23,400 460090460090 The following notes are relevant: (i) On 1 October 2018, Queenie sold one of its products for RM12 million (included in revenue in the trial balance). As part of the sale agreement, Queenie is committed to the ongoing servicing of this product until 30…