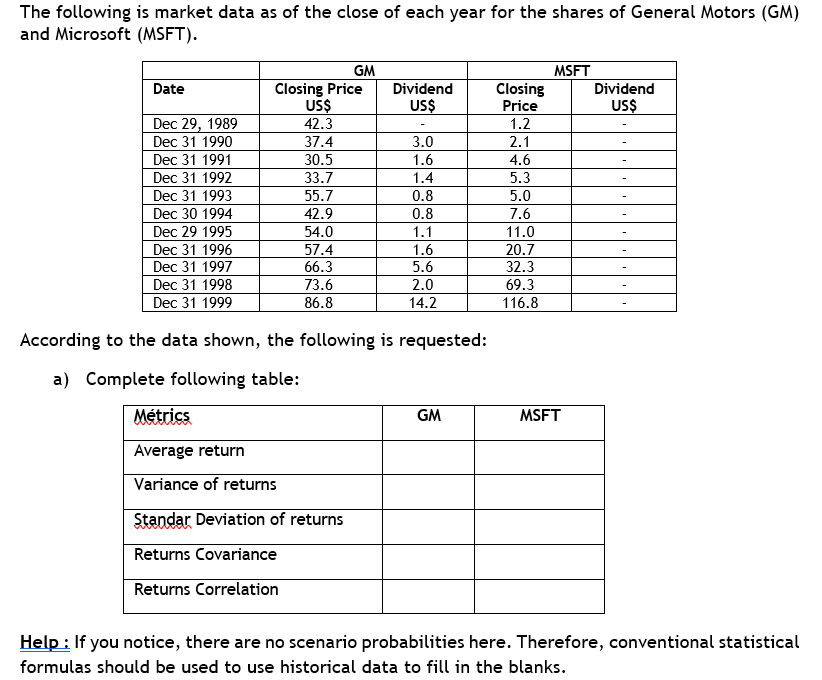

The following is market data as of the close of each year for the shares of General Motors (GM) and Microsoft (MSFT). Date Dec 29, 1989 Dec 31 1990 Dec 31 1991 Dec 31 1992 Dec 31 1993 Dec 30 1994 Dec 29 1995 Dec 31 1996 Dec 31 1997 Dec 31 1998 Dec 31 1999 Closing Price US$ 42.3 37.4 30.5 33.7 55.7 42.9 54.0 57.4 66.3 73.6 86.8 GM Métrics Average return Variance of returns Standar Deviation of returns Returns Covariance Returns Correlation Dividend US$ 3.0 1.6 1.4 0.8 0.8 1.1 1.6 5.6 2.0 14.2 According to the data shown, the following is requested: a) Complete following table: GM Closing Price 1.2 2.1 4.6 5.3 5.0 7.6 11.0 20.7 32.3 69.3 116.8 MSFT MSFT Dividend US$ Help: If you notice, there are no scenario probabilities here. Therefore, conventional statistical formulas should be used to use historical data to fill in the blanks.

The following is market data as of the close of each year for the shares of General Motors (GM) and Microsoft (MSFT). Date Dec 29, 1989 Dec 31 1990 Dec 31 1991 Dec 31 1992 Dec 31 1993 Dec 30 1994 Dec 29 1995 Dec 31 1996 Dec 31 1997 Dec 31 1998 Dec 31 1999 Closing Price US$ 42.3 37.4 30.5 33.7 55.7 42.9 54.0 57.4 66.3 73.6 86.8 GM Métrics Average return Variance of returns Standar Deviation of returns Returns Covariance Returns Correlation Dividend US$ 3.0 1.6 1.4 0.8 0.8 1.1 1.6 5.6 2.0 14.2 According to the data shown, the following is requested: a) Complete following table: GM Closing Price 1.2 2.1 4.6 5.3 5.0 7.6 11.0 20.7 32.3 69.3 116.8 MSFT MSFT Dividend US$ Help: If you notice, there are no scenario probabilities here. Therefore, conventional statistical formulas should be used to use historical data to fill in the blanks.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter13: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 8PEB

Related questions

Question

100%

COURSE: FINANCE LEVEL 2

Please, see attached files

Thanks

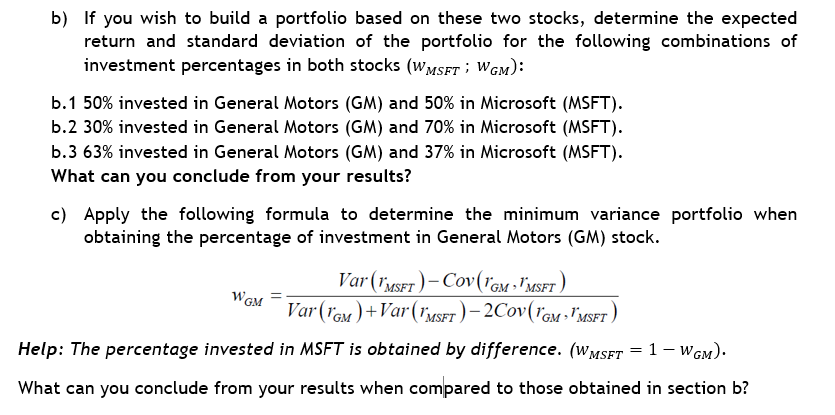

Transcribed Image Text:b) If you wish to build a portfolio based on these two stocks, determine the expected

return and standard deviation of the portfolio for the following combinations of

investment percentages in both stocks (WMSFT; WGM):

b.1 50% invested in General Motors (GM) and 50% in Microsoft (MSFT).

b.2 30% invested in General Motors (GM) and 70% in Microsoft (MSFT).

b.3 63% invested in General Motors (GM) and 37% in Microsoft (MSFT).

What can you conclude from your results?

c) Apply the following formula to determine the minimum variance portfolio when

obtaining the percentage of investment in General Motors (GM) stock.

Var (MSFT)-CoV (GM - MSFT)

Var (GM)+Var (MSFT)-2COV(GM MSFT)

Help: The percentage invested in MSFT is obtained by difference. (WMSFT = 1 - WGM).

What can you conclude from your results when compared to those obtained in section b?

WGM

Transcribed Image Text:The following is market data as of the close of each year for the shares of General Motors (GM)

and Microsoft (MSFT).

Date

Dec 29, 1989

Dec 31 1990

Dec 31 1991

Dec 31 1992

Dec 31 1993

Dec 30 1994

Dec 29 1995

Dec 31 1996

Dec 31 1997

Dec 31 1998

Dec 31 1999

Closing Price

US$

42.3

37.4

30.5

33.7

55.7

42.9

54.0

57.4

66.3

73.6

86.8

GM

Métrics

Average return

Variance of returns

Standar Deviation of returns

Returns Covariance

Returns Correlation

Dividend

US$

3.0

1.6

1.4

0.8

0.8

1.1

1.6

5.6

2.0

14.2

According to the data shown, the following is requested:

a) Complete following table:

GM

Closing

Price

1.2

2.1

4.6

5.3

5.0

7.6

11.0

20.7

32.3

69.3

116.8

MSFT

MSFT

Dividend

US$

Help : If you notice, there are no scenario probabilities here. Therefore, conventional statistical

formulas should be used to use historical data to fill in the blanks.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,