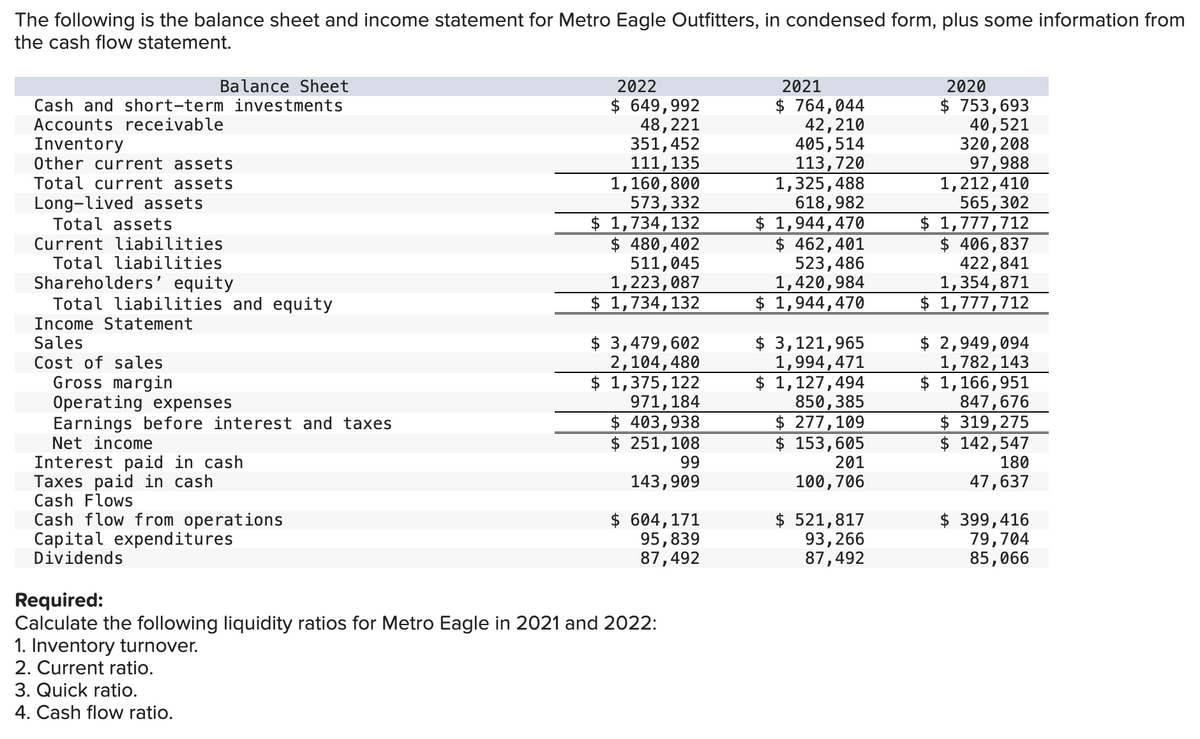

The following is the balance sheet and income statement for Metro Eagle Outfitters, in condensed form, plus some information fro the cash flow statement. Balance Sheet Cash and short-term investments Accounts receivable Inventory Other current assets Total current assets Long-lived assets. Total assets Current liabilities. Total liabilities Shareholders' equity Total liabilities and equity Income Statement Sales Cost of sales Gross margin Operating expenses Earnings before interest and taxes. Net income Interest paid in cash Taxes paid in cash Cash Flows Cash flow from operations Capital expenditures Dividends 2022 $ 649,992 48,221 351, 452 111, 135 1,160,800 573,332 1. Inventory turnover. 2. Current ratio. 3. Quick ratio. 4. Cash flow ratio. $ 1,734, 132 $ 480,402 511,045 1,223,087 $ 1,734, 132 $ 3,479,602 2,104,480 $ 1,375, 122 971, 184 $403,938 $ 251,108 99 143,909 $ 604,171 95,839 87,492 Required: Calculate the following liquidity ratios for Metro Eagle in 2021 and 2022: 2021 $764,044 42,210 405,514 113,720 1,325,488 618,982 $ 1,944, 470 $ 462,401 523,486 1,420,984 $ 1,944, 470 $ 3,121,965 1,994,471 $ 1,127,494 850,385 $ 277,109 $ 153,605 201 100,706 $ 521,817 93,266 87,492 2020 $ 753,693 40,521 320,208 97,988 1,212,410 565,302 $ 1,777,712 $ 406,837 422,841 1,354,871 $ 1,777,712 $ 2,949,094 1,782, 143 $ 1,166,951 847,676 $ 319,275 $ 142,547 180 47,637 $ 399,416 79,704 85,066

The following is the balance sheet and income statement for Metro Eagle Outfitters, in condensed form, plus some information fro the cash flow statement. Balance Sheet Cash and short-term investments Accounts receivable Inventory Other current assets Total current assets Long-lived assets. Total assets Current liabilities. Total liabilities Shareholders' equity Total liabilities and equity Income Statement Sales Cost of sales Gross margin Operating expenses Earnings before interest and taxes. Net income Interest paid in cash Taxes paid in cash Cash Flows Cash flow from operations Capital expenditures Dividends 2022 $ 649,992 48,221 351, 452 111, 135 1,160,800 573,332 1. Inventory turnover. 2. Current ratio. 3. Quick ratio. 4. Cash flow ratio. $ 1,734, 132 $ 480,402 511,045 1,223,087 $ 1,734, 132 $ 3,479,602 2,104,480 $ 1,375, 122 971, 184 $403,938 $ 251,108 99 143,909 $ 604,171 95,839 87,492 Required: Calculate the following liquidity ratios for Metro Eagle in 2021 and 2022: 2021 $764,044 42,210 405,514 113,720 1,325,488 618,982 $ 1,944, 470 $ 462,401 523,486 1,420,984 $ 1,944, 470 $ 3,121,965 1,994,471 $ 1,127,494 850,385 $ 277,109 $ 153,605 201 100,706 $ 521,817 93,266 87,492 2020 $ 753,693 40,521 320,208 97,988 1,212,410 565,302 $ 1,777,712 $ 406,837 422,841 1,354,871 $ 1,777,712 $ 2,949,094 1,782, 143 $ 1,166,951 847,676 $ 319,275 $ 142,547 180 47,637 $ 399,416 79,704 85,066

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter12: The Statement Of Cash Flows

Section: Chapter Questions

Problem 12.1KTQ

Related questions

Question

Transcribed Image Text:The following is the balance sheet and income statement for Metro Eagle Outfitters, in condensed form, plus some information from

the cash flow statement.

Balance Sheet

Cash and short-term investments

Accounts receivable

Inventory

Other current assets

Total current assets

Long-lived assets

Total assets

Current liabilities

Total liabilities

Shareholders' equity

Total liabilities and equity

Income Statement

Sales

Cost of sales

Gross margin

Operating expenses

Earnings before interest and taxes

Net income

Interest paid in cash

Taxes paid in cash

Cash Flows

Cash flow from operations

Capital expenditures

Dividends

2022

$ 649,992

48,221

351, 452

111,135

1,160,800

573,332

$ 1,734, 132

$ 480,402

511,045

1,223,087

$ 1,734, 132

1. Inventory turnover.

2. Current ratio.

3. Quick ratio.

4. Cash flow ratio.

$ 3,479,602

2,104,480

$ 1,375,122

971,184

$ 403,938

$ 251,108

99

143,909

$ 604,171

95,839

87,492

Required:

Calculate the following liquidity ratios for Metro Eagle in 2021 and 2022:

2021

$ 764,044

42,210

405,514

113,720

1,325,488

618,982

$ 1,944,470

$ 462,401

523,486

1,420,984

$ 1,944,470

$ 3,121,965

1,994,471

$ 1,127,494

850,385

$ 277,109

$ 153,605

201

100,706

$ 521,817

93,266

87,492

2020

$ 753,693

40,521

320,208

97,988

1,212,410

565,302

$ 1,777,712

$ 406,837

422,841

1,354,871

$ 1,777,712

$ 2,949,094

1,782, 143

$ 1,166,951

847,676

$ 319,275

$ 142,547

180

47,637

$ 399,416

79,704

85,066

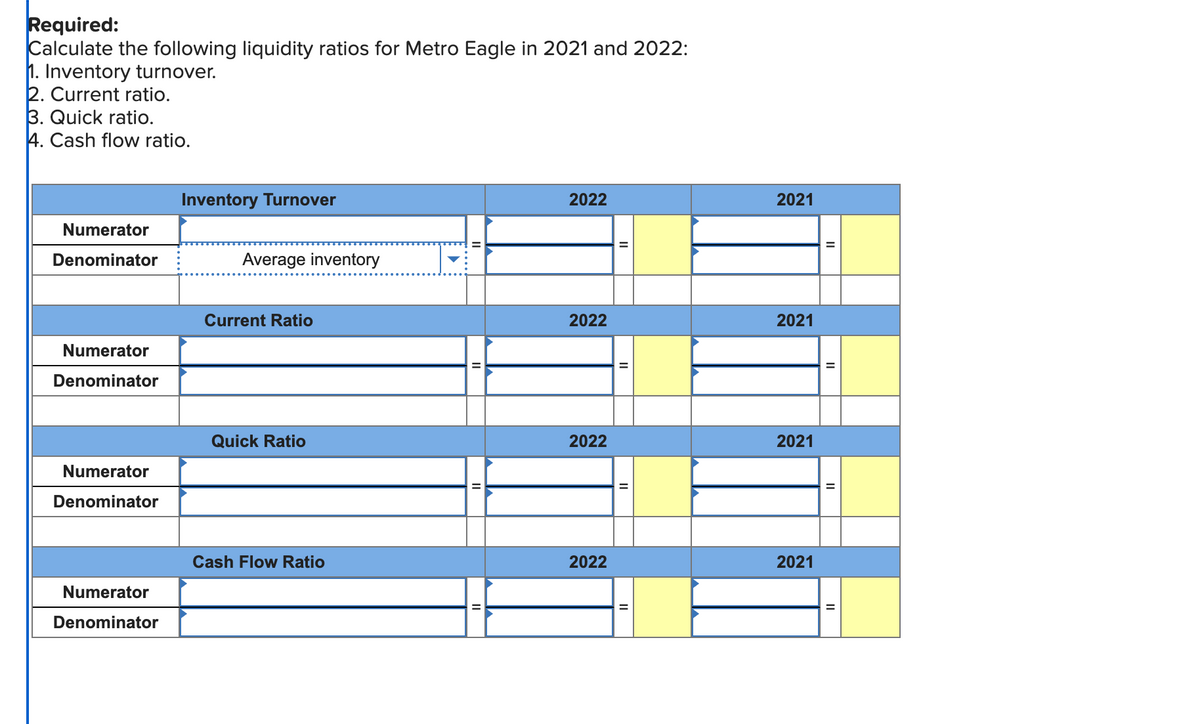

Transcribed Image Text:Required:

Calculate the following liquidity ratios for Metro Eagle in 2021 and 2022:

1. Inventory turnover.

2. Current ratio.

3. Quick ratio.

4. Cash flow ratio.

Numerator

Denominator

Numerator

Denominator

Numerator

Denominator

Numerator

Denominator

Inventory Turnover

Average inventory

Current Ratio

Quick Ratio

Cash Flow Ratio

11

2022

2022

2022

2022

2021

2021

2021

2021

11

II

II

||

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub