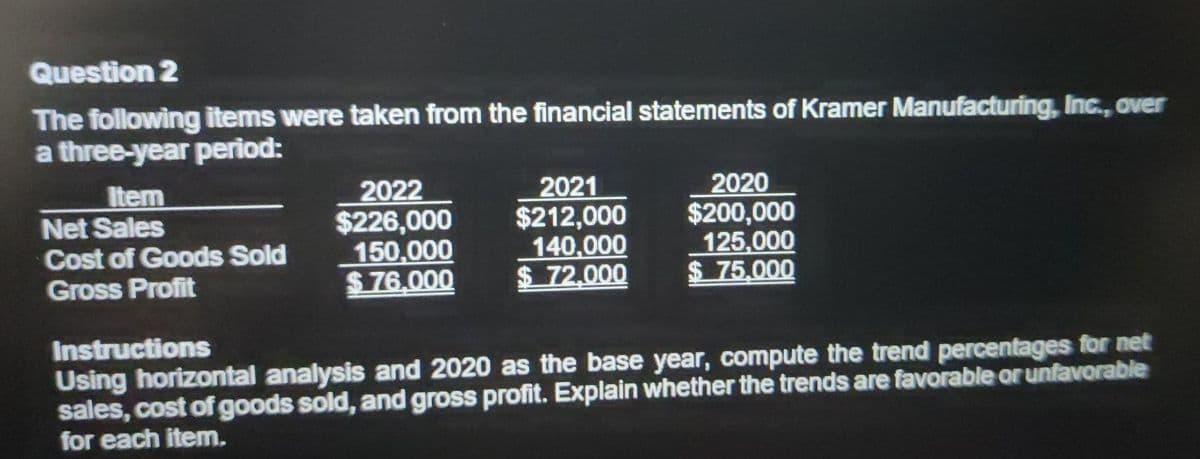

The following items were taken from the financial statements of Kramer Manufacturing, Inc., over a three-year period: Item Net Sales Cost of Goods Sold Gross Profit -醉融除 2022 $226,000 150,000 $76.000 2021 $212,000 140,000 $ 72,000 2020 $200,000 125,000 $ 75,000 Instructions Using horizontal analysis and 2020 as the base year, compute the trend percentages for net sales, cost of goods sold, and gross profit. Explain whether the trends are favorable or unfavorable for each item.

The following items were taken from the financial statements of Kramer Manufacturing, Inc., over a three-year period: Item Net Sales Cost of Goods Sold Gross Profit -醉融除 2022 $226,000 150,000 $76.000 2021 $212,000 140,000 $ 72,000 2020 $200,000 125,000 $ 75,000 Instructions Using horizontal analysis and 2020 as the base year, compute the trend percentages for net sales, cost of goods sold, and gross profit. Explain whether the trends are favorable or unfavorable for each item.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter14: Financial Statement Analysis

Section: Chapter Questions

Problem 14.1EX: Vertical analysis of income statement Revenue and expense data for Innovation Quarter Inc. for two...

Related questions

Question

Transcribed Image Text:Question 2

The following items were taken from the financial statements of Kramer Manufacturing, Inc., over

a three-year period:

Item

Net Sales

Cost of Goods Sold

Gross Profit

2022

$226,000

150.000

$ 76.000

2021

$212,000

140,000

$ 72,000

2020

$200,000

125,000

$ 75,000

Instructions

Using horizontal analysis and 2020 as the base year, compute the trend percentages for net

sales, cost of goods sold, and gross profit. Explain whether the trends are favorable or unfavorable

for each item.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning