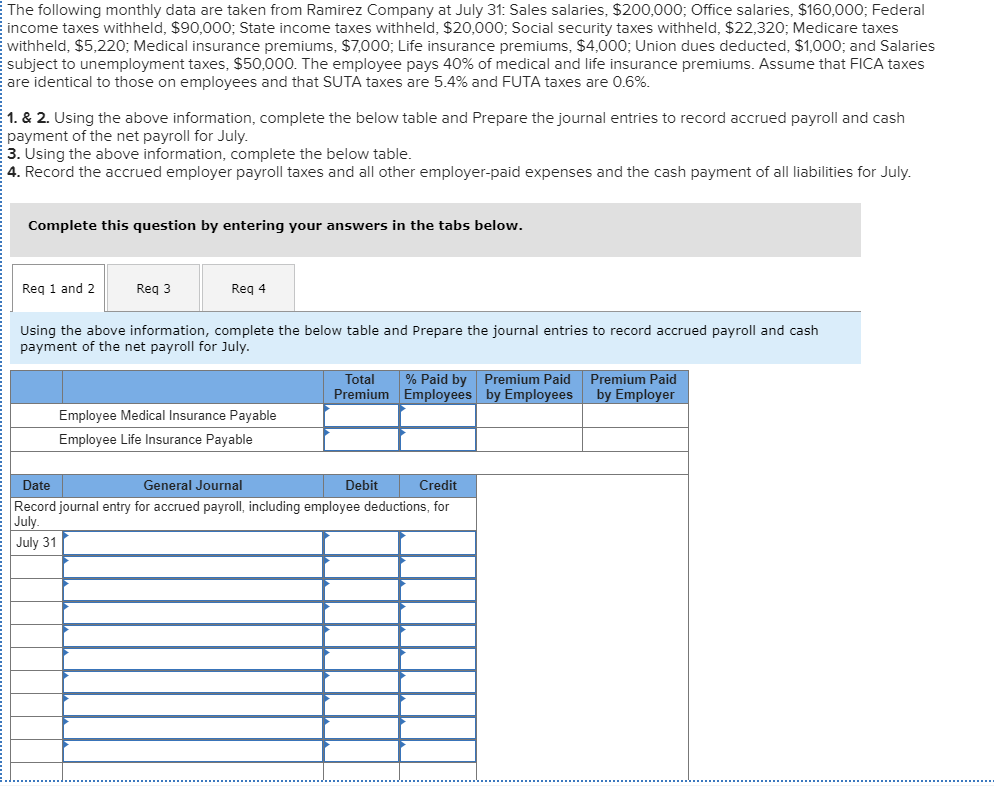

The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $200,000; Office salaries, $160,000; Federal income taxes withheld, $90,000; State income taxes withheld, $20,000; Social security taxes withheld, $22,320; Medicare taxes withheld, $5,220; Medical insurance premiums, $7,000; Life insurance premiums, $4,000; Union dues deducted, $1,000; and Salaries subject to unemployment taxes, $50,000. The employee pays 40% of medical and life insurance premiums. Assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6% 1. & 2. Using the above information, complete the below table and Prepare the journal entries to record accrued payroll and cash payment of the net payroll for July. 3. Using the above information, complete the below table. 4. Record the accrued employer payroll taxes and all other employer-paid expenses and the cash payment of all liabilities for July. Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Req 4 Using the above information, complete the below table and Prepare the journal entries to record accrued payroll and cash payment of the net payroll for July Premium Paid by Employer Premium Paid % Paid by Premium Employees by Employees Total Employee Medical Insurance Payable Employee Life Insurance Payable Date Credit General Journal Debit Record journal entry for accrued payroll, including employee deductions, for July July 31

The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $200,000; Office salaries, $160,000; Federal income taxes withheld, $90,000; State income taxes withheld, $20,000; Social security taxes withheld, $22,320; Medicare taxes withheld, $5,220; Medical insurance premiums, $7,000; Life insurance premiums, $4,000; Union dues deducted, $1,000; and Salaries subject to unemployment taxes, $50,000. The employee pays 40% of medical and life insurance premiums. Assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6% 1. & 2. Using the above information, complete the below table and Prepare the journal entries to record accrued payroll and cash payment of the net payroll for July. 3. Using the above information, complete the below table. 4. Record the accrued employer payroll taxes and all other employer-paid expenses and the cash payment of all liabilities for July. Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Req 4 Using the above information, complete the below table and Prepare the journal entries to record accrued payroll and cash payment of the net payroll for July Premium Paid by Employer Premium Paid % Paid by Premium Employees by Employees Total Employee Medical Insurance Payable Employee Life Insurance Payable Date Credit General Journal Debit Record journal entry for accrued payroll, including employee deductions, for July July 31

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter9: Payroll Accounting: Employer Taxes And Reports

Section: Chapter Questions

Problem 1CP

Related questions

Question

100%

Transcribed Image Text:The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $200,000; Office salaries, $160,000; Federal

income taxes withheld, $90,000; State income taxes withheld, $20,000; Social security taxes withheld, $22,320; Medicare taxes

withheld, $5,220; Medical insurance premiums, $7,000; Life insurance premiums, $4,000; Union dues deducted, $1,000; and Salaries

subject to unemployment taxes, $50,000. The employee pays 40% of medical and life insurance premiums. Assume that FICA taxes

are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6%

1. & 2. Using the above information, complete the below table and Prepare the journal entries to record accrued payroll and cash

payment of the net payroll for July.

3. Using the above information, complete the below table.

4. Record the accrued employer payroll taxes and all other employer-paid expenses and the cash payment of all liabilities for July.

Complete this question by entering your answers in the tabs below.

Req 1 and 2

Req 3

Req 4

Using the above information, complete the below table and Prepare the journal entries to record accrued payroll and cash

payment of the net payroll for July

Premium Paid

by Employer

Premium Paid

% Paid by

Premium Employees by Employees

Total

Employee Medical Insurance Payable

Employee Life Insurance Payable

Date

Credit

General Journal

Debit

Record journal entry for accrued payroll, including employee deductions, for

July

July 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage