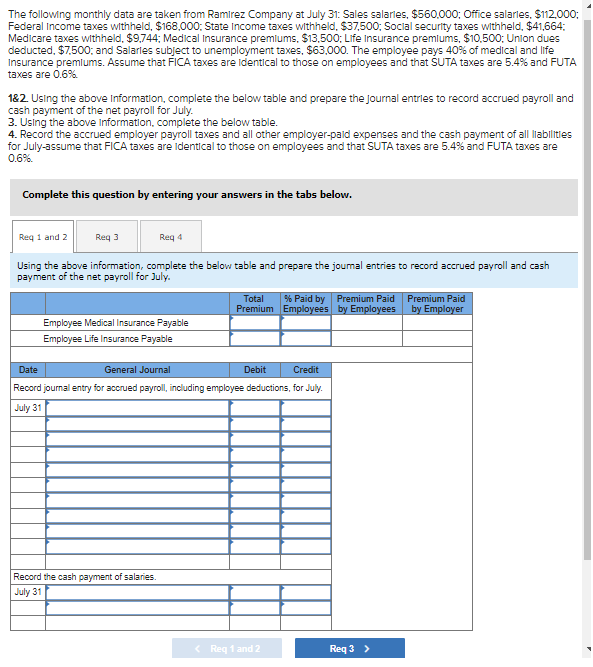

The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $560,000: Office salarles, $112.000: Federal Income taxes withheld, $168.000: State Income taxes withheld, $37,500: Social security taxes withheld, $41,664: Medicare taxes withheld, $9,744; Medical Insurance premlums. $13.500; Life Insurance premlums, $10,500: Union dues deducted, $7,500: and Salarles subject to unemployment taxes, $63,000. The employee pays 40% of medical and life Insurance premlums. Assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6%. 182. Using the above Information, complete the below table and prepare the Journal entries to record accrued payroll and cash payment of the net payroll for July. 3. Using the above Information, complete the below table.

The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $560,000: Office salarles, $112.000: Federal Income taxes withheld, $168.000: State Income taxes withheld, $37,500: Social security taxes withheld, $41,664: Medicare taxes withheld, $9,744; Medical Insurance premlums. $13.500; Life Insurance premlums, $10,500: Union dues deducted, $7,500: and Salarles subject to unemployment taxes, $63,000. The employee pays 40% of medical and life Insurance premlums. Assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6%. 182. Using the above Information, complete the below table and prepare the Journal entries to record accrued payroll and cash payment of the net payroll for July. 3. Using the above Information, complete the below table.

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 1PA: On January 1, 2018, King Inc. borrowed $150,000 and signed a 5-year, note payable with a 10%...

Related questions

Question

Transcribed Image Text:The following monthly data are taken from Ramirez Company at July 31: Sales salarles, $560.000; Office salarles, $112.000:

Federal Income taxes withheld, $168,000: State Income taxes withheld, $37,500; Socilal security taxes withheld, $41,664:

Medicare taxes withheld, $9,744; Medical Insurance premlums, $13,500; Life Insurance premlums, $10,500; Union dues

deducted, $7.500: and Salarles subject to unemployment taxes, $63,000. The employee pays 40% of medical and life

Insurance premlums. Assume that FICA taxes are ldentical to those on employees and that SUTA taxes are 5.4% and FUTA

taxes are 0.6%

182. Using the above Information, complete the below table and prepare the Journal entrles to record accrued payroll and

cash payment of the net payroll for July.

3. Using the above Information, complete the below table.

4. Record the accrued employer payroll taxes and all other employer-paid expenses and the cash payment of all labilitles

for July-assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are

0.6%.

Complete this question by entering your answers in the tabs below.

Req 1 and 2

Req 3

Req 4

Using the above information, complete the below table and prepare the joumal entries to record accrued payroll and cash

payment of the net payroll for July.

% Paid by Premium Paid

Premium Employees by Employees

Total

Premium Paid

by Employer

Employee Medical Insurance Payable

Employee Life Insurance Payable

Date

General Journal

Debit

Credit

Record journal entry for accrued payroll, including employee deductions, for July.

July 31

Record the cash payment of salaries.

July 31

< Reg 1 and 2

Req 3 >

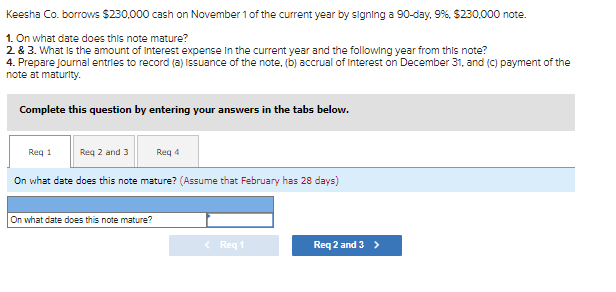

Transcribed Image Text:Keesha Co. borrows $230.000 cash on November 1 of the current year by signing a 90-day. 9%, $230,000 note.

1. On what date does this note mature?

2 & 3. What Is the amount of Interest expense in the current year and the following year from this note?

4. Prepare Jounal entries to record (a) Issuance of the note, (b) accrual of Interest on December 31, and (C) payment of the

note at maturity.

Complete this question by entering your answers in the tabs below.

Req 1

Req 2 and 3

Reg 4

On what date does this note mature? (Assume that February has 28 days)

On what date does this note mature?

< Req 1

Req 2 and 3 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning