The following payments are to be received and Using an annual effective interest rate of 2% (a) with payments P50,000 at the end of the first year, P 52,500 at the end of the second P 55,000 at the end of the third year and so on, until the final payment is P75,000. Determine the present value of these payments at time 0 and accumulated value at the time of the last payment using Increasing Annuity formulas instead. You may verify results only using the general formula. year,

The following payments are to be received and Using an annual effective interest rate of 2% (a) with payments P50,000 at the end of the first year, P 52,500 at the end of the second P 55,000 at the end of the third year and so on, until the final payment is P75,000. Determine the present value of these payments at time 0 and accumulated value at the time of the last payment using Increasing Annuity formulas instead. You may verify results only using the general formula. year,

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 17P

Related questions

Question

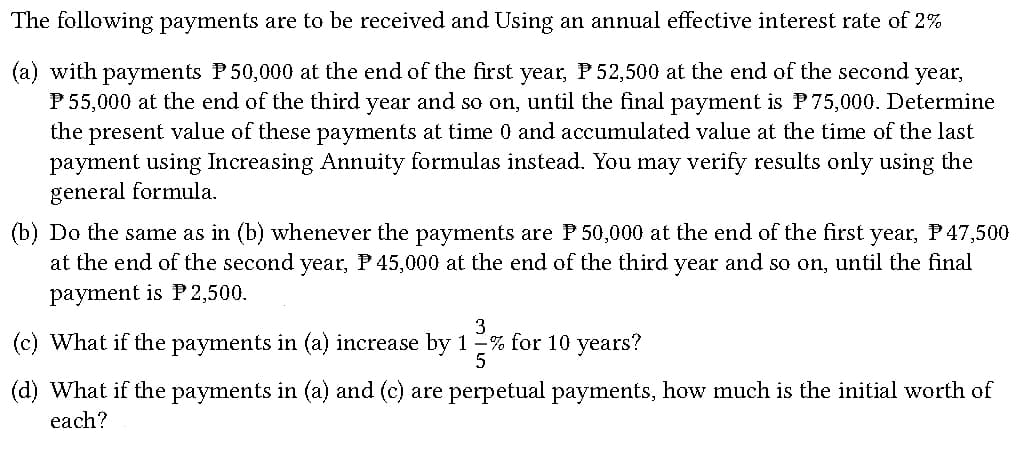

Transcribed Image Text:The following payments are to be received and Using an annual effective interest rate of 2%

(a) with payments P50,000 at the end of the first year, P52,500 at the end of the second year,

P 55,000 at the end of the third year and so on, until the final payment is P75,000. Determine

the present value of these payments at time 0 and accumulated value at the time of the last

payment using Increasing Annuity formulas instead. You may verify results only using the

general formula.

(b) Do the same as in (b) whenever the payments are P 50,000 at the end of the first year, P47,500

at the end of the second year, P 45,000 at the end of the third year and so on, until the final

payment is P 2,500.

3

(c) What if the payments in (a) increase by 1% for 10 years?

5

(d) What if the payments in (a) and (c) are perpetual payments, how much is the initial worth of

each?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning