The following selected post-retirement benefit accounts were lifted from the 2021 unadjusted trial balance of ENN Corporation. No adjusting entry had been made yet at year end in relation the post retirement benefits related accounts. Accrued Pension Expense, January 1, 2021 Pension expense for 2021, amount contributed to the plan #624,800 450,000 Additional information: The memorandum account balances and other off-books transactions are as follows: Plan asset at fair market value, January 1, 2021 Accumulated benefit obligation at present value, January 1, 2021 Payments to retirees at scheduled retirement in 2021 Current service cost Settlement rate Actuarial loss on plan asset Actuarial loss on accumulated benefit obligation 2,650,800 3,275,600 560,000 480,000 12% 120,000 80,000 There had been no remeasurement (actuarial) gain or loss from plan asset and accumulat retirement obligation in the prior years. The asset ceiling at the beginning and at the end of the ye was at $250,000 and $350,000, respectively.

The following selected post-retirement benefit accounts were lifted from the 2021 unadjusted trial balance of ENN Corporation. No adjusting entry had been made yet at year end in relation the post retirement benefits related accounts. Accrued Pension Expense, January 1, 2021 Pension expense for 2021, amount contributed to the plan #624,800 450,000 Additional information: The memorandum account balances and other off-books transactions are as follows: Plan asset at fair market value, January 1, 2021 Accumulated benefit obligation at present value, January 1, 2021 Payments to retirees at scheduled retirement in 2021 Current service cost Settlement rate Actuarial loss on plan asset Actuarial loss on accumulated benefit obligation 2,650,800 3,275,600 560,000 480,000 12% 120,000 80,000 There had been no remeasurement (actuarial) gain or loss from plan asset and accumulat retirement obligation in the prior years. The asset ceiling at the beginning and at the end of the ye was at $250,000 and $350,000, respectively.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter19: Accounting For Post Retirement Benefits

Section: Chapter Questions

Problem 6RE

Related questions

Question

8. How much is the plan asset at fair market value, December 31, 2021?

9. How much is the accumulated benefit obligation, December 31, 2021?

10. What is the prepaid(accrued) pension expense as of December 31, 2021?

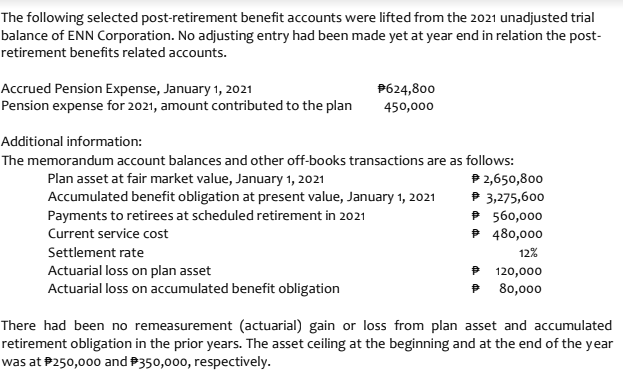

Transcribed Image Text:The following selected post-retirement benefit accounts were lifted from the 2021 unadjusted trial

balance of ENN Corporation. No adjusting entry had been made yet at year end in relation the post-

retirement benefits related accounts.

Accrued Pension Expense, January 1, 2021

Pension expense for 2021, amount contributed to the plan

P624,800

450,000

Additional information:

The memorandum account balances and other off-books transactions are as follows:

P 2,650,800

P 3,275,600

P 560,000

P 480,000

Plan asset at fair market value, January 1, 2021

Accumulated benefit obligation at present value, January 1, 2021

Payments to retirees at scheduled retirement in 2021

Current service cost

Settlement rate

12%

Actuarial loss on plan asset

Actuarial loss on accumulated benefit obligation

P 120,000

P 80,000

There had been no remeasurement (actuarial) gain or loss from plan asset and accumulated

retirement obligation in the prior years. The asset ceiling at the beginning and at the end of the year

was at P250,000 and P350,000, respectively.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning