The following selected transactions relate to liabilities of Company A. Company A's fiscal year ends on December 31. January 13 Negotiate a revolving credit agreement with Company B that can be renewed annually upon bank approval. The amount available under the line of credit is $10 million at the banks prime rate. February 1 Arrange a three-month bank loan of $4.1 million with Company B under the line of credit agreement. Interest at the prime rate of 8% is payable at maturity. May 1 Pay the 8% note at maturity. Required: Record the appropriate entries, if any, on January 13, February 1, and May 1. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 should be entered as 5,000,000).)

The following selected transactions relate to liabilities of Company A. Company A's fiscal year ends on December 31. January 13 Negotiate a revolving credit agreement with Company B that can be renewed annually upon bank approval. The amount available under the line of credit is $10 million at the banks prime rate. February 1 Arrange a three-month bank loan of $4.1 million with Company B under the line of credit agreement. Interest at the prime rate of 8% is payable at maturity. May 1 Pay the 8% note at maturity. Required: Record the appropriate entries, if any, on January 13, February 1, and May 1. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 should be entered as 5,000,000).)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 11RE: On December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to...

Related questions

Question

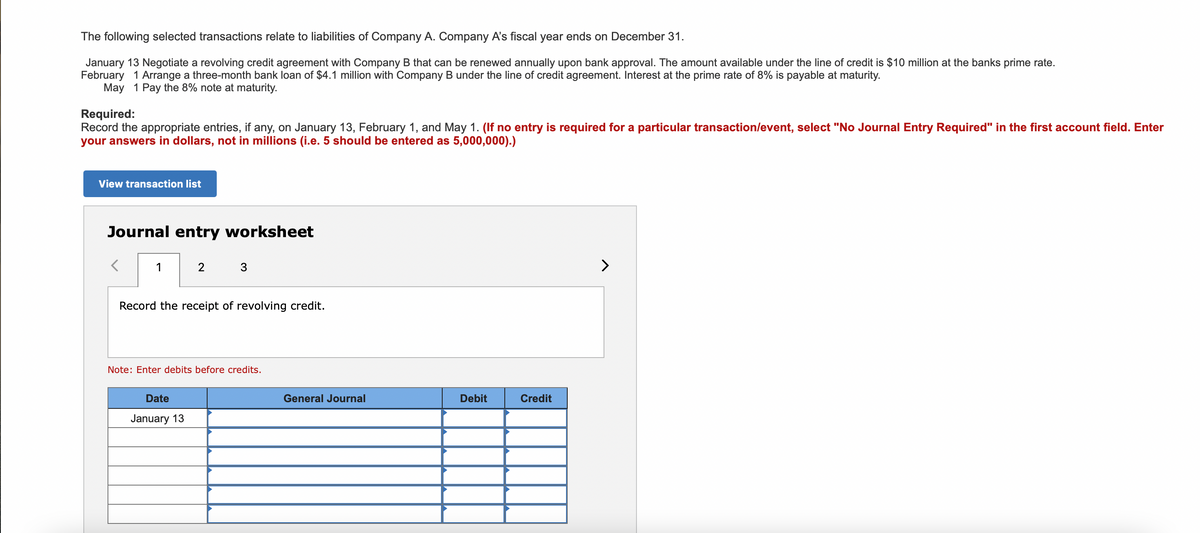

Transcribed Image Text:The following selected transactions relate to liabilities of Company A. Company A's fiscal year ends on December 31.

January 13 Negotiate a revolving credit agreement with Company B that can be renewed annually upon bank approval. The amount available under the line of credit is $10 million at the banks prime rate.

February 1 Arrange a three-month bank loan of $4.1 million with Company B under the line of credit agreement. Interest at the prime rate of 8% is payable at maturity.

May 1 Pay the 8% note at maturity.

Required:

Record the appropriate entries, if any, on January 13, February 1, and May 1. (If no entry is required for a particular transactionlevent, select "No Journal Entry Required" in the first account field. Enter

your answers in dollars, not in millions (i.e. 5 should be entered as 5,000,000).)

View transaction list

Journal entry worksheet

1

3

>

Record the receipt of revolving credit.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

January 13

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,